“Here he goes again!” You must feel really tired of this phrase. Anyone and everyone is talking about it.

Well, what to do?

Asset allocation is the simplest way to ensure that you continue to build your wealth with a focused, rule based model without going crazy while swinging like a pendulum between fear and greed.

Basically, asset allocation keeps your portfolio and you, both, sane.

I embarked upon a journey to find out more as to how asset allocation helps investors like you and me. Can we build some models that can be used to power our wealth creation journey with lesser bumps, fewer accidents and better fuel efficiency?

So, I did a little experiment – call it Asset Allocation backtesting – one of the many that you will see in times to come.

In case you don’t know, Asset Allocation includes deciding a mix of equity, bonds, cash and/or any other asset class, allocating an initial weight to them and then rebalancing on a periodic basis.

Now, here’s what I did.

- Invested in a mix (aka asset allocation) of Equity and Bonds. There are 3 different mix (60:40, 50:50 and 40:60)

- Equity is represented by a large cap Nifty 50 index fund. Bonds are represented by a Gilt Fund, no credit risk and a good proxy for a lot of Govt savings. Both regular, growth plans.

- The start date of the portfolio is April 3, 2006. (I have prices available only from then.)

- The backtest involves 2 scenarios. One, the portfolio is rebalanced yearly / quarterly. Two, the rebalancing is done when the allocation or mix changes in the band of either +/- 2% or +/- 5%.

I chose mutual funds because they come close to replicate actual results with costs. I am not disclosing the name of the funds as the focus is on asset classes and not the funds.

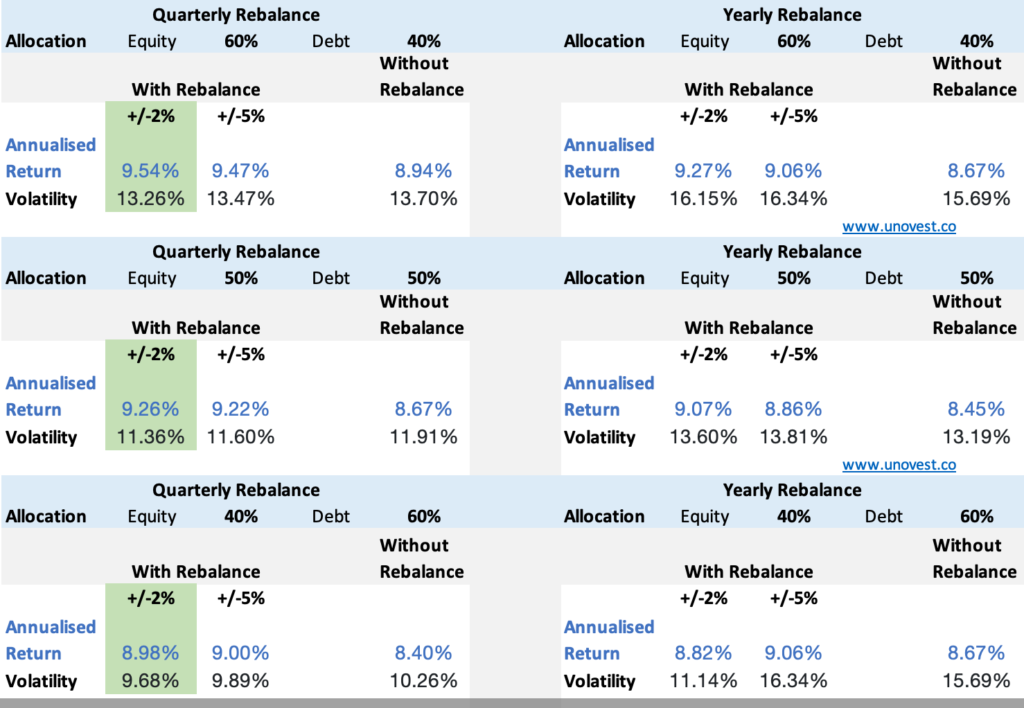

Have a look at this image below. (check it on your desktop browser for a clear view)

You can see the results for a combination of asset allocation mix, rebalancing frequency (quarterly / yearly) and the tolerance band ( 2% or 5%).

ASSET ALLOCATION – IS THE MIX BENEFICIAL?

Note: A 2% tolerance band means that for an allocation of 50%, no action will be taken if it remains between 48% and 52%. Volatility is calculated using standard deviation.

QUESTION FOR YOU: Which of the above scenarios will have the highest return per unit of volatility?

Here are some interesting observations:

- In all 3 scenarios, rebalancing with a 2% tolerance band seems to produce the most bang for the buck. Even that small percentage difference over many many years and produce a large absolute sum of difference.

- The volatility is lower than if you had done nothing, meaning, you did not rebalance at all. Lower volatility translates into lower ups and downs (basically, less anxiety).

- The returns are better than if you had left the portfolio as is.

- All in all, for the above scenarios, asset allocation and rebalancing seems to work!

This is just one idea. There are so many more questions and possibilities.

- What if we do a monthly or half yearly rebalancing?

- What if I have a different tolerance band?

- What if, instead of a lumpsum, I invest regularly?

- What about exposure to other assets or sub assets such as International funds, mid/small caps, short term funds or arbitrage?

- What if I change my underlying investment?

- What about taxes and other charges?

All valid questions. And we will explore them in future posts. The backtesting tool will shortly be available on Unovest 2.0 website as well.

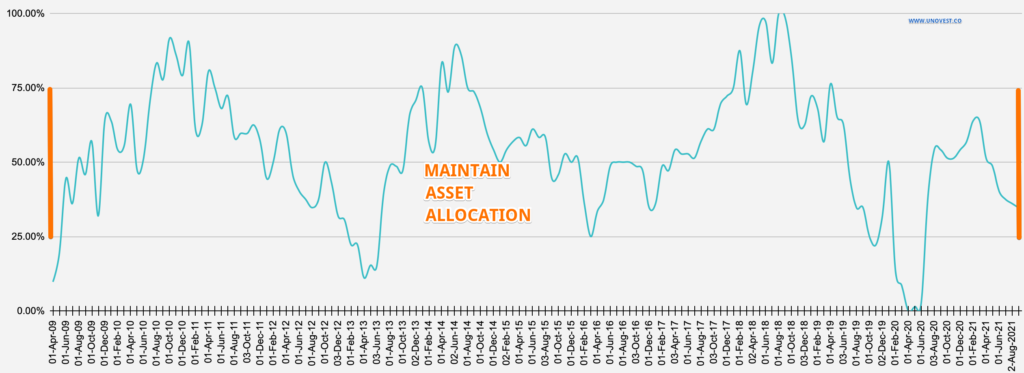

Market Model Update

For the month of August 2021, our market model repeats its sane, consistent recommendation – maintain your asset allocation.

Now, make asset allocation work for you!

Between you and me: Do you follow an asset allocation in the portfolio? Do you find it easy or difficult to practice asset allocation? Do share your comments/feedback.

I invest in hybrid funds for asset allocation.

A good article to reinforce my belief.

Thanks.

In the above numbers in the image, how come the ‘without rebalance’ returns % are different for the quarterly rebalance and yearly rebalance cases?

For eg, the 60-40 case, without

rebalance returns % for both quarterly and yearly cases must be the same right?

That is because based on the rebalance frequency, the final values could be a little different.

Suppose, I am rebalancing quarterly every Jan 1, then for this year 2021, my last rebalance will have been on Jan 1, 2021. however, if I am doing quarterly, the last rebalance date would be July 1, 2021 (Jan, Apr, July, Dec as quarters).

Ideally, we will like them to come to a common current date.