[The fool’s take] Feel proud! You are a solider too. You are finally making a contribution towards the economy. As your small savings become smaller, the govt coffers will be relieved to fight the bigger menace.

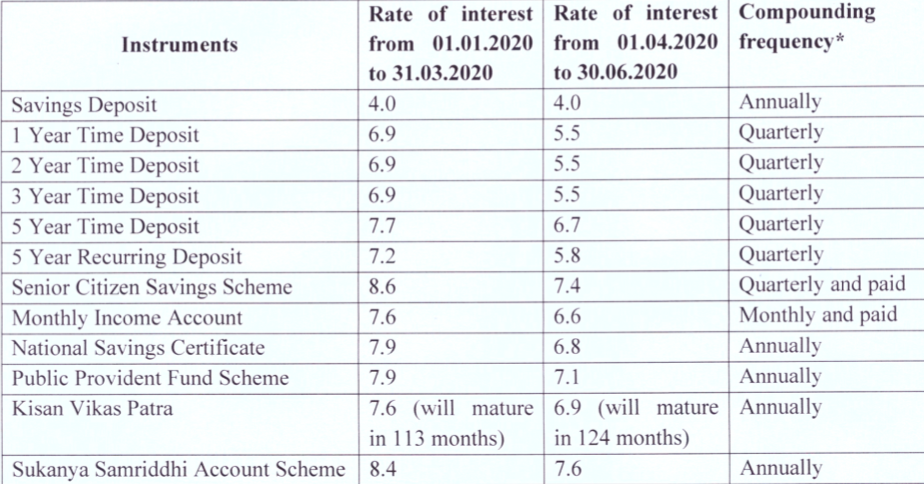

On a serious note, this is what happened. Interest rates on small savings were slashed across the board.

Before you make a big hue and cry about this act of robbing the common man (without even holding a gun), I will ask you to do this. Find out how much of your portfolio exposure is to any of these investments.

Because, if it is a small one, then it ain’t going to make much difference. Why the ruckus?

If it is large, then… oh my God! Wait! It is a large exposure!!

You had it coming.

You see the inflation rate (official one) has been down for some time. And yet the small savings such as PPF, SCSS and others were given preferential treatment for long. They kept enjoying high interest rates even when the largest PSU bank, which you swear by, was continuously reducing rates on its Fixed Deposits.

The last straw was the virus! It left no scope but to cut the interest rates.

I know it is like rubbing salt on the wounds. Apologies, if it feels that way.

I realise the middle aged investor has PPF as a part of his/her financial and tax saving plan. The senior citizen relies on the SCSS to meet monthly expenses.

What should you do?

Remember, the RBI recently cut its policy rates. You are not completely at the receiving end. Your home loans are going to get cheaper too (hopefully!)

Not to forget that inflation is down too and is likely to remain so in the current scenario.

Indian economy is looking at an ongoing low (may be even lower) interest rates. This means, as inflation tones down, further cuts on these saving instruments cannot be ruled out.

Your goal based portfolio planning has to take into account these aspects, including best and worst case scenarios. You have to diversify your portfolio enough to be not impacted by just one event, or one big event.

The message is loud and clear. There is a cost to safety/guarantee and you cannot have the best of both the worlds.

So, as small savings are getting smaller, plan your portfolio in a way that it grows larger.

Read More: Notes on PPF, VPF and Debt Funds and other fixed income options

Note: In case of Senior Citizen Savings Scheme, the rate at the time of account opening continues to apply. All new accounts get the new rates.

For PPF and Sukanya Samriddhi Yojana schemes, the new rates will apply immediately for the quarter of April 1 to June 30, 2020.

Between you and me: What changes, if any, are you making to your portfolio? Do participate in the discussion.

Leave a Reply