A new fund offer currently asking for your money is the DSP Quant Fund. What is this fund about and does it deserve to be a part of your portfolio? Let’s find out.

When it comes to fund management, there are 2 broad ways to build a portfolio. One is passive, the other is active. Click here to read the primer on active vs passive.

Somewhere in between the passive and active, there is a branch that intends to bring the best of both the worlds – the low cost nature of index funds and the quality and outperformance aspect of active funds. Call them smart passive funds.

A lot of research has been done on what makes a portfolio perform / out perform. Essentially, what are the factors responsible for stock portfolio performance. There are about 7 to 8 factors including

- Value

- Quality

- Momentum

- Size

- Liquidity

- Low Volatility

At various points of the market cycle, one or more of these are likely to drive the performance of a portfolio.

Fund managers and investors in their zeal to chase alpha picked up on these and started a new set of funds also known as factor funds. While they have been a rage globally, in the Indian context too, we have seen a few. They are very little interest today. Some such funds/ETFs are –

- Kotak NV 20 (based on Nifty 50 Value 20 TRI Index)

- ICICI Pru Nifty NV 20

- SBI ETF Quality (based on Nifty 200 Quality 30 TRI)

DSP Quant Fund is yet another factor based fund, which is expected to operate by rules around the factors.

The making of DSP Quant Fund

DSP has taken a leaf from the playbook of its earlier partner, BlackRock, which has a big presence in the factor funds space.

DSP Quant Fund positions itself as a rules driven fund based on good investing principles. It applies factor based scoring and an optimisation formula around growth, quality and value. It expects to outperform the BSE 200 benchmark over 7 years plus time horizon.

Since the benchmark is BSE 200, this is more of a large & mid cap fund. It is categorised as a thematic fund since the fund house already has an active fund that occupies the large & mid cap category (as defined by SEBI).

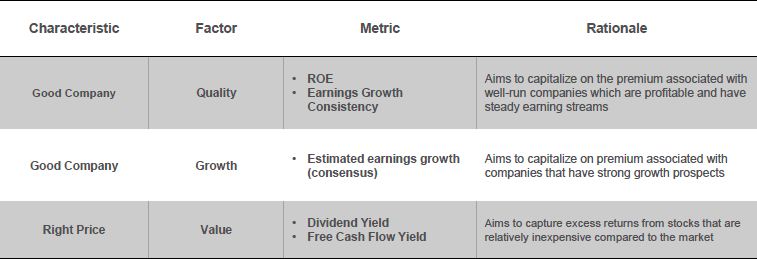

On the BSE 200 stocks universe, the fund uses the following factors to filter and optimise its own portfolio.

On the face of it, they appear like what any sensible fund manager would apply to his portfolio. The difference is that they are converted into rules thus eliminating space for personal judgement.

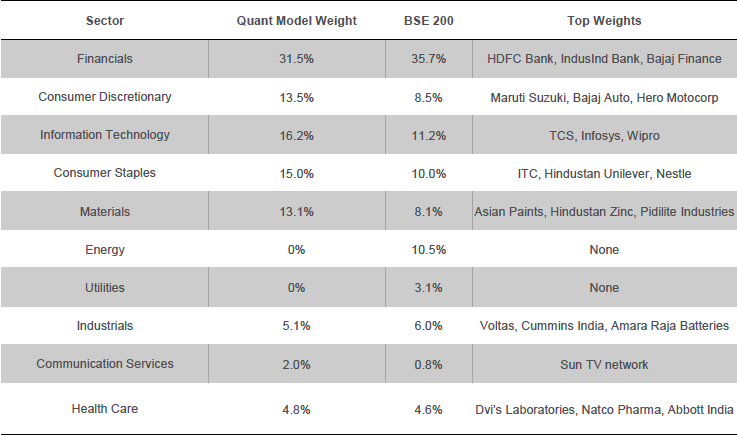

The fund will use percentile rank to avoid overweighting large market cap stocks, which is one of the issues with the existing indices. What is the likely difference once can see in the portfolio?

