Post the Supreme Court Order upholding the winding up of schemes, the cash distribution has started to the unitholders. To read about the payout from the main scheme in Feb 2021, click here.

If you are an investor in one of the Franklin Templeton schemes that are in the process of winding up, you have received an email. This is about payout distribution from the Segregated Portfolio 1 which holds the Vodafone Idea 8.25% (July 2020) investment.

[Update as on July 10, 2020] – Franklin Templeton has received the full maturity amount from Vodafone Idea. It will be distributed to the unitholders in the week starting July 12, 2020.

See details below.

The email seems to have caused some confusion. For better understanding, I am sharing with you a summary of what it says.

In Jan 2020, Vodafone Idea was downgraded. Various schemes from FT held the debt investment of the company in their portfolio. The one we are referring to is the Vodafone Idea 8.25% with maturity on July 10, 2020.

FT immediately wrote down 100% of the investment. Then as per SEBI guidelines for side pockets, it shifted the holding into a segregated portfolio.

A segregated portfolio is different from the main scheme and has its own existence. The idea is to ensure that if there is any recovery from the investment, it goes to only those investors which suffered initially.

Well, there seems to be a reason for optimism. Now, this specific debt investment in Vodafone Idea has paid out interest for the past 1 year. The interest is received by the segregated portfolio in the side pocket. FT is distributing this receipt to the investors in the segregated portfolios.

For clarity, we will be using Franklin India Ultra Short Bond Fund as an example here on.

What is the basis of distribution?

So, FT estimated the overall amount recoverable from Vodafone Idea 8.25% (July 10, 2020). This includes interest paid till now + principal payable at maturity + any further interest payable till the maturity date.

It has received Rs. 65.92 crores interest now in the Franklin India Ultra Short Bond Fund, which is 7.58% of this total recoverable amount.

FT will extinguish (consider it redeemed, in other words) 7.58% of your units in the segregated portfolio and pay out a price per unit.

Basically, if you had 10,000 units in the Franklin Templeton Ultra Short Bond Fund – Super Institutional Growth – Direct Plan, then 758 units will be redeemed/extinguished and a payout at the rate of Rs. 1.4325 units will be made.

This is about Rs. 1,085 approx. (758 units * Rs. 1.4325 partial payment per unit).

The total no. of units will reduce by the no. of redeemed units. In our example of 10,000 units, the balance units will be (10000 – 758), that is, 9,242 units.

General Formula for calculating the payout is

Total Units held by you * 7.58% * applicable price per unit.

If you have a different plan of this scheme or a different scheme, you should refer to the email received from FT which has the table with the price per unit. Use it to calculate the amount.

For reference, here is the table for Franklin Templeton Ultra Short Bond Fund

| Plan | Partial payment price per unit (INR) |

| Retail Plan Growth Option | 1.3468 |

| Retail Plan Daily Dividend Option | 0.5078 |

| Retail Plan Weekly Dividend Option | 0.5120 |

| Institutional Plan Growth Option | 1.3797 |

| Institutional Plan Daily Dividend Option | 0.5053 |

| Super Institutional Plan Growth Option | 1.4251 |

| Super Institutional Plan Daily Dividend Option | 0.5094 |

| Super Institutional Plan Weekly Dividend Option | 0.5105 |

| Direct Super Institutional Plan Growth Option | 1.4325 |

| Direct Super Institutional Plan Daily Dividend Option | 0.5084 |

| Direct Super Institutional Plan Weekly Dividend Option | 0.5103 |

How can you know the no. of units you hold?

Please refer to the AMC statement (it sent to you in January) or the latest CAMS consolidated statement to know the no. of units held by you in the segregated portfolio.

Once the final maturity amount is distributed, all the units of the Segregated Portfolio 1 will be extinguished and the side pocket will be closed down.

Can you expect more payments from this segregated portfolio?

The full maturity amount has been received by Franklin Templeton and will be distributed to the unitholders in the week starting July 12, 2020.

What if the final payout from the maturity amount on July 10,2020?

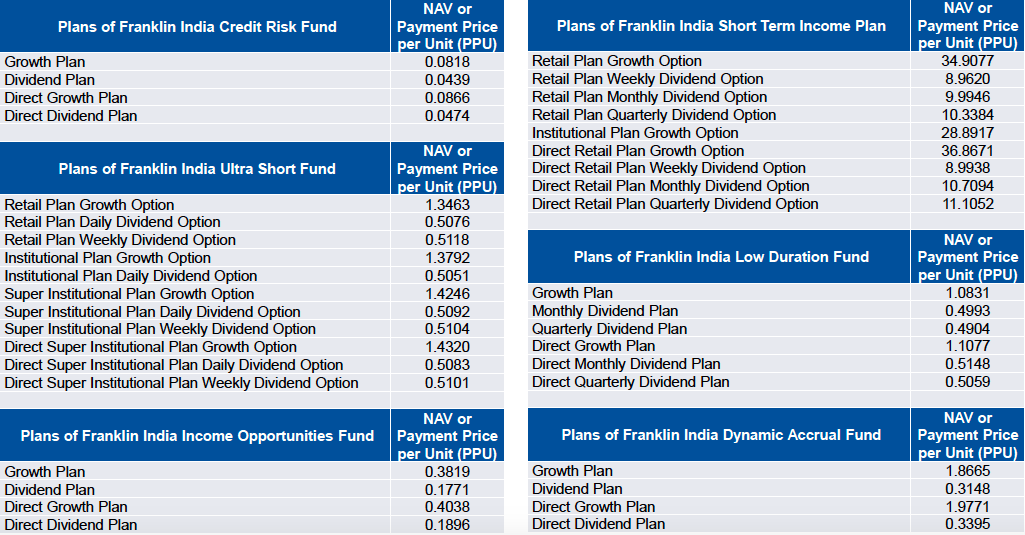

The fund house has released the following Payment Per Unit (PPU) values. Pick your fund scheme and multiply the PPU with the balance units in the Segregated Portfolio – 1.

