PPFAS AMC has announced a new fund. This is going to be the 4th fund after its flagship Flexi cap fund, tax saver fund and liquid fund.

The NFO or New Fund Offer opens on May 7, 2021.

In its hallmark style, the fund house has gone to great lengths to offer a transparent, informative communication chain to make a pitch to prospective investors.

They have even explained why are they launching a new fund and why this fund?

Investors too don’t expect anything less from a fund house whose reputation is built on transparency and clear communication. Along with the one which has delivered on risk and performance too.

So, what is the new Parag Parikh Conservative Hybrid fund about?

If Parag Parikh Flexi cap fund was about growing wealth (there is no income option in the fund), Tax Saver was a sub set to save taxes and liquid fund was to hold money safely for shorter periods, then the Conservative Hybrid Fund is about generating regular income.

This is the simple proposition of the fund and how it wants to differentiate from its peer schemes within the fund house.

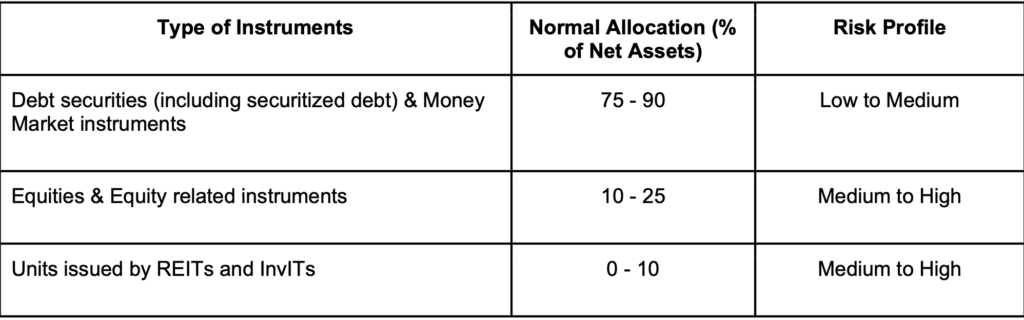

It will use a combination of debt investments, REITs / InvITs as well as equity to create an inflation beating portfolio.

This is the suggested asset allocation of the scheme. Source: Scheme Information Document

Given its category choice, the fund is free to pick its debt investments based on accrual or duration across time frames. With the fund house’s track record, it will however, is unlikely to take any credit risks.

In terms of equities, the offer documents suggest that it will try and pick stocks with strong cash flows, basically, which have a high dividend yield along with those with a special situation that can lead to additional income gains.

The equity limits remind us of the monthly income plans of yore, which stopped being called so after the SEBI categorisation rules.

The REITs / InvITs too provide dividend / interest income along with capital appreciation, which means regular cash flows to the hybrid fund with some growth.

To manage this strategy meaningfully and to keep it attractive to investors too, the fund has kept the expense ratio at 0.3% (plus GST) for direct plans.

Should you invest in this fund?

Retirees or those who want additional passive income and investors looking for a low risk opportunity to get a little edge over inflation, are likely to be receptive to the fund idea.

As usual, all debt funds are positioned as alternative to Bank FDs. The falling returns from the Fixed Deposit has become the prime reason for several new investors to explore the mutual fund space (both in fixed income and equity).

Now, the Bank FD offers guaranteed returns and safety (through the govt insurance of Rs. 5 lakhs that comes along). In contrast, this fund depends on the performance of its investments to give you an income. There is a completely possibility that in one or more of the months, you may not receive any income.

Even in terms of expected returns, if the fund ends up investing most of its money in debt securities with high credit rating, then a 7% return would be a reasonable assumption.

With equities and other investments too, to expect anything more than 8% to 9% over a period of time is likely to lead to a huge disappointment.

Let me also state that there is no shortage of ideas for regular income in or out of the mutual fund space.

As for regular income, one should note that the income receipts from mutual fund are added to your total income and taxed accordingly. There is no special tax treatment.

I understand that some investors may also look to park short term surplus, say moving from the liquid fund to this hybrid fund. Be warned that the fund is likely to show a little volatility in the immediate to short term. You need to have a time horizon of 2 years plus for investing in this fund.

Hence, there is no need to rush and line up to invest. (I know die hard fans will do just that!)

I am going to observe for 1 year and see what the fund actually does.

Summary

- Low risk Multi asset hybrid fund – predominantly debt along with Equity, REITs / InvITs

- Low cost – 0.3% for direct plans

- Returns are not guaranteed

- No track record – it’s a new fund

Between. you and me: How do you see this fund? Are you planning to invest? Would love to know your reasoning.

Can I use this fund for my debt portion of the overall portfolio. Currently I am having ppf, epf and liquid fund for debt portion.

It’s a hybrid fund even though conservative, the NAV will fluctuate a bit.

am investor in their flexi cap fund since 2018, attended their investor work shops, really honest guys with high degree of integrity, hence i would choose to invest in this fund with them due to their ethical work nature which is rare in modern world.

A part of emergency funds can be deployed in this fund…methinks.

Can this fund be a substitute for PPF?

Should I withdraw money from my PPF Account and invest in this fund as the interest rates would surely decline from July 2021 onwards?

Kindly suggest.

No way. PPF is a sovereign guaranteed investment option. If your purpose is only higher return, then why not equity?

Vipin ji, almost two years have elapsed since the launch of Parag Parikh Conservative Hybrid Fund. I’m sure that you must have tracked it’s performance.

Kindly advice whether I should invest in it or not as I have fixed income investments only in PPF Account.

I’m 54 years and want to shift some equity investments into fixed income products.

If the above fund is not suitable, then kindly suggest some good Gilt/Debt funds that protect capital and also give reasonable returns.

Regards.

Sanjay ji, I use the fund selectively for investors. However, know that this fund holds some equity as well as REITs too, which add an element of volatility (ups and downs in value). YOu can look at the watchlist mentioned in the LightHouse for all the funds that we use across categories. Thank you