2020 marked a culmination of the problems that started to emerge since 2018 in the debt fund space, triggering a flight to safety. Lakhs of investors were left stuck as they faced an unprecedented event where 6 debt schemes announced winding up. The risk in debt funds played out for real and like never before.

With this background, I invited Arvind Chari, Head of Fixed Income at Quantum Advisors along with Pankaj Pathak, Fund Manager – Fixed Income of Quantum AMC for a chat to make sense of what has happened so far and what’s in store for fixed income investors in 2020 and beyond.

VK: Arvind, for the last 2 years, we have been moving from problem to problem. IL&FS, DHFL along with many other defaults and and now an AMC.

I repeat this question I asked you in 2019 as well – What is going on? When even experts and fund managers failed, how do investors go about safeguarding against such risks?

Arvind Chari – (AC) The answer to what is going on is the same as before. The impact of it though has magnified. Beginning 2014 and more so after demonetization, debt mutual funds increased their exposure to corporate bonds.

Within corporate bonds, the share of non-AAA corporates bonds rose. This increase in exposure was happening at a time when corporate balance sheets were stressed as reflected in the rising NPAs in Public Sector Banks.

Demonetization and GST were other shocks from which the economy has yet to recover. The economy had begun to slowdown by early 2017. The ILFS default in September 2018 brought the issue of high risk taking in debt funds to limelight.

Mind you, this risk taking was not specific to only credit risk funds. This is not a one AMC problem. This was kind of ‘pandemic’. We saw liquid funds, ultra short term funds suffering defaults and write-downs.

COVID is, as they say, ‘the straw that broke the camel’s’ back. The seeds of the problem are actually from before.

SEBI categorises funds based on interest rate risks. But the investor has no control over how much credit risks his liquid fund can take.

For the investor, I must admit, debt and debt funds are difficult. But it need not be.

If the investor is clear on the returns that she wants to earn from debt and the risk she is willing to take on for that, she will make the right decision.

VK: What are the steps you think need to take to prevent these episodes?

Pankaj Pathak: (PP) – The flight to safety as we call is already visible. Liquid Funds own a lesser share of non-AAA corporates and the credit risks in other categories has also come down. I am not sure, if it will always stay like this. As things get better, we may see risks being taken again in funds which does not meet the objective of the investors requirements.

Just look at the number of risk events India has faced over the last 20 years and you will fund similar mistakes in fund management repeated.

The industry does reform in every crisis. However, they also tend to repeat or commit new mistakes.

Investors and Financial advisors need to be clear about what is the objective of the debt fund and why does the investor need that debt fund.

For most, the good old fixed deposit may still be the best investment.

VK: What’s the assessment of the current interest rate environment? What is in store for bonds in 2020 & beyond?

AC: The repo rate is now below the all-time lows. So is growth. At Quantum, we are debating whether India’s potential growth itself may have come down below the 6.3% average real GDP growth over the last 20 years. The RBI’s Deputy Governor commented on the same too.

Growth brings stability. Growth should be the only priority for now.

So if you see from that perspective, the Repo rate can be cut (reduced) further from the current levels of 4%. The Reverse Repo rate is 3.4%.

We should not be surprised to see more rate cuts of 50-100 bps.

The important thing though is how much does it help in reviving demand and improving the overall risk environment.

I believe monetary policy (interest rate cuts and easy liquidity) has its limitations.

VK: So, should investors moderate their return expectation?

PP: We have been saying this for some time. In all our commentaries over the last 6-12 months, we have been indicating that interest rates are headed lower and investors should reduce their overall return expectations. Not only from debt funds, but also from all other fixed income investments.

We have seen reduction in savings rate, bank fixed deposits, small savings, PPF.

As the repo rate has gone down, so have the returns on liquid funds. A safe liquid fund will struggle to earn 4% in today’s times.

So, of course, return expectations from fixed income need to be moderated. DO NOT try to chase higher returns at this stage.

VK: Is it a time for tactical allocation to any particular bond type / Gilts?

PP: There are two avenues where there may be tactical opportunities to earn a slightly higher return.

One is credit risk (investing in lower rated companies/weaker companies)– which we have been and we continue to recommend, tactical or otherwise – AVOID.

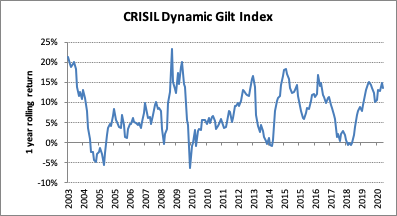

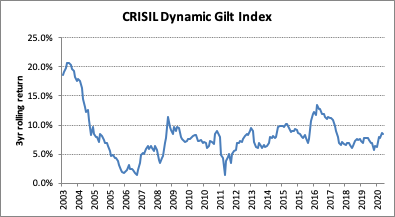

The other is in longer tenor Gilt Funds/ income funds. As interest rates fall, price of longer maturity bonds increase and hence boosts the NAV. However, if the long term interest rates rise, then the bond price falls and the NAV drops.

See the charts below.

This is how volatile the returns are: so tactical is great, if you can time it well. Seasoned fund managers may not get it right. Retail investors less likely.

It is better to be in a Dynamic Bond Fund and bet on the fund manager to get it right over time. This ‘over-time’ is important to stress. Remain invested in the bond fund, as an alternative, to your fixed deposit and hope that the fund manager can ride the volatility.

Tactically, we believe that the government’s fiscal deficit will need to be increased much more and thus long term bond yields may rise from the current levels.

The Quantum Dynamic Bond Fund currently has a lower maturity profile, (thus lower interest rate risk). We will await clarity from the RBI and government on how they manage the fiscal deficit. But the dynamic bond fund allows us to increase the maturity tactially to benefit from a fall in bond yields.

VK: Last time I had asked your view on passive investing in debt funds? In 2019, we got the Bharat Bond ETF. Does that qualify as a low cost, passive investment?

AC: Any low cost product/structure innovation is good for the investors. So this ETF meets that requirement.

But the ETF also carries all the interest rate and credit risks (lesser so in this case) as any other open-ended bond fund.

My worries with this ETF are two: A) the liquidity in the secondary markets. B) the inherent credit risk in PSUs if they are privatised.

VK: 2020 has thrown off the hook a lot of people. What have been your key learnings so far?

PP: 2008 and 2013 – bond fund investors learnt about interest rate risks, 2018-2020 – they learnt about credit risks.

For me the biggest learning has been on continuing the communication with your investors on what they should expect from my fund that they have invested in. Keep it simple.

AC: Investment management at the start and end is a management of risks. You are managing other peoples money and thus need to ensure that it meets the objective of why they invested in your fund in the first place. In fixed income, it is to keep it safe and liquid.

Personally, what I learnt from the lock-down, is the need to learn key life skills. Be humble, Be grateful and Donate.

VK: Where do you invest in fixed income / bonds? What allocation?

AC: My contingency money is in my bank savings account and Quantum Liquid Fund. I do not invest in fixed deposits. A third of my overall portfolio is in debt which is in the Quantum Dynamic Bond Fund.

Thanks for sharing your views with us Arvind & Pankaj. I hope investors too have got a much better perspective on bonds and interest rates and how should they be planning their investment strategy.

Disclaimer: No part of this interview should be considered as investment advice. If you are not sure how to build your bond / fixed income portfolio, please talk to your investment advisor.

Read More: 5 questions about debt funds

Leave a Reply