Going ahead with our Franklin India Ultra Short Bond Fund example, let’s say you have 10,000 balance units in your account under option ‘Direct Super Institutional Plan Growth Option’. Your payout is likely to be 10,000 * Rs. 1.432 = Rs. 14,320.

— An alternative thumb rule you can use is this. Take your previous interest amount (that you received in Mid June 2020). Say that is Rs. 7580.

Now, divide this amount by 7.58%. So Rs. 7,580 / 7.58% = Rs. 1 lakh. This is the total value (interest + principal) of your holding in the segregated portfolio.

Out of this, Rs. 7,580 has already been paid out. So, the balance left is Rs. 1 lakh – Rs. 7,580 = Rs. 92,420. This is the amount you should expect.

Note, the fund house will send you an account statement too.

What is the taxation for these payouts?

You will have to be a little careful here. I am sharing with you my understanding of taxation.

The first thing that you need to know is that the units in the segregated portfolio were transferred at ZERO cost. Remember, they were first written off completely to zero and then transferred.

Now, if you have acquired your original units in the FT scheme less than 3 years ago from today, then all receipts will be treated as short term capital gains. Tax is payable as per you income tax bracket.

If they were acquired more than 3 years ago, then you can take benefit of long term capital gains tax at 20%. No indexation is possible, since the unit cost is zero.

You wonder if that has put you at a disadvantage since you actually had paid for the original units and the segregated portfolio is an extension of the main scheme.

Exactly, you had! Hence, you will be able to take the benefits when the main scheme payouts happen. Because of this segregation, the investment moved out of the main scheme.

The main scheme’s value dropped and it has lesser profits. Consequently, the expected tax in the main scheme will be lower.

Does this event mean that the FT schemes have started payouts? What about the court cases and stay on e-voting?

No, this has nothing to do with the main schemes, which are currently under litigation. The e-voting was stayed. There is no update on them.

This distribution is happening from the Segregated Portfolio – 1 with holds this specific Vodafone Idea 8.25% (July 2020) investment, which will now stand closed.

That’s all for now. Should you have any questions, please feel free to ask.

Very Nice & Simple Explainable

Why do the extinguish units (Which represent the principal) against interest Payment. In the example , if I held 10000 units , after getting this interest I should still have the 10000 units until principal is repaid

Since, all units have to be ultimately be cleared out, they are using the extinguishing approach. The fund will cease to exist after clearing all payments and units.

Even i did not understand this ..the current NAV is around Rs 27 and they are making the payout at Rs 1.4 for this proportionate units… this makes a huge 20X difference in the invested amount if they are treating them as redeemed units

You are confusing the payout from the side pocket with that of the main scheme. The Nav of Rs. 27 is for the main scheme and it remains unchanged. Even the units remain the same for now.

The segregated portfolio 1 containing Vodafone Idea was at zero NAV. Now that the interest is received, it has been distributed. Ultimately, the scheme has to be closed and units extinguished, hence the current method.

Does that mean that investor can redeem /sell units from their main portfolio?

No, nothing can be done on the main portfolio until the court decides the next steps.

how to know what was the principle amount and what is the interest part in my payout.. e.g. let’s say i have 10000 unit.. received ~10000*1.4 rs as my payout. what is the principle and what portion is interest in it.

You really can’t use the principal + interest relationship with a debt fund investment. There is the invested value and the current value and based on time horizon, you get short term capital gains (less than 3 year of holding) or long term capital gains (more than 3 years). Read the post for the question on what may apply to you.

Correct me if I am wrong.

So that means, it is final payment for vodafone segregated portfolio. This portfolio will be closed by July 20. Remaining units will be there in main portfolio. And the main portfolio payout will be only after the courts decision. We need to wait little long. Also this final payout is only for segregated portfolio with Vodafone, our remaining money stays in main portfolio.

Raghu, the segregated portfolio is already closed now after the payment was received on July 10, 2020. The payouts to the resident investors have been made too. The rest should be completed by 20th.

Yes, the main portfolio stays where it is and awaits the court decisions. thanks.

First let me thank you for detailed post. It was very informative. But somehow i could not find what i was looking for.Could you help me ?

I sold 20,588 units of Franklin India Ultra Short Bond Fund Super Institututional plan on 17th Jan. When i checked my latest cams statement, i could not find any segregated portfolio units. Does that mean i am not going to get any payment? Did i make a wrong move by selling all my units ?

Thank you!

Unfortunately, you sold out earlier. The segregated portfolio was created on Jan 22 and was available to only the investors invested as on that date.