Using the above factors, this is the difference one can see in the portfolio vis-a-vis the benchmark. This is the result as on March 31, 2019.

The fund is likely to have lower drawdowns too. On the other hand, the rise in comparison to the index may remain a bit muted.

Proof of passive – the fund will rebalance once every 6 months.

Should you invest in DSP Quant Fund NFO?

What do I like about this fund?

One of the key concerns with active funds has been that they are driven by a fund manager’s whims. It has been observed in the past that several funds flounder once the star fund manager leaves. Looks like the DSP Quant Fund is unlikely to face this issue. As it says, “the rules, rule”. That’s a good thing and prevents acting on bias. (Mind you, only the fund has rules. It can’t prevent you from behaving irrationally, though!)

Another key concern with active funds is the high costs (even though they are hardly ever beating the marked index). These costs can be as high as 2%. The DSP Quant fund cost or expense ratio is expected to be 0.4% per year for the direct plan. There is no reason to complain about the expense ratio and hopefully they will have a glide down path for it with rising AUM.

Well, you can still go for just an index fund with a much lower cost and no fund manger to bother. But that wouldn’t be smart, right? That’s why you might consider a rules based, smart passive fund like this.

What I don’t like about this fund?

For starters, it is a beginning. It’s a new fund. While they have back tested their strategy, I am not a big fan of back testing. The real world always turns out to be different. The strategy has not gained experience of its own, specially over a 7 year period it claims one should invest for.

Having said that, the fund house does have the experience of various other schemes over 10 years or more.

I also don’t know how much tweaking have they allowed in the strategy / optimisation. Basically, can they change the rules? How frequently? What basis? Because, if that happens, it is no different than any other fund.

The fund warns those who have less than 7 years investment horizon or desired to invest in a momentum style of investing. They should avoid.

Long story short, if you are willing to make this fund a core holding in your portfolio (with at least 10% allocation), you may consider investing in the fund. This means you need good conviction.

There is no hurry though. This is going to be an open ended fund and once it opens you can take your call after seeing the fund behaviour in the real world. I would do that.

Remember this is not a plan vanilla passive index fund but a smart passive fund.

Over the next decade or so, I believe the passive and smart passive will occupy a larger portion of your MF investments because the active fund mangers will fail to justify themselves.)

Trivia 1: The Quant in the fund name is confusing. It goes against the purpose of the fund and suggests that the fund will operate on algorithms, may be use high frequency trading.

Trivia 2: The S&P BSE 200 index is designed to measure the performance of the top 200 companies listed at BSE Ltd., based on size and liquidity across sectors.

I’m not able to grasp that DSP is blindly eliminating Energy basket of stocks which include India’s largest company Reliance Industries which has not only given excellent returns over the last several years but it’s no longer an energy company and also India’s largest retail chain operator apart from telecom operator and considering their growth plans, they’re expected to do well for next many years.. Definitely, it’s not only one such stock and there are many more high quality growth stocks which they’ve excluded.

Certainly, there is a great risk in this fund and their strategy that it may lag behind even Sensex or NIFTY50 over 7-10 year periods let alone beating BSE200 benchmark.

Retail investors would be better off with a low cost pure index fund rather than variants of index funds.

Remains to be seen Manish. The beauty of the rules is such, if something does not qualify, it does not qualify.

This is the review I was waiting for 😀 Thanks for the sane voice as always, Vipin.

My perfect fund, after obsessing over analyzing various funds, is a fund that invests 40% in Nifty, 30% in Nifty Next 50 and 30% in debt papers with a maturity of maximum 1 year. And that which does rebalancing once every 6 months within the fund so there’s no tax liability for the investors unless they withdraw. I can do this myself but rebalancing may incur taxes, and that bothers me.

An equity hybrid fund does the same thing but it actively manages the equity portion which bothers me. And also, an equity hybrid fund can sometimes invest up to 80% in equity as well which is above my desired limit.

Thanks Srikanth. Your voice may be heard soon by one of the fund houses.

As for rebalancing, during the accumulation phase, the new cash flow can take care of this to a large extent without needing to move the existing investments.