As per Budget 2020, dividends are now taxable in the hands of investors. There will be no Dividend Distribution Tax paid by the companies or mutual funds. Additionally, there is a TDS of 10% if the dividend paid is more than Rs. 5,000 in a financial year.

Given the new tax rules, should you switch to growth option or just continue?

Let’s get some background first.

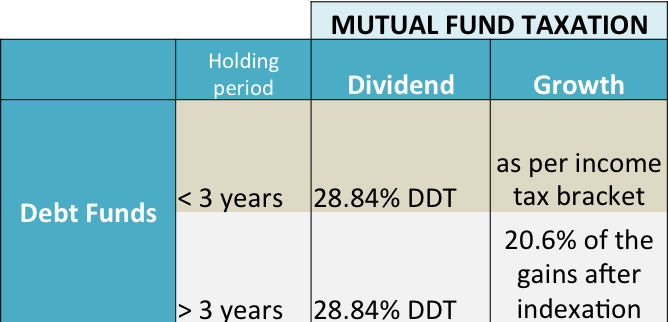

In case of debt fund dividends, dividend distribution tax was applicable at the rate of 28.84%. Any appreciation or capital gain is taxed on the basis of short or long term. See the image below.

If the holding period has been less than 3 years, the short term capital gains tax at your marginal income tax rate applies.

If the holding period is more than 3 years, long term capital gains tax applies at the rate of 20% + surcharge along with the benefit of indexation.

So, for someone in the highest tax brackets using dividend option to park money in debt funds made sense. This changed on Feb 1, 2020.

As per new rules in Budget 2020, the 28.84% DDT will go away from April 1, 2020. Instead, dividends will be taxed at the marginal rate of tax. If you happen to be in the 42.xxx% tax bracket, that’s your tax rate on the dividends too.

Ok, now let’s come to the issue at hand.

If you have parked your money in in debt (liquid/ultra short or low duration) funds using the dividend option for transferring to equity funds, should you switch the funds to the growth option?

I am sure as you are reading this, the answer has automatically unfolded for you. If your debt fund investment is short term in nature, that is, for the purpose of switch or STP into equity funds, it is not going to make any difference even if you switch.

Because for less than 3 years of holding, in dividend or growth options, the tax is applicable at your marginal tax rate.

But what about the TDS at 10%.

Let’s take an example.

If you have Rs 1 crore parked in a liquid fund with the dividend option and you are switching Rs. 5 lakh every month into equity, it will take about 20 months for the full transfer.

During this period, you are likely to have a growth of about 6% (annualised, assumed). Even if 80% of it is given out as dividend, that makes it approximately 5%.

The likely dividend (again assuming money is regularly moving out from the fund to equity) is going to be around Rs. 2.5 to Rs. 3 lakhs (That’s definitely more than Rs. 5,000 threshold for no TDS.

The TDS in this case is likely to be over Rs. 25,000, which will show up in your tax return and can be claimed back, if that is the case. However, you will agree, the TDS is not the full tax.

As someone in the higher tax brackets, you will likely shell out even more tax since 10% is not your tax bracket.

So you see, you have to pay taxes irrespective since a redemption is taking place (either via switch or an STP mode). The TDS only ensures that you are paying the tax a bit in advance.

This remains true even if you shift from dividend to growth option.

—

Having said this, if your holding period is likely to be more than 3 years in debt funds, the dividend option is disastrous. Choose only growth option, irrespective of your tax bracket. In fact, if you are in the dividend option, switch to growth now.

nice post. very helful

nice one

Thanks unovest for this valuable and fruitful sharing. you have all the basic details that was needed to be covered. It will really help the reader still who is having a zero knowledge of investment.

Recently, I have created a blogging platform www. thewisemoney .in please also visit there and write your suggestions about how can i improve it?

Thanks and best wishes Chandan.