Another month, another set of queries. Markets too expensive? Shouldn’t we wait before investing?

If you haven’t read, the same question I tried to find an answer in May 2021 with this note.

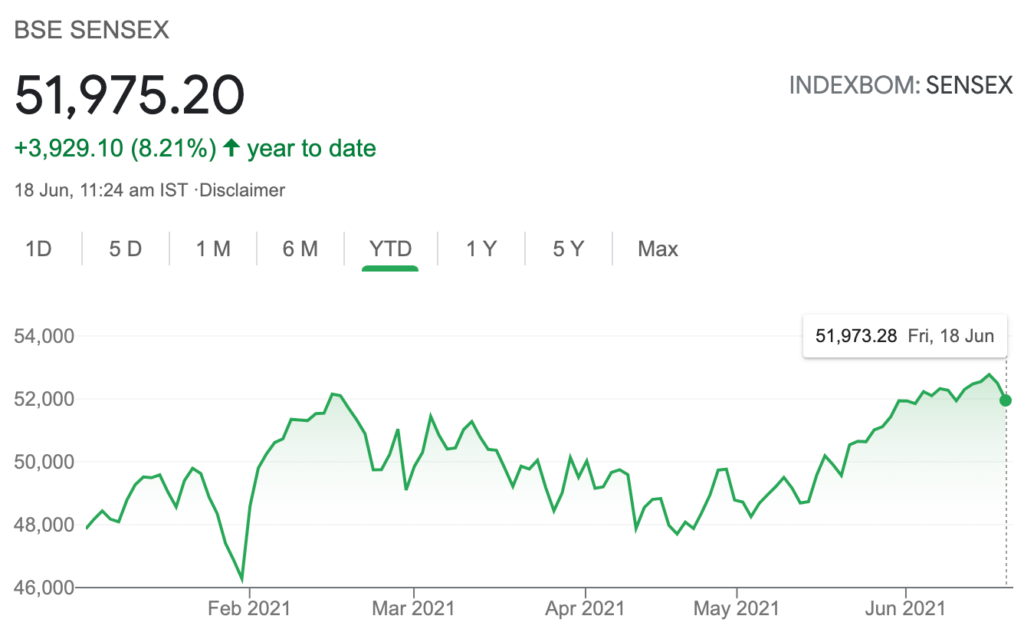

One month has passed. The Sensex 30 is up 6% since then (as of June 18, 2021) in a sort of fast and furious moves. And that is bound to make any investor a little jittery.

Caution is warranted.

And that is our question – how much cautious do we need to be?

Not invest in equity at all?

Or, can we stay within our asset allocation.

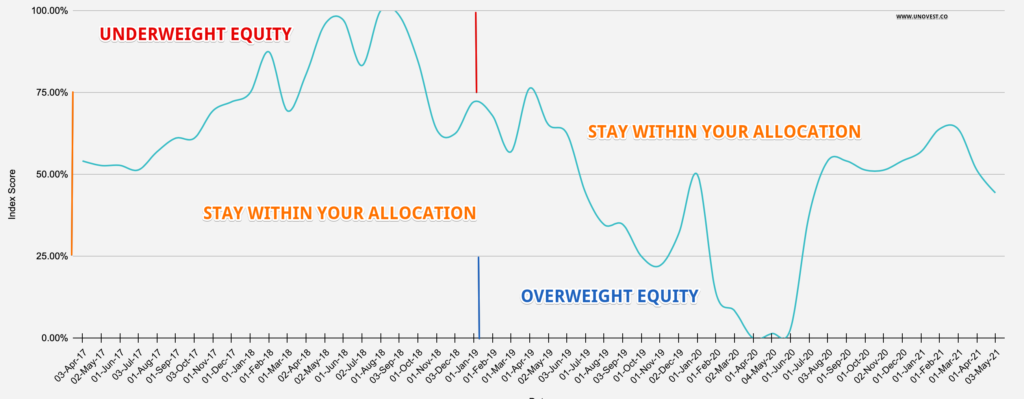

The previous note had this image of what the market is trying to tell us.

This one used data from April 1, 2014 to May 2021. And as we concluded, staying within the asset allocation was the best course of action, for almost always.

Let’s see what the recent data is telling us now.

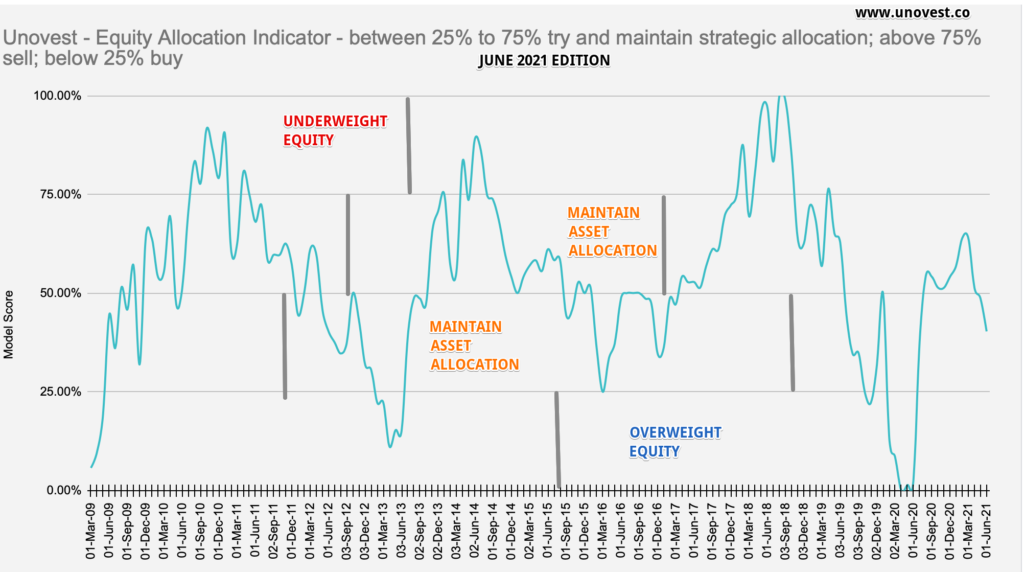

Here’s the updated model.

Note: As requested by many of you, there is now data since inception of Nifty 200 Index (April 1, 2006).

The rest of the model is the same.

- Take monthly 10 year G-Sec rates (courtesy Investing.com) and Nifty 200 PE ratios (courtesy NSEindia.com) from 2006 onwards.

- Calculate 3 year rolling percentile rank for each

- Calculate a single score with equal weightage to both ranks.

That score is what appears on the graph above, starting from 2009.

The model seems to be working all the way. Even with the additional data points, the inferences haven’t changed.

Yes, there are those wild periods of excess on one side or the other. However, trying to make the best of those opportunities, may not come naturally to some one. The emotional grip of greed and fear is too tight.

Staying within the asset allocation appears to be the best course of action, almost always.

It’s true now – in June 2021 – too.

Asset allocation rules save the day for you and me. It is the simplest way to manage risk, make sure you don’t miss out on decent returns and still get from Point A to Point B of your investing journey.

The middle path, if you may!

Read More: How to fail at investing?

Dear Vipin

I would like to construct this model for US markets, would it be possible for you to share your excel for the same

Sure. Can you send an email to vipin@unovest.co and I will respond. Thanks