As per SEBI Categorisation, credit risk funds invest 65% or more of the portfolio in AA or lower rated securities. So, you can look at a portfolio and tell if a fund is a credit risk fund or not. Right?

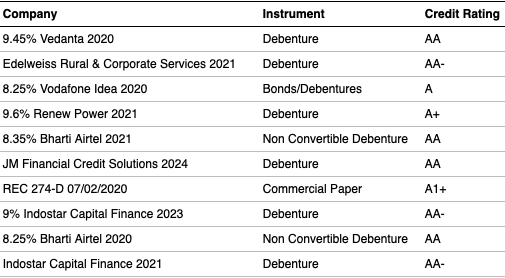

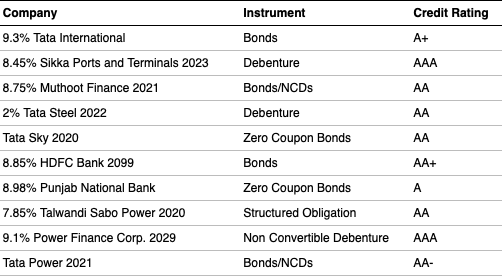

Good. Here’s a quick quiz for you. Below are the top holdings of 3 credit risk funds.

Now, the question. Which of the above portfolio conveys the best picture of a credit risk fund?

I don’t know about you, but to me, Fund 1 seems to fit the bill. The other 2 even have AAA rated instruments in their top holdings. I mean really!

I would rather go to a corporate bond fund or a short term fund to have AAA. Why choose a credit risk fund?

OK, so back to our 3 funds. Let me disclose their real names.

Fund 3 is ICICI Prudential Credit Risk Fund.

Fund 2 is HDFC Credit Risk Debt Fund.

Can you guess the name of Fund 1?

Unlikely! I did a trick on you! 🙂

Fund 1 is the Franklin India Ultra Short Bond Fund – Super Institutional Plan. It is not part of the credit risk fund category. It is instead a part of the ultra short term category.

Read more about SEBI categorisation here

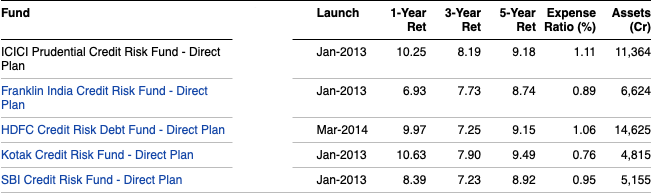

Moving on, look at the image below. It is a peer comparison of a few credit risk funds, including the 2 we used above.

The number to notice is the expense ratio, typically close to 1%. This is for direct plans. Add another 50 bps or more for regular plans. And what do they give for it? Anybody’s guess!

Now see this.

The expense ratio of this fund is 0.41%, for a portfolio which plays on credit.

Credit risk funds are a joke, really!

- If I come to a credit risk fund, I come looking for the risk. Why choose a credit risk fund for safety aka AAA?

- Credit risk funds charge an expense ratio equal to equity funds, without commensurate effort. Forget the performance, even the portfolios don’t reflect risk.

- Franklin India UST, even though an ultra short bond fund, has more lower rated securities and hence higher credit risk than the so called, credit risk funds.

- Franklin India UST does it for me at a much lower cost. The fund is known for its credit calls including using structured products.

Between you and me: What is your take on credit risk funds?

Note: Nothing in this post should be considered as a recommendation. You should talk to your advisor if this is the right fit for you.

Disclosure: I am an investor in Franklin India UST Bond Fund.

Thanks Vipin for this information