In the past few years, there is a spate of launches of smart Beta funds or semi passive or index fund with a minor twist. Adjusted for volatility, quality, momentum, weights, caps – you can have your pick. One of the latest smart beta NFOs is the ABSL Equal Weight Nifty 50 Index fund.

Seems like a new concept, you ask? Well, it is not really new. The first fund with this idea is already 3.5. years old.

The concept is actually quite simple.

Take the top 50 stocks by market cap and invest equally in all, that is 2% each in the 50 stocks. Absolutely no bias. Imagine how the portfolios will look like!

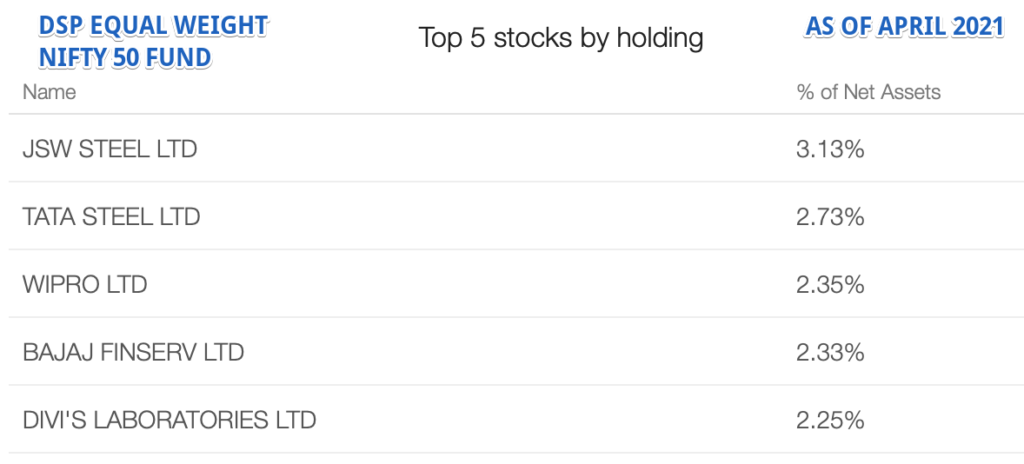

For reference, below is the top 5 holdings of the DSP Equal Nifty 50 Index fund .

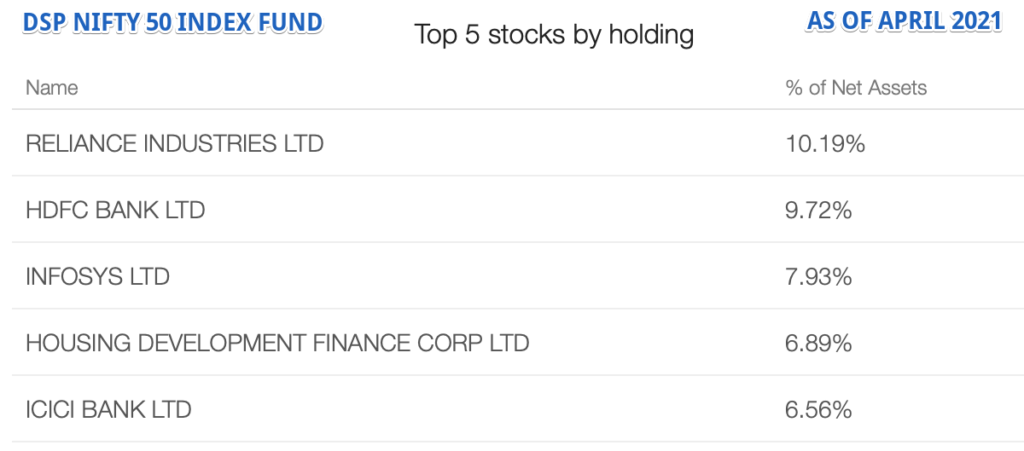

In contrast, an index such as Nifty 50, also the top 50 companies by market cap, will invest in the ratio of the market cap. Here’s DSP Nifty 50 Index Fund’s composition.

Remember the entire set of 50 stocks is the same, it is just the weightage that are different. Yet they look like chalk and cheese, right!

Note, since the rebalancing happens quarterly for the equal weighted fund, you might see some values less than or more than 2%. In any case, perfect 2% weightage is not possible.

The smaller market cap companies within Nifty 50 also get the same respect as the largest market cap company.

Another promise of the equal weight Nifty 50 is that it reduces sectoral concentration (true), gives more diversification (true) and reduces the risk in the portfolio (mostly true for longer time frames).

However, the bigger argument being pushed around is that the equal weight Nifty 50 also provides higher returns than the Nifty 50, its base index, to the investor.

The story, so far on, this doesn’t check out. Let’s see.

Performance or Safety – What’s it for the Equal Weight Nifty 50?

We take the existing funds in the space as they exist in reality and not just on an excel sheet and see how have they fared.

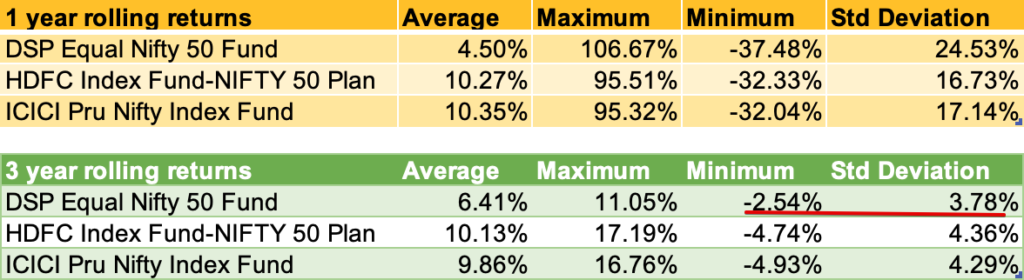

For obvious reasons, we are using rolling returns calculations (Data courtesy – PrimeInvestor).

We have also limited the rolling return observations to the youngest fund – DSP Equal Nifty 50 Index Fund. It has been around for just 3.5 years and all observations are limited to that period to avoid any time bias.

See the comparison below for 1 year and 3 year rolling returns of DSP Equal Weight Nifty 50 and the Nifty 50 index funds from HDFC and ICICI Pru.

You have to focus on the average number as that comprises of most of the outcomes of the period. The maximum and minimum are edge cases and you have to be very lucky or unlucky to get just that.

With the 3 year data points, we see a lower fall and lower standard deviation. That make it slightly safer than the Nifty 50, so far!

The right way to look at the Equal Weight idea is to consider it a more diversified option. If you want to chase higher returns with it, you might be in for a disappointment.

Here’s NSE page on the Equal Weight Nifty 50 Index.

Between you and me: What’s your take on the Equal Weight Nifty 50 idea?

Your point that the Nifty 50 equal weight index is more diversified is insightful.

But we could alternatively get that diversification from choosing a bigger index like 100, 200 or 500. Which option would you recommend?

Slight difference. With Equal weigh nifty 50, it is reducing concentration within large caps / super large caps.

With the broader indices you expand the universe towards mid/small and the number of securities too.

And a Nifty 100 , for example, will still have 30% to 40% in the top 5 stocks.