“Never let a crisis go waste”.

SEBI has taken this adage seriously and come out with a comprehensive set of guidelines to communicate risk associated with mutual fund schemes.

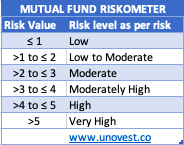

Remember the image below. This is a RiskOMeter. You see it as a part of your mutual fund scheme factsheet.

The unfortunate part is that no one ever paid attention to it – not the investor, not the advisor. No one one what it meant beyond the risk names – “High”, “Low”, “Moderate”, etc.

But you ask, what does “Moderately High” really mean?

Let me paint a picture. You are driving on the road. It’s slightly dark. After a few minutes, you get a vague feeling that a vehicle is approaching from the opposite side. You have but no idea of what size, at what speed and in which lane?

You know only when you make a deep swerve to the side and are saved by a hair split of a distance. Some one else may not be so lucky.

Phew! Hopefully, that is likely to change.

SEBI now wants mutual funds to do a more detailed quantitative exercise under the hood and use it to calculate risk scores for each scheme and then use that score to reflect in the risk-o-meter.

With this, the next time you see a moderate risk on the riskometer, you will know what it truly means.

To make that possible, SEBI has given extensive guidelines for equity as well as debt schemes. For hybrids, they will use the 2 sets of parameters in conjunction to arrive at the risk score and hence the riskometer rating.

For debt funds, there are 3 key risks that need to be evaluated:

- Credit Risk (based on credit ratings issued)

- Interest Rate Risk (based on Macaulay’s Duration which measures interest rate sensitivity)

- Liquidity Risk (based on what can stop an investment from being sold quickly)

In case of equity funds, the 3 key assessments are:

- Market Cap (Large, Mid or small cap)

- Volatility (based on daily volatility for last 2 years)

- Impact cost (also a proxy for liquidity)

Similarly, gold, FOFs, REITs, InvITs, etc have been given separate attention as well.

There are clear categories and scores against each of the above parameters which then lead to a weighted score.

Interestingly, in case of debt funds, the liquidity score rules them all (the recent crisis weighs in heavily). If the average score of the 3 parameters is less than the liquidity score, then the liquidity score is taken as the risk score. (We will see what it means as we take up a case study)

In our post today, we will use 3 of our debt funds (1 liquid, 1 dynamic bond and 1 short term debt fund) and see where do they fall on the riskometer using the new risk scoring guidelines.

To read the detailed guidelines, click here.

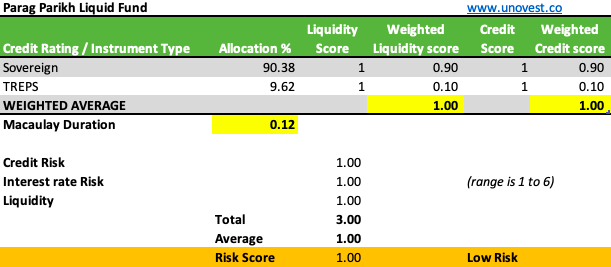

Fund 1: Parag Parikh Liquid Fund

Parag Parikh Liquid fund invests primarily in T-Bills with less than 91 days of residual maturity. It is one of the safest avenues to park short term money.

The fund’s current riskometer says “Low” risk. Let’s see if the new SEBI guideline confirms the same.

Every instrument in the portfolio gets a liquidity score and a credit score. They are then weighted with the allocation in the portfolio to arrive at the weighted score.

As for the interest rate risk, the portfolio’s Macaulay Duration decides the score for the same. If this duration is less than or equal to 0.5, the score is 1, if it is more than 5, it gets a score of 6.

All the scores in the respective parameters are totaled and a simple average is calculated.

So, the average risk score of the fund is 1, which as per SEBI’s guidelines is Low Risk. Even against all the 3 risk parameters, the fund has the lowest score (which translates to the best score).

The methodology seems to work.

