We are in World War V. No that’s not 5 but V for Virus, the CoronaVirus.

It is dire out there. Lives are at stake and while the world tries to get ready to fight this menace, it will cause serious disruption to lives of people as well as the world economy.

As investors, you are likely worried too. What will happen to the portfolio?

Here’s the straight one. Your portfolio will get hurt too, specially, if you are in stocks or anything market linked.

However, hasn’t that been the case always?

We have something to worry about, always. A flu, a war, a despot / dictator, a trade pact, a military treaty, climate change, acts of terrorism, BREXIT, negative interest rates and now the CoronaVirus.

Each one comes with at least one “end of the world” scenario. It has been happening for centuries. And yet, here we are, in year 2020.

I don’t mean to demean the fact that not everyone was lucky and not everyone survived but humanity as a whole has. We are likely to survive and move forward after this one too.

And if you are with me on this, then you also know that worrying for the portfolio may not be the most efficient thing to do.

The conflict of long term vs short term

As long term investors we need to ignore short term noise. Yet, it is becoming increasingly difficult to do so. As someone famously said, long term is just a sequence of many short terms.

So, let’s accept the fact that the events in the short term and our emotional reaction to them is a normal thing to do. However, letting the emotional reaction to trigger investment actions can be a recipe for disaster.

I know it is not easy to remain stoic when markets are going crazy. (Heck you may even be thinking that either I am crazy or being paid by someone to write all this for you. It isn’t so!)

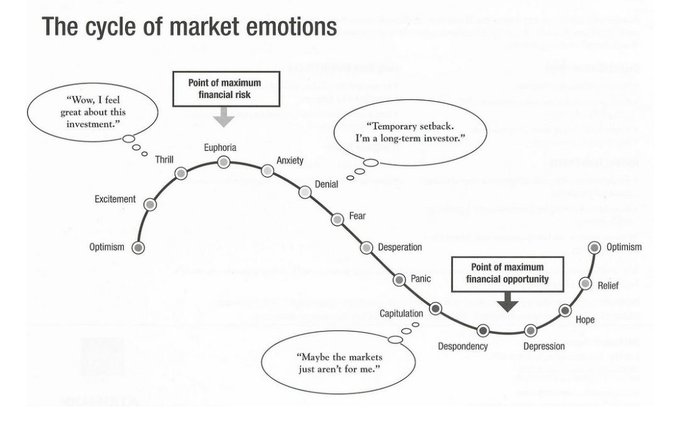

The markets always behave like a roller coaster and in quite a pattern. See the image below.

Now, here’s the challenge for you?

Note the words. Add whatever piece of news you can think of or an event you can remember, alongside the various points. 1 century ago, 10 years ago, 5 years ago, 1 year ago, a few months ago, last week, yesterday, today!

You get the drift!

OK. So, what do you do?

If I were to put it simply, what needs to be done is this.

At the height of euphoria, rebalance to your asset allocation.

At the depth of despair/despondency, rebalance to your asset allocation.

That’s all.

No, you will not be able to time it perfectly, but just following your asset allocation, you will reduce your portfolio pain a great deal.

Does that make sense?

Between you and me: Where do you think we are today in this market rollercoaster? What are you doing with your portfolio?

Leave a Reply