The announcements made in Budget 2021 has made bond markets a little nervous. They reacted by pushing G-sec yields a bit higher. How does that impact choice of debt funds post Budget?

Several observers believe that the first step may have been taken towards a rise in interest rates. Though when will it truly materialise, remains a question.

For an investor, this scenario begs a question. What kind of debt funds to choose for investments now?

Year 2020 already gave us a few good lessons. You already now know that credit quality is important. That chasing yields/returns is not the right thing to do.

Don’t make investments on the basis of recent performance.

That gives you a basic framework on what debt funds you should NOT choose.

Read: A refresher on debt funds– Safety, Taxation and Returns

Let’s add a bit more to it.

As we have mentioned in past notes too, all debt funds are marked to market. In other words, they get a daily price which is inversely affected by changes in interest rates. So, if the interest rates are going up, their value/price will go down and vice versa.

In debt fund parlance, the funds that have a higher duration will be at higher risk of losing value, not because of credit quality but because of the mark to market accounting norms. We refer to the medium and long term duration funds. Clearly, you may avoid them.

Now, if you invert this, you have a choice of funds that are affected little by change in interest rate movements. In fact, they may see a positive change.

Which are these debt funds?

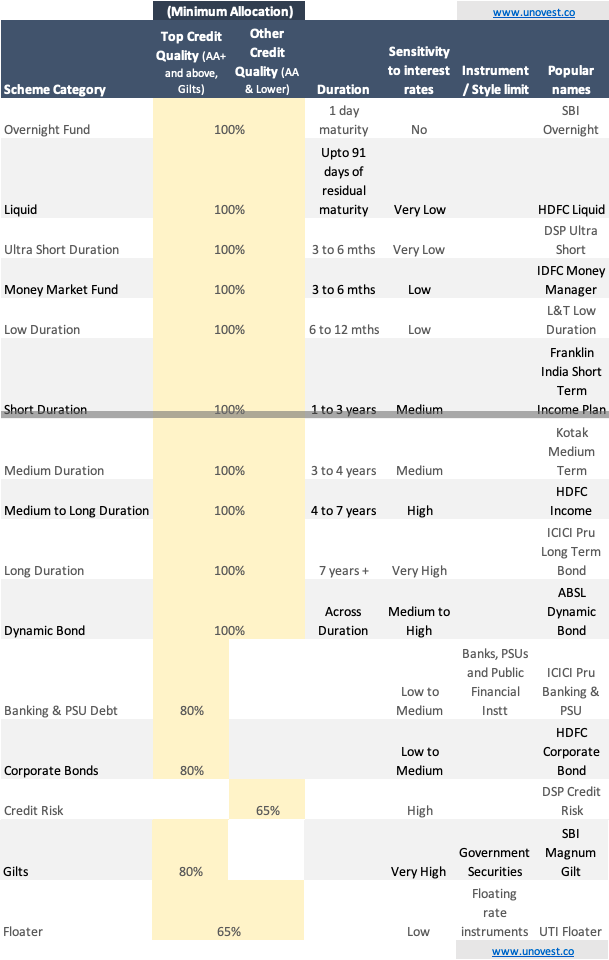

Well, there are 16 categories of debt funds specified by SEBI. Let’s try to make sense of them first. See the image below.

SEBI defined debt mutual fund categories

Note: All fund names mentioned above are examples and not recommendations.

What can you take away from this?

- As you may notice, the Floater, Money Market, Ultra Short and Low Duration seem to be most apt for the current environment with a short time horizon. They are unlikely to be affected by rise in interest rates. If at all, minimally.

- For a slightly longer investment horizon (3 years plus), Short Duration, Dynamic Bond and Corporate Bond funds may also be considered. Over that time frame, they should be able to smoothen out any short term negative impact.

- Don’t forget to look at the strategy of the fund you are considering as also its track record and credit rating.

- Finally, keep it simple. Just focus on your time horizon and the need. Don’t get greedy and look for higher returns.

Is this guideline helpful to pick debt funds that work for you?

Do share your thoughts and questions.

Overnight funds don’t offer instant redemption, do they?

No

You have written very well on mutual funds. This article is useful for everyone. Especially new investors will benefit from this. Accept greetings.

Hi Vipin,

The returns from low duration mutual funds have fallen to below 4%. Given that, what’s the point in investing in these low duration funds?

I guess there is a need to look elsewhere, may be NPS Tier 2. What’s you thought?

These funds will be able to adjust to revised rates when they move up.