Annuity has come to be a defining feature of retirement oriented investments. So, you have Pension Plans being pushed down your throats by insurance companies. One of the most debated investment options – NPS – too asks for a compulsory annuity of at least 40% of the final maturity value.

What does the annuity do?

Annuity is just another name of a pension. It allows you to receive a predefined cash flow on a regular basis.

An annuity is typically offered by an insurance company such as LIC, HDFC Life, ICICI Pru, SBI Life, etc. You offer (or are forced to in case of NPS & pension plans) funds to this company, which will provide you a fixed pension/income on a regular basis.

The annuity amount is determined via a rate which the companies fix internally and can vary from one to the other.

Here are some of the annuity options that LIC offers:

- Annuity payable for life at a uniform rate.

- Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

- Annuity for life with return of purchase price on death of the annuitant.

- Annuity payable for life increasing at a simple rate of 3% p.a.

- Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor.

Today the annuity rates are somewhere around 7%. The rate is locked in for the annuity period you choose.

This means that if you deposit Rs. 10 lakh into your annuity account, you will get Rs. 70,000 per year as your annuity income.

“So, what’s the problem? Isn’t it great to have a fixed income?”, you ask.

Yes, of course, it is nice to have income coming to you regularly. However, annuity ignores a problem.

It ignores the devil in our lives – inflation.

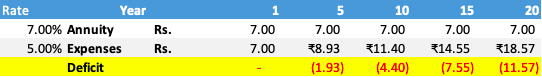

If your annuity rate is at 7% but if your expenses grow even at just 5%, you will soon be staring at a deficit. See the table below.

You are getting a simple rate of return, but your inflation is compounding the costs every year.

Where do you get the extra money from to fund your expenses, lifestyle?

Will you reduce your consumption over time? Quite unlikely.

Mind you, I am not even talking taxes, which can reduce your income further.

Have you checked out the retirement fund calculator?

So, who should buy an annuity?

Clearly, annuity as a product is not for everyone. Even for those in their post retirement phase.

However, on a case to case basis, it may find a place in a financial plan.

I would venture to say that you can go for an annuity today, if

- You are getting an annuity rate of 9%+

- You need an assured income (as a retiree or otherwise)

- You are not looking for capital appreciation or growth (you have enough money and security is more important to you)

- You may not even be concerned about return of invested money.

- You are in lower tax brackets

Almost makes it impossible!

Anyone?

Not only that 7% return is taxable, and eats into the inflation part of your cost of living; the biggest problem is that this 7% return is including ‘return/refund’ of your principal corpus – this means that you will not get any return/refund of your principal corpus. If you opt for that option, then, the return is roughly 5% which is slightly more than your savings bank interest rate. (though to be fair, this return of 7% varies depending upon your entry age – for a 60 years person this return would be roughly slightly more than 8% p.a.)

This whole thing of annuity is a fraud in India by all these life insurance companies – chiefly started by none other than LIC who started the practice of giving 35% first year commission and then 10 to 15% commission perpetually to their agents.

Do you want to give your hard earned and saved retirement money to someone who would give a return of just 7% without refund of principal corpus/amount.

I would not.

But I do not have any choice. I have to compulsorily buy the annuity against all the NPS/Superannuation Fund, etc. (all retirement oriented saving instruments).

This is a big fraud – but I do not have any choice.

This is Gross!

Why should an NPS investor be forced to buy an Annuity from a life insurance company? I think one should have the option to invest in Pension / Retirement plans of Mutual Funds. And why only Pension plans?

In any case, PFRDA is not paying any pension. NPS money is being managed by PFRDA-registered Pension Fund Managers, the same agencies that run the Mutual Fund business.

An investor should have the option to continue holding his investment in NPS after 60. And given two choices –

1. receive Monthly Dividend Payout, as in case of MFs or

2. register a SWP with growth option.

Vivek, hope your words are read/heard by the right set of people.

Hi Vipin,

What if somebody aged 35 yrs is looking for investing 20 – to 40 lakhs for capital protection in annuity products (immediate annuity ) and re invest the same received annuity every year in –

1)MFs

2)Fds

to generate a higher sum for future ???

Hi Dhiraj

I consider that complicated. Plus why will you keep your money blocked?