If you are invested in Franklin India Dynamic PE Ratio Fund of Funds, know that there are some fundamental and important changes being carried out.

#1 It is getting a new name

The fund will now be Franklin India Dynamic Asset Allocation Fund of Funds. It has an expanded mandate now. What is that mandate?

#2 The Asset Allocation parameters of the Fund are changing.

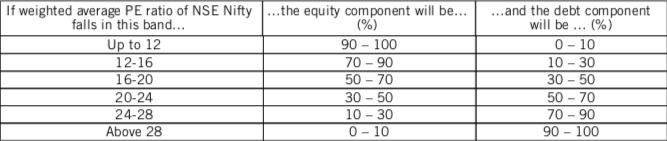

The fund is designed to invest in equity and debt based on certain pre defined parameters based on Average PE of Nifty index. Here’s how it works.

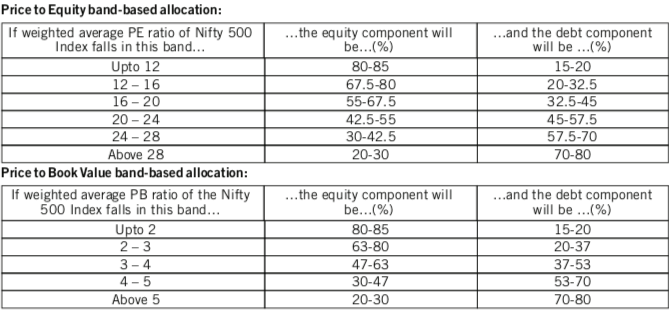

Going forward, the fund will use a combination of P/E and P/B ratios of Nifty 500 index to determine its equity allocation. Both ratios will have a 50:50 weightage in the decision.

As you will notice, currently the fund has an option to go 100% in equity or debt.

In the proposed change, There is a minimum 20% allocation to equities.

Note: Currently, the Dynamic PE ratio is invested 35% into equity via the Bluechip Fund. (Source: ValueResearch)

This is likely to change as the fund implements its new policy starting October 21.

#3 The fund of fund has new fund choices too.

The money you invest in this fund is further invested into 2 (or 4) funds based on parameters listed earlier. The investment is of course only into equity or debt funds of Franklin.

The equity portion is currently invested in Franklin India Bluechip Fund and if the overall investment from this Dynamic PE fund exceeds 20% of the Bluechip fund, then subsequent investments will be moved to Franklin India Equity Fund (formerly, Prima Plus).

For the debt portion, Franklin India Short Term Income Plan (a short duration fund) is the first choice till 20% of the fund size and then Franklin India Income Opportunities Fund (a medium duration fund).

From October 21, 2019 the Dynamic PE fund will have Franklin India Equity Fund as the primary fund and the Bluechip fund as the second option.

The Franklin India Equity Fund (FIEF) is a multi cap fund and allows Dynamic PE fund to access a wider mandate. The Bluechip fund’s mandate has been curtailed since SEBI’s recategorisation norms. 80% of its portfolio can now invest only in the Top 100 stocks.

As for the debt option, Franklin India Short Term Income Plan continues to be the first choice till 20% of the fund size. However, the second fund in the basket will be Franklin India Low Duration Fund. The Low Duration fund carries lower interest rate sensitivity compared to the Short Term Income Plan.

So, what do these changes in Franklin India Dynamic PE Ratio Fund of Funds mean for you, the investor?

If you invested in this fund, it is primarily because you don’t like the volatility of equity funds – you need a more sedated option. You also probably like the fact that the fund manager can increase or decrease equity exposure based on market valuations.

That doesn’t change yet.

However, the risk profile will go up a few notches.

The equity allocation of the fund will increase with the new parameters in place. Not to forget the minimum equity allocation at 20%.

There is an additional dose of mid and small caps introduced in the portfolio, courtesy the wider mandate of Franklin India Equity Fund.

In terms of debt, however, replacement of a medium duration fund with a low duration fund is pushing the risk downwards. That is a second option, though.

Even the taxation on the fund will remain the same. As a fund of fund, it is subject to debt fund taxation, that is, if you sell within 3 years of buying, you pay tax on short term gains at marginal income tax rate. If you hold for more than 3 years, you get to benefit from long term capital gains tax lower rate (with indexation).

Not happy? The fund house has allowed exits (with no exit load) till October 18, 2019. Taxes will apply though.

If you stay put, it will taken as your consent to the changes and your investments will continue.

What are you planning to do?

Hi Vipin

Another good analysis of a MF scheme. I like the way you see things from different perspective. What I also like is the fact that every time you cover the Tax impact, which can be (should be) a significant factor in decision making. Many MF analysts leave that to the investors imagination. Good work.

Naren

Thanks Naren.

Thanks for the detailed post. I currently have this fund (core) as well as the Franklin India equity fund (satellite) in the portfolio.

I am thinking of stopping SIP in the multicap fund ( since it will be a part of the dynamic pe fund) and starting SIP in Prima fund as the satellite option. What do you recommend?

Hi Swapnil, This decision completely depends on what you are trying to achieve with your portfolio.

However, can you use the Prima Fund from the mid cap category? You may.

Thanks for the prompt reply. Appreciate it 👍