The Government of India has announced a monthly series of the Sovereign Gold Bonds 2019. They are available for subscription every month from June 2019 to September 2019.

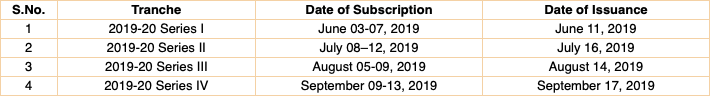

Here is a link with all the details that you need to know about these Bonds. The issue calendar as available on RBI’s website is as below.

The key features of these bonds are:

- Available as bonds, no need to hold physical gold.

- Buy as little as 1 gm worth of bond

- Fixed interest rate of 2.5% per year, payable half yearly (taxable)

- Can be converted into demat and traded on stock exchange

- No capital gains tax post 8 years of holding for individuals. Indexation benefit available for others.

- You can buy it via banks, post offices

Before you rush to buy the bonds, here are a few points for you to consider:

ONE. You will not have real physical gold in your hand. So, if you think that in a year, when there is a family wedding, you would just use this gold to make that piece of fine jewellery, sorry, that would not be easy.

Yes, it can be. If you have a demat account then you can sell the bonds or a part of them on the exchange and then do the needful. Remember you will incur capital gains tax when you sell before maturity.

TWO. In case you are thinking that when World War 3 breaks out and the paper currency becomes worthless, your gold bonds will be the universal currency to buy anything you want, I am afraid to say you are being too optimistic.

This is just a bond, a piece of paper and not real gold. It might have some value due to its underlying asset as Gold but it surely is no equal to the shiny yellow metal itself.

THREE. Gold continues to remain an investment of choice in uncertain times. I think the word “investment” is wrong. Gold is a preserver of value, of purchasing power. In any case, uncertainty is the norm for the world.

If you are investing in Gold Bonds for the returns, you might end up disappointed.

Why should you invest in Sovereign Gold Bonds 2019-20?

If you have made long term allocation to Gold in your portfolio. This is a great way to get that allocation working for you. You might also be saving a bit every year for your child’s marriage, choose this way.

Oh yes, the bonds offer a 2.5% fixed interest rate every year, paid half yearly. That’s a clear bonus, actually an incentive for you to hold a bond than physical gold. On top of that, you get market price when you sell.

If you hold till maturity, that is 8 years, you don’t incur any taxes too.

Purely as an insurance against the uncertainty factor, you can have some of your portfolio in Gold. (Personally, I don’t do it!)

Remember the tagline of the Sovereign Gold Bonds is Invest Wisely. Earn Safely.

Are you investing?

Leave a Reply