One of the all time, most argued topics has been buy vs rent a house. I still remember sitting with my friends, years ago, discussing (in fact, arguing) as to which option is better. One of us was for buying a house and the other was clear as to “Never”.

I only realised much later, how loaded that question is? There is no one right answer. Apart from financial aspects, individual situations, emotional needs, property preference, family needs, etc. go a long way to determine the right course of action for any single person/family.

Having said that, it is the financial part that still needs its due attention. In my view, that provides an objective input to an otherwise heavily subjective decision.

Now, there is no dearth of resources on evaluating the buy vs rent a house decision. However, I haven’t come across a comprehensive calculator – one which factors in key assumptions to provided a really objective input to the entire decision.

So, I built one.

What are the things under consideration in rent vs buy a house decision?

Here is a list.

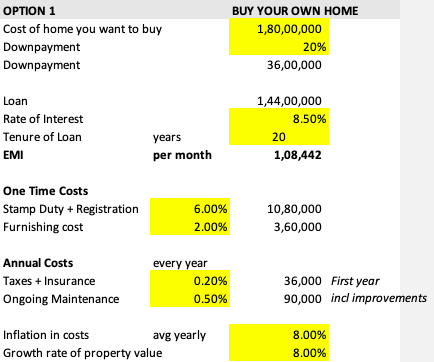

- What kind of house would you prefer to have? More specifically, the initial buying cost?

- How much downpayment you intend to make or your own contribution?

- Hence, what is the loan amount you will go for? Rate of interest, period of loan?

- Any one time costs that will be incurred such as Stamp Duty, Registration charges and Furnishing costs to get the house ready for moving in?

- Recurring costs for taxes, insurance and maintenance and expected inflation on these costs

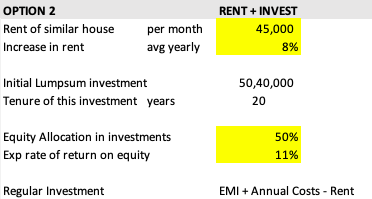

- Then comes in the option about renting. If you don’t buy, what is the rent today of a similar property?

- How much is this rent likely to increase on an annual basis?

- Now, since you are renting, how will you invest all that surplus? More importantly, will you play completely safe and invest 0 in equity or go all in and do 100%. Of course, there is a range in between for you to use.

- What are the growth rates or expected return on both property as well as the equity portion of investments? This is a key assumption and you are requested not to get aggressive here.

With that understanding, I set out to build this excel calculator. You can download from the link below.

It has got 2 sheets. One, takes your inputs and the other provides a summary of the two options and a decision that you may consider.

Let’s look at the inputs For Option 1 – Buy a home. Here’s what you need.

Here’s Option 2 – Rent a home and invest the surplus

Most of the above inputs are self explanatory. We plan to invest any surplus in a mix of investments that suits us. Remember, higher equity allocation doesn’t always mean a higher final outcome for you. Volatility is at play and it can produce a different outcome than you hope.

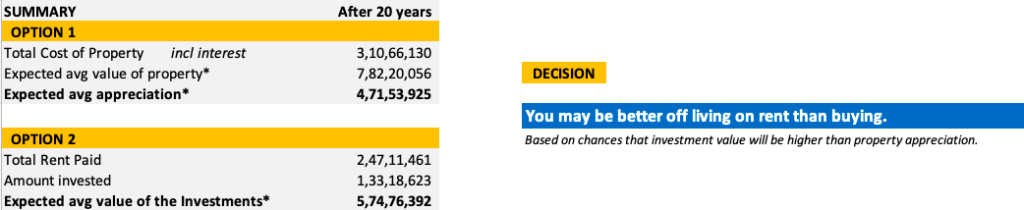

Based on the inputs, here’s what the decision may be.

One of the important things at work here is that there is no linear growth assumption. Markets don’t behave in a straight line and hence I run thousands of scenarios to see what exactly are the chances that one option trumps the other.

With the set of inputs I have used, renting turns out to be a better option. As inputs change, the decision can range from “Just Buy that house” to “Don’t buy that house at all”.

Given the current India real estate scenario, for most people, renting will turn out to be the better option. I say that only from a financial point of view. Not to mention, that renting also leaves a lot of liquidity in your hands.

Then there is the current preference of accessibility over ownership by the latest generations. They are just happy renting for convenience. Well, it might just be making a lot more financial sense too. Check out the calculator.

Between you and me: So, what are you doing or did? What are the influencers for your decision?

I think the EMI calculation mentioned in the excel sheet is wrong. Could you please check?

Loan 4,500,000

Rate of Interest 8.50%

Tenure of Loan years 10

EMI per month 42,148

EMI should be around 55,000 not 42148

Good catch, Sir! Corrected!

1. Not Buying . Wrote something on similar lines

https://docs.google.com/document/d/1v15Ao_2S-WUqdAx5_1tZUZNKVU7BYUw8TSaAtvguR8w/edit

2. your assumption of 8% is quite magnanimous for real estate:) for a property worth 1.8 cr, at 8%.

That’s an awesome note, Abhishek. Sums up about everything we go through around the decision. Most still fall prey and end up buying though.

The growth rate is an individual assumption.

Vipin,

How about the rent saved for the person who buys own house, In the end that also is part of total savings for him/her

So, the comparable cash flows are 1. EMI 2. Rent. You choose one of them. The savings gets incorporated automatically.

Rent saved will never match interest paid. Another fundamental mistake lot of people make is they compare current rent( close to work place) to emi of new home( which is far off) and forego years of travel expenses and time spent in traffic.

problems with own house:

we lose flexibility, our location(move to different city for work, far from office etc.) preferences might change, our preference for number of bed rooms can change as the family grows/shrinks

Yes, all of these are true!

I think financial calculations are also full of assumptions. The returns on the investment is the biggest assumption here. I think owning a house is also a form of diversification. I don’t want all my assets in financial markets. An own home to live is always a comforting factor. But buy or rent decision can be made based on several other factors such as

1) What is the status of one’s job? If you talk about paying 45k as rent then he must be in a stable, settled 35 years old professional unlikely to move around jobs often. So owning a house makes sense instead of paying huge rent forever.

2) Does one switch between India and abroad often for work? You may need to shift your home items somewhere whenever you move abroad which is troublesome, if you own a home, you just lock it down and go. You could pay your loan faster by income from abroad as well.

3) Does he plan to settle in same city after retirement? If yes, buying a home makes sense because no point paying rent for till death and you may not get a home to buy at a preferred location after 30 years. On the other hand, if you come from a different city and you will move there after some years, then you either buy something there or just invest.

4) Buying a house in a city which is prone to water shortages, floods, etc could be suicidal. Its risky to buy a home where life may not be easy

5) You also need not buy if the rent at your city is on the lower side. So here the flexibility takes higher precedence as the rental outflow is low.

Finally, if the current RE situation gives you big discounts for homes along with lower interest rates it is favourable to buy provided you think through above points

Relevant inputs Pradeep. As mentioned, this is one hell of a subjective decision. The numbers form maybe 10% to 20% role in the overall process.

nice information shared.

Great calculation. Upon reading your post, I think my wife and I need to assess our financial capability again. We really want to have a house at one of the top rated developer. My wife and I are not getting any younger so we really want to have our own house before we retire.