Yes, you still want to go for the 3 month EMI Moratorium. I just want to let you know that this is not free money. It comes with a cost.

Here’s the earlier post on the RBI announcement. The update is that this moratorium is automatic. For the next 3 months, your EMI will not be deducted by the bank. Unless you pay up yourself. So, if you are not proactive with your manual EMI payment, you are likely to incur this cost.

Let’s find out cost now. I have made a calculator you can use to find out the likely impact on you. Read on.

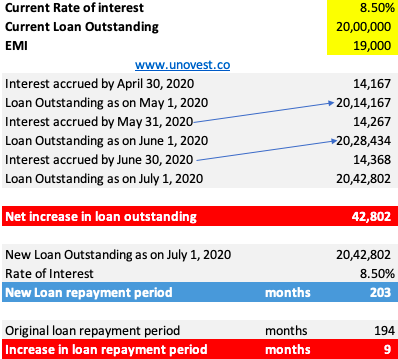

Assume, your home loan outstanding is Rs. 20 lakhs and your current rate of interest is 8.5%. The current EMI is Rs. 19,000.

This is what you are planning to do.

- Don’t pay EMI for 3 months, till June

- End of June, don’t pay any additional amount, such as, interest for these 3 months

- Start paying the regular EMI from July

How will your loan outstanding and repayment period will change if you choose to go with the 3 month EMI moratorium?

At the end of 3 months, your loan outstanding will go up by Rs. 42,802. This is the interest on the interest that built up during the period.

Your total loan repayment period also goes up by 9 months.

Simply put, in the above case, the cost of 3 month moratorium is 6 months of additional EMIs. This is a big cost to pay.

This can change based on the specific inputs of your case.

Now, why don’t you find out the impact for yourself. Here is a quick calculator you can use.

If you want to use Google Sheets, this is the link.

Stay safe!

sorry but i didn’t got this calculation….

can you simply this “The repayment schedule for such loans as also the residual tenor, will be shifted across the board by three months after the moratorium period. Interest shall continue to accrue on the outstanding portion of the term loans during the moratorium period.”

to a common man’s language?

Sir, the article was written to explain just this. 🙂

isn’t the interest should need to applied to total of 3 month emi insted of principal amount?

The way it works is, that interest is applied on the outstanding principal amount.

Now, the EMI that you pay has both principal and interest component. Every month one portion goes towards interest and another reduces the principal outstanding.

IN this case, since you are not paying EMI, the principal amount does not reduce. Instead it accrues additional interest. AT the end of 2 or 3 months of non EMI payment, the outstanding principal goes up.

Assuming your EMI doesn’t change, the term of the loan will increase to make up for this increase in principal..

Hope that clarifies.

okay got it thanks

Okay! Thanks to RBI that for helping loan payers during this strange time.