Saving TAX occupies a significant part of our mind space, specially if we are in the 30% or higher tax bracket. Along with inflation, high taxes lead to a double whammy.

Today, let’s discuss and understand a way to save 9x tax on our investments by shifting our tax liability from “income” to “capital gains”.

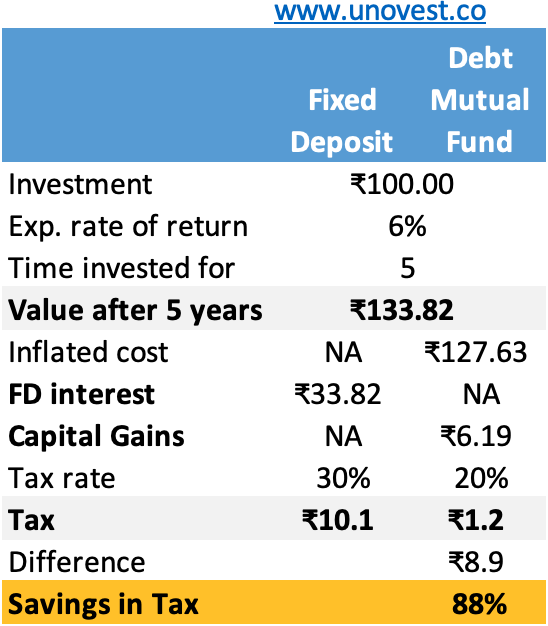

Suppose you have to invest Rs. 100 for 5 years, safely.

There are 2 choices with you.

#1 Invest in a Fixed Deposit with a guaranteed rate of return and the credit insurance (upto Rs. 5 lakhs) offered by Govt. However, the interest is taxed every year at your marginal rate of income tax.

The fixed deposit also comes with a lock in, typically plus a penalty for premature withdrawal.

#2 Invest in a debt mutual fund which has holdings in short term Govt Securities. There is no credit risk. However, there are no guarantees. You can withdraw your money anytime at the current market value.

If you stay invested for 3 years or more, you pay long term capital gains tax at 20% rate, that too only when you sell.

—

Now, a bank FD today offers about 6% return.

For simplicity, let’s also assume that the debt mutual fund will also give us a similar return.

As a result, Rs. 100 invested 5 years at 6% becomes Rs. 134 approx.

However, this is before tax.

How much tax do you have to pay, assuming you are in the 30% tax bracket?

Option 1 – Bank FD:

- Investment – Rs. 100 invested

- Value After 5 years – Rs. 134 approx

- Total Gain – Rs. 34

- Your tax at 30% rate on Rs. 34 is Rs. 10.2 (We are not assuming the annual tax payment on interest for now.)

Option 2 – Debt Mutual Fund:

- Investment – Rs. 100 invested

- Value After 5 years – Rs. 134

- Total Gain – Rs. 34 (Incorrect!)

You see, the Income Tax Rules allow you to inflate your cost of purchase for debt mutual funds just like you do in case of property.

The average cost inflation over the last 10 years is about 6%. Let’s say, going forward, it will only be about 5%. What does this mean for your tax?

It means that when time comes to pay taxes, the cost of your purchase is not 100 but 100 * (1+5%)^5, that is, Rs. 128 approx.

So, let’s go back to our calculation.

- Investment of Rs. 100 (adjusted for inflation) – Rs. 128

- Current value – Rs. 134

- Capital Gain – Rs. 6

- Tax on this capital gain at 20% flat – Rs. 1.2

Let’s compare.

- Tax paid on Bank FD – Rs. 10.2

- Tax paid on Debt Mutual Fund – Rs. 1.2

There is a difference of about Rs. 9 in the tax payment, which means you save about 9x tax in a debt mutual fund vis-a-vis a Bank FD.

In other words, you pay 10x tax on a Bank FD.

While this obvious, completely legal method is available to us, we spend time and energy looking for elusive solutions.

What say?

—

Note: The idea here is not to belittle any investment. Just to bring about a different perspective.

There are several nuances with respect to each investment, which have to be taken into account when making investment decisions. Tax efficiency is one of the aspects to consider. It is not the only one.

—

Know more and compare mutual funds with a different lens. Get your account here.

1. We have assumed 6% inflation, but in reality that is around 3% from the trends in the rolling 5 year window computed for the past 20 years.

2. The CII index released by the income tax dept is not close to 6% for a period of 5 year block. Of late that is close to 3%. Here is the computation for the same

Year Cost CAGR(for 5 year period)

2006-07 122 4.06%

2007-08 129 4.2%

2008-09 137 4.68%

2009-10 148 5.54%

2010-11 167 7.38%

2011-12 184 8.57%

2012-13 200 9.17%

2013-14 220 9.94%

2014-15 240 10.15%

2016-17 264 7.49%

2017-18 272 6.34%

2018-19 280 4.94%

2019-20 289 3.79%

2020-21 301 3.45%

2021-22 317 3.73% (CAGR with respect to 2016-17 base price)

3. That will make the capital gains to be 14 Rs (134- (317/264)*100) and the capital gains tax to be 14*0.2 = 2.8

Debt Mutual Funds are not giving return of 6-7%, it`s more like 2-3% now a days and there is a risk of capital loss too like in case of DHFL. At least with bank you have that safety.