Corporate Bond Funds have been on a rock and roll. Check the increasing AUM of the funds. Investors are flocking on the back of double digit returns in this category. The events of the last few months seem to have had no impact on them. How long is the party to continue?

Let’s find out today.

What are corporate bond funds?

These are debt mutual funds, which invest minimum 80% in highest rated investments. This is one of the big reasons to even consider this category – little or no credit risk.

Know that this definition came from SEBI in Oct 2017 and several existing funds restructured themselves to fit into this category by April – May 2018.

Investors looking for income or fixed income allocation are considering these funds.

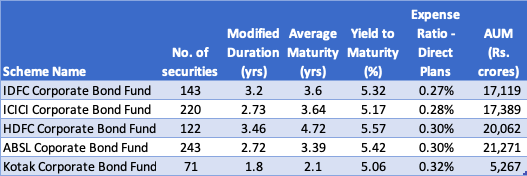

Here are some of the largest corporate bond funds.

What is the credit rating profile of these funds?

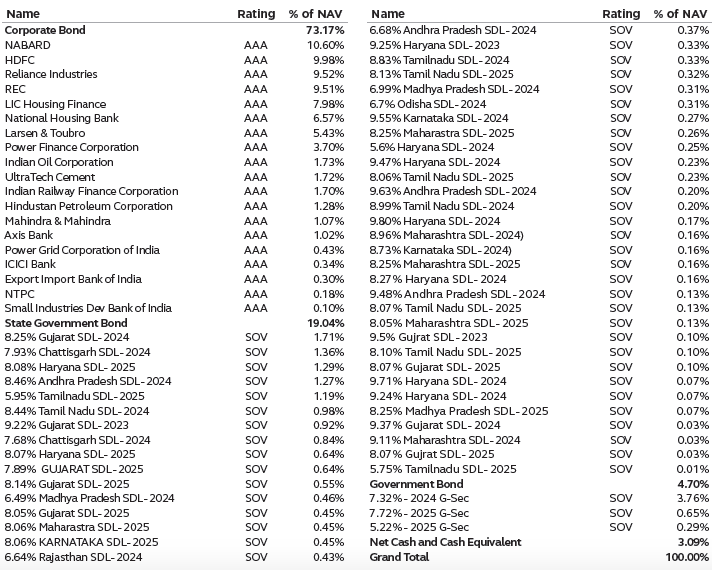

The current portfolio of all these funds comprises predominantly of AAA Corporate / PSU Bonds and Sovereign rated instruments. So, little or no credit risk.

Here’s a snapshot of the portfolio of IDFC Corporate Bond Fund.

These funds have in the past had lower than AA+ rated investments. January 2020 portfolios will testify to that. However, the recent COVID cum Credit crisis ensured a flight to safety to maintain the right perception in the investor’s eyes.

So, what is the risk in these funds?

While AAA rating is great, we know that the past few years have not been very rosy for such ratings too. ILFS, DHFL and others were all AAA rated.

The funds have also known to hold lower credit ratings for a portion of the portfolio. That could backfire at times.

The other risk is that of sensitivity to interest rate movements. This is reflected via the duration of the portfolio. A duration of 1 means that if the interest rate moves up by 1%, the portfolio value will go down by 1%. (There is an inverse relationship)

The way the portfolios are positioned currently, they have all moved up their average maturities and resultantly the duration too. While this is to lock into the interest rates available now, any significant upward movement in the interest rate can lead to a short term loss in value.

What is the ideal tenure of holding for these funds?

Nothing less than 3 years. That is also the time when the long term capital gains taxation kicks in and enables you to take the benefit to lower tax.

Am I better off in a Gilt Fund or a Dynamic Bond Fund?

Depends. Gilt funds will carry no credit risk as they invest only in Govt Bonds and Treasury Bills. However, the funds are known to be highly volatile. The past returns of these funds currently look very attractive, but I am afraid the they days are gone. You can’t expect the same any more.

As for Dynamic Bond Funds, they are managed differently. They aim to benefit from the interest rate environment by managing their duration in a way that they can make capital gains. They don’t have restrictions of using long or short investments.

Actually, dynamic bond funds is to debt what a multicap fund is to equity. However, it does not take away the fact some of the dynamic bond funds can be very volatile including resulting in temporary loss of value.

So, you may not be better off with these funds but can consider them based on your specific need and preference.

What are the expected returns from a Corporate Bond Fund?

The answer to that lies in the comparison table shown earlier. You have to look at the Yield to Maturity (YTM) of the funds. That is your expected yield for now from the respective funds.

Ideally, you should subtract the expense ratio too to get the net of expense YTM.

In case of HDFC Corporate Bond Fund, the number is 5.27% approx. For IDFC Corporate Bond Fund, it should be 5% approx.

The actual returns can be different but this is a good gauge for now.

If you expect the same double digit returns going forward, you are likely to be disappointed.

If you have invested over the last 1 year or so, then over the next 3 years, the average returns will moderate to more around 8% or so.

Which of the above funds should I consider?

If you can put the performance numbers aside, there are 2 funds that you can consider for the fixed income allocation in your portfolio.

IDFC Corporate Bond fund is particular about using the top rated debt in the portfolio and doesn’t try to scrape returns from the bottom.

HDFC Corporate Bond has been quite consistent in its portfolio approach too.

Both the funds have maintained their expense ratios while other funds have increased.

Having said that, the other funds are not out of consideration.

If you have any further questions, please feel free to ask.

A gr8 analysis!!

Very informative.

Helps in decision making.