One of the common queries for investors planning for a regular income via their mutual funds is whether to go for SWP vs Dividend? SWP stands for Systematic Withdrawal Plan.

There are 2 key points to note in the comparison.

- SWP allows you to define the amount, tenure as per your needs. You have complete flexibility and control over the process. You can start, stop anytime, as well as increase or decrease the amount. Dividend is dependent upon the whim of the fund house. They decide if they want to give you a dividend, when and how much. In most cases, it remains a nearly fixed amount and doesn’t change over the years (conveniently forgets inflation).

- As for taxation, Dividend received is added to your total income and tax paid as per your marginal tax bracket. In case of SWP, every time money comes out, it is treated as a sale/redemption and capital gains are calculated. Assuming you are using a debt fund, for less than 3 years of holding, you pay short term capital gains tax as per your tax bracket. After 3 years, you are allowed to do cost indexation and pay only 20% tax on the reduced long term capital gains.

If you consider the above two points, SWP is a superior option to Dividends for most investors.

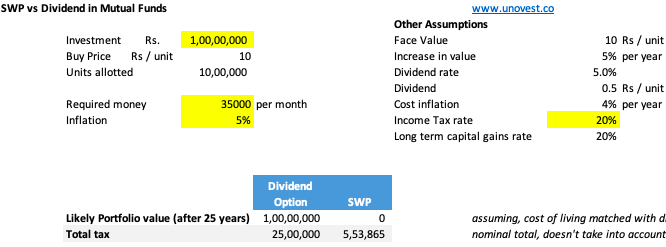

Here’s a quick calculator for SWP vs Dividend option

Use the link below to download a simple calculator to help you see how SWP vs Dividend numbers play out.

Big Question

Having said that, the question is which option keeps your original investment intact? The first response is dividend. Well, not entirely true.

In case of dividend option in a liquid fund (for example), the original value is more likely to remain intact as the fund scheme distributes only the value increase as dividend. However, as your expenses increase over a period of time due to inflation, you can be forced to sell some of the units to make up for the shortfall, thus reducing your dividend over time. (Bit of a Chicken and Egg!)

So, unless you are willing to live just on the dividend, come what may, even dividend option may not leave your original investment intact.

In case of SWP, you can change your withdrawals based on requirements and that is likely to eat into the capital too.

Read more about Systematic Withdrawal Plan

In all ways, SWP is a more practical option. What do you think?

Leave a Reply