Budget 2020 proposals are out. While enough has already been written and said, let’s go beyond that.

Let’s look at some of the key proposals to develop an understanding of how they impact us and what we can do, if at all.

Note: The Money and You workshops in Pune are scheduled on Feb 8 (Kalyani Nagar) and Feb 22 (Baner). Read the details here and register now.

Tax, tax and tax

The biggest highlight of this budget is the focus on tax collection. In essence, this is what the budget documents says:

Tax se bachna mushkil hi nahi, namumkin hai!

Almost every possible source of expense or income now has a TDS or TCS.

TDS is tax deducted at source and is collected by the buyer or payer

TCS is not what you think. It is tax collected at source, collected by the receiver.

If you send money to your children above Rs. 7 lakhs in a year for their foreign studies, there will be a 5% TCS.

If you are planning to make an overseas trip using a tour operator, there will be a 5% TCS of the package amount. Any money sent via the LRS or Liberalised Remittance Scheme is also covered under the TCS.

What can you do about it? Noting much. You can, of course, adjust the tax paid when filing your tax returns and even claim back as a refund, if so due, but the advance tax in the form of TCS has to be paid. The downside is you will need to block additional money till you seek a refund.

EPF, NPS and Superannuation fund contributions

The tax free employer contributions in your EPF, NPS and Superannuation fund is now limited to Rs. 7.5 lakhs in a financial year. Even the interest earned on the above in aggregate on the above contribution will be tax free only to that extent.

High income earners who were using NPS and EPF (including VPF) to reduce their tax liability will have a cap to work with now.

What can you do about it? If you still feel that saving with these options and earning that guaranteed return works for you, you may continue investing. Else, you have a wide choice of investment instruments that can work for you.

Lost taxes and the NRI

For the purpose of preventing abuse of the non resident clause, the new provisions say that if you stay outside of India for 120 days (instead of the 182 days earlier) and have pay taxes in no other country, then your entire income is taxable in India.

CBDT under the Ministry of Finance has clarified the it does not cover bonafide workers in other countries (or the regular NRI). They will continue to be taxed only on the income generated in India.

What can you do about it? Nothing much again. Actually, there is nothing much to do since it is targeted at those NRIs who planned to have no tax jurisdiction. As I understand, those employed in the merchant navy will now have to file and pay taxes in India.

The game of income tax slabs

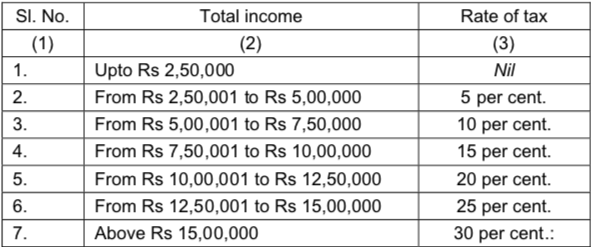

As a salaried individual, you can now exercise a choice every year, that is, of choosing which tax slabs you want to use to pay your taxes.

If you are someone who hardly takes benefits of any of the savings, investments or expense driven tax benefits, then the budget 2020 introduces an option for you to go for new income tax slabs and pay less tax than before.

Remember, to take benefit of the new slabs, you have to forego all exemptions available under the old tax slabs.

However, if you are like me (I am not salaried, BTW), who ends up using the interest on home loan benefit, invests Rs. 1.5 lakh under Section 80C and medical insurance premium under Section 80D, you may just want to continue with the old tax slabs.

What can you do about it? Well, play the game! In a few weeks or months, enough online tools are going to be available to help you save the most tax. In fact, the Income Tax Department’s online tax filing website should have the option too.

The dividend tax

This is a big one. Dividend is the opium of the investors and they have gone big after it.

So far, dividends declared by companies and mutual funds were subject to DDT or Dividend Distribution tax.

Hence, dividends received on your direct stocks or your mutual funds were exempt in your hands (upto Rs. 10 lakhs in one financial year). Over 10 lakhs, you had to pay 10% tax.

No more. As per the Budget 2020 proposal, companies or mutual funds will not be subject to DDT. The dividends will be paid in full to the investor. Every investor has to now add the dividends to their total income while filing the tax returns and pay tax as per the marginal tax rate.

So, if you happen to be in the 30% plus tax bracket, you will now pay 30% tax (plus surcharge) on your dividend. This is true even if it happens to be a measly Rs. 100.

Those in the lower tax brackets and receiving some dividends may actually benefit since the overall tax liability may be less.

In addition, mutual funds will deduct 10% TDS on dividends over Rs. 5,000 paid out to any one.

That’s it for now.

In the Money & You workshops, we will see how most of this is immaterial in the long term and how you can use the proven personal finance and investing principles to build wealth and meet your financial goals.

What are the proposals you think impact you the most? Do share your thoughts in the comments section.

nice one

As an employee, We all have to suffer from income-tax and insurance policies, etc. nice article. I got some new information from this blog. Thank you.

Over this blog you will get to know about the budget 2020 taxes. This article gives suggestions on limitations and delimitation of the topic. I enjoyed reading while going through this article and this is the best link for gaining all the information about it.