One of the rudest realisations of year 2020 has been how credit risks in debt funds can come to bite. Now, investors ask, “no equity, no credit risk, give me a safe tax efficient investment option.” In this context, we explore the Quantum Dynamic Bond Fund and if you should prefer it over the RBI Bonds.

Let’s get some facts about the fund.

Quantum Dynamic Bond Fund is a debt fund with an investment objective

to generate income and capital appreciation through active management of a portfolio consisting of short term and long term debt and money market instruments.

The investment objective seems all encompassing. However, the fund has a mandate to avoid credit risks.

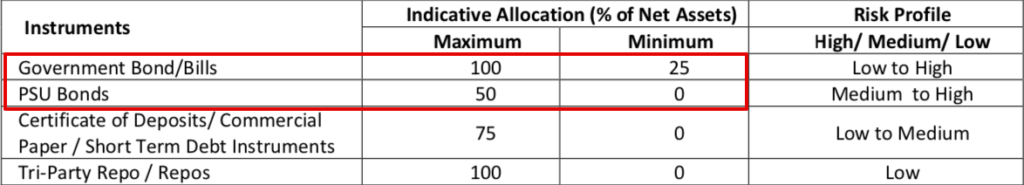

The ideal asset allocation of the fund gives us a better picture of where it is likely to invest.

One thing that clearly stands out is the exclusion of corporate bonds from the asset allocation table.

In reality, the fund prides itself in the fact that it doesn’t take any credit risks. The investment universe of the Quantum Dynamic Bond Fund is limited to government securities, AAA/AA rated PSU bonds and money market instruments.

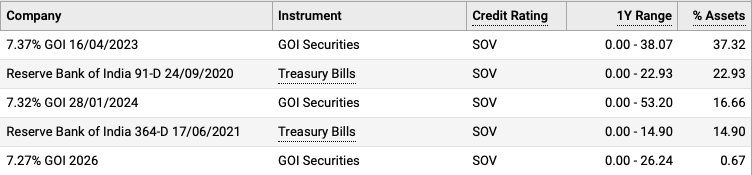

I checked the half yearly portfolios from 2017 till June 2020 and found that this is indeed true. The fund has never invested outside of top rated PSU Bonds, Govt Securities, T-Bills and money market instruments.

The fund also works with a very conservative approach, which made it switch to a completely G-Sec / T-Bill portfolio post March 2020. There is currently not even a single PSU bond in the portfolio.

This is the single biggest positive about the fund – Avoids credit risk altogether.

So, how does this pan out for the fund?

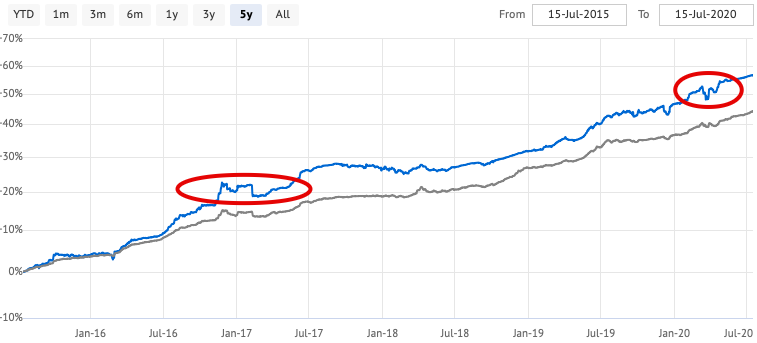

Here is a 5 year NAV chart movement for the Quantum Dynamic Bond Fund (blue line).

Oh my God! This looks scary. Why is the fund that takes no credit risk so volatile? What am I missing?

Good observation! The fund doesn’t take any credit risks, that is a fact.

No credit risk means the fund is unlikely to face any defaults in the portfolio. Also, if a security got downgraded, it is unlikely to be moved to the side pocket in the portfolio. Each of these events can lead to a permanent loss of value.

We all know the saga behind Franklin Templeton funds.

So, then why the ups and downs?

This brings us to an important characteristic of the fund – dynamic bond. While the fund doesn’t take any credit risks, it has a mandate to alter its portfolio structure based on its assessment of the interest rate environment.

If it expects interest rates to go down, it will hold on to long term govt bonds and try to capture capital gains. If it expects interest rates to rise, it will hold on to short tenure govt bonds or Treasury Bills and wait for interest rates to rise to be able to lock in high yields.

The dynamic nature makes the fund interest rate sensitive. There are times, when movements in the interest rates will have an impact on the fund and its NAV will suffer. That’s just the way the fund accounting works.

Most dynamic bond funds as well as long term bonds will have a volatile movement, primarily because of the interest rate sensitivity of the portfolio.

Does this mean as soon as I invest, I can face an immediate loss?

A fair question. Yes, that’s a possibility.

You have to keep in mind that with dynamic bond funds, your time horizon has to be 3 years or more. In this time period, the strategy can play out and you are unlikely to see a negative impact on the portfolio.

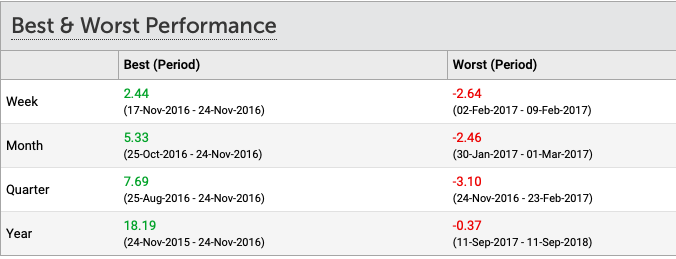

If you look at the following Best & Worst Performance for the fund, you see how it has fared.

In March 2020, the fund faced a 2.67% top to bottom decrease in NAV, however, it was recovered within days. Refer to the same NAV chart above.

Again, aren’t RBI Floating Rate Bonds better?

If tax doesn’t bother you and you don’t want any down movement in the value of your investment (even though temporary), you should stick with RBI Bonds and similar non-quoted fixed income investment options.

What should one expect from the Quantum fund going forward?

One of the most important things about the fund is that it will not take any credit risks and invest only in Sovereign / PSU securities.

I mention that to ensure that you peg your expectations of returns accordingly.

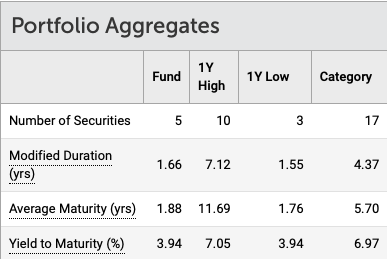

Currently, the fund holds a mix of short and long term investments. The interest rate sensitivity, measured by Modified Duration and which causes the volatility, is also low (much lower than other bond funds of a similar nature).

If you look at the yield to maturity, the fund is positioned to deliver about a 4% to 5% return over 3 to 5 years. The fund can try and capture some gains because of interest rate movements to deliver the above number.

Remember, over 3 years of holding, debt funds get the cost inflation indexation benefit because of which you pay much lower long term capital gains tax.

Assuming, inflation holds the same way as the returns, you will effectively pay close to zero tax.

In Summary

If you are looking for a zero credit risk investment with better tax efficiency and have a holding period of 3 to 5 years, Quantum Dynamic Bond Fund can find a place in your portfolio. You have to be ready to accept a little volatility though.

One typical use case would be parking of long term emergency funds. The first 6 to 12 months of your emergency portfolio needs to be in lower duration investments. Beyond that, you can consider using this fund.

Another use is to make this a part of your long term fixed income asset allocation.

If you have any further questions, I will be happy to answer them. Please feel free to send across.

Leave a Reply