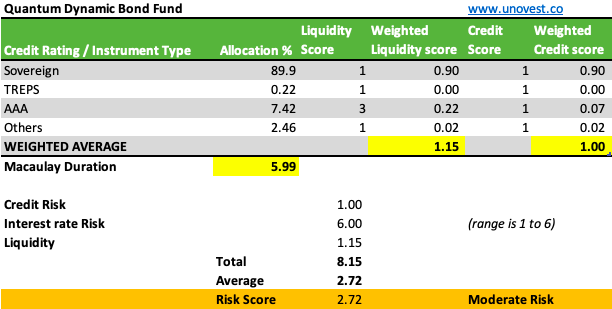

Fund 2: Quantum Dynamic Bond Fund

Quantum Dynamic Bond Fund falls under the category of Dynamic Bonds. It has an investment mandate to actively manage the debt portfolio based on the interest rate environment (without taking any credit risks).

The following is the current distribution of credit rating/instrument type in the portfolio.

When we apply the guidelines, the risk score turns out to be 2.72 leading to a moderate risk profile. Again, it is in line with the fund actually does.

As you will note, there are no issues with the credit risk and liquidity parameters. The fund manages duration and hence that item gets the highest score (leading to a Moderate risk).

The fund house too has so far marked the scheme as “Moderate”. Good alignment.

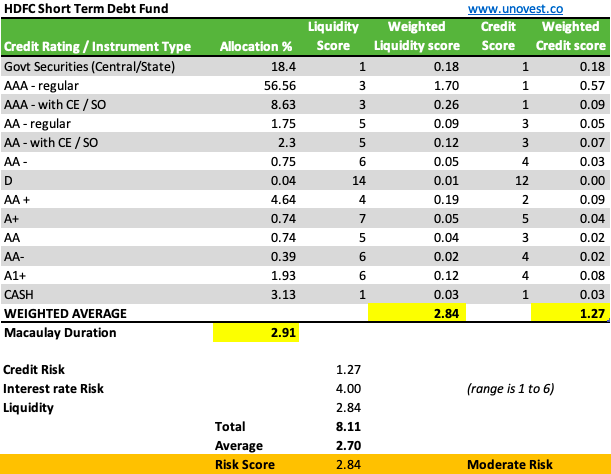

Fund 3: HDFC Short Term Debt Fund

HDFC Short Term Debt fund falls in the short term debt fund category as specified by SEBI. It invests in various debt securities in a way that that the Macaulay Duration (measure of interest rate sensitivity) of the entire portfolio lies between 1 years and 3 years.

The following is the distribution of the fund’s credit ratings and instrument types. As you will notice, the fund uses various mechanisms of Structured Obligations (SO) and Credit Enhancements (CE).

While, these steps create a better credit profile for the fund, they tend to get a push back on liquidity. SEBI has incorporated it into the scoring mechanism.

The funds average risk score is 2.7 (based on the 3 parameters) and yet the final score is taken as 2.84, which is equal to the liquidity score.

I had mentioned earlier that SEBI has placed a higher emphasis on liquidity and hence if the liquidity score is higher than the average score, the former will be the risk core of the scheme.

In this case, the liquidity score of 2.84 > 2.7 of the average score. Hence. 2.84 is the risk score. Here, this doesn’t change the riskometer rating though, which continues to be “Moderate”.

I would say this quite reflects the nature and behaviour of the fund.

This becomes interesting when you see that the fund house currently gives a “Moderately Low” risk rating to this fund scheme.

Risk Scoring mutual funds schemes

Remember, the idea behind risk scoring of mutual fund schemes is to understand risks better when you take the decisions.

If the fund’s rating moves from the current “Moderately Low” to “Moderate”, are you supposed to let it go?

I don’t think so. It only allows us to better appreciate the risks involved and see it is in alignment with the kind of portfolio we want.

The risk scoring is not perfect. For example, it will ignore the fact that some of the short to medium term debt funds could be positioned based on the existing interest rate environment. This allows them to work with higher duration to bring in capital gains.

However, the risk scoring guidelines will push the fund to a higher risk category. Of course, higher duration means higher risk but a thought through positioning by the fund cannot be disregarded too.

Then there is the case of AAA rated securities, to which SEBI provides the best credit and liquid scores of 1 each. Now, we all know from the last few years, how some AAA rated investments have done.

So, again, a fully AAA portfolio doesn’t mean that there is low risk in the portfolio. It sometimes takes just one security / investment within the portfolio to create a hole and make the entire portfolio questionable.

While the risk scoring guidelines are a step in the right direction, use them as one of your filters – an important one – in your decision making tool kit.

Happy investing!

Between you and me: What is your take on these new risk scoring guidelines? Do you think it will help you appreciate the risks better, specially with debt funds?

Leave a Reply