ECL Finance Ltd (a group company of Edelweiss Financial Services) has announced a Rs. 1,000 crores Secured Non Convertible Debenture Issue at interest rates as high as 10.6%. The issue opens December 13, 2018. Should you invest?

Well, the attractive coupon rate on offer, specially in the current market scenario, has caught the attention of many investors. At around 10%, it is at around 2% more than a Bank FD. But is that the only thing to look at. Let’s see if this Edelweiss NCD deserves your cheque.

ECL Finance Ltd is a non-deposit taking NBFC (non banking financial company), which offers a broad suite of secured corporate loan products, retail loan products which are customised to suit the needs of corporates, SMEs and individuals. (Source: Product Note)

The two of the largest categories of leading are Structured Collateralised Credit and Loans against securities forming about 22% and 30% respectively of the company’s loan book. The new NCD issue is most likely to further the lending in these existing line of business.

For the record, the company has been making public NCD issues since 2014. This year 2018 itself, it has done issues in April and July.

The credit rating for the current issue is AA (Outlook Stable) by CRISIL as well as ICRA. This is not the best rating from the credit rating ladder (AAA being the highest/best).

Not that credit ratings have been very helpful but they are what they are. In fact, almost every NCD issue by the company since 2014 has had the same AA or equivalent rating from various rating agencies.

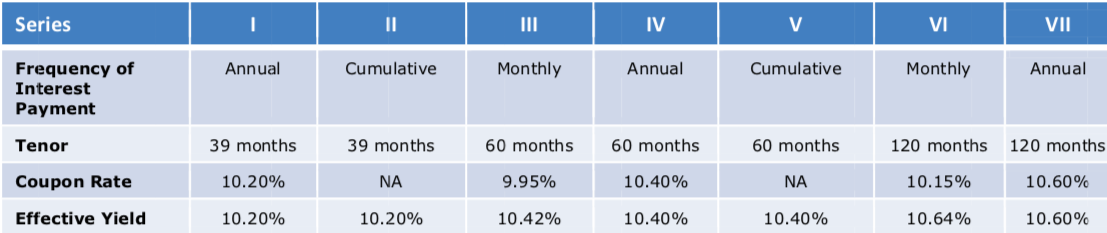

The current NCD issue is available for various tenures and payout options marked as Series. Here’s a summary table.

Source: Product Note; Effective yield takes into account the compounding effect on an annualised basis. In this case, the monthly payout is annualised to arrive at the effective yield.

The best rate is for the 120 months or 10 years offering 10.6% interest. Please note that this is pre-tax coupon / interest rate.

The cumulative option is not available for the 10 year tenure.

The minimum investment in this NCD is Rs. 10,000 (10 NCD of Rs. 1000 each). The issue opens on Dec 13, 2018 and closes on Jan 11, 2019. The allotment will be made on first come, first serve basis.

The allotment will be compulsory in demat form which means that the NCD is likely to be listed on the exchanges and hence can be bought and sold there too. However, you will need to have a demat account to hold this NCD.

(One doesn’t need to open an Edelweiss broking account for this purpose. Any demat account is good enough.)

30% of the issue has been reserved for HNI and Retail segment each, while 20% each for Corporates and QIBs. HNI refers to Individuals and HUFs investing over Rs. 10 lakh and retail application is less than Rs. 10 lakhs.

Now the big question – should you invest?

Let’s take up the various factors one by one.

#1 NCDs fall in the same category of Fixed Income as that of Bank Deposits & Debt Mutual Funds. They are likely to offer a higher returns at a higher risk. As you note, this is not the highest rated (AAA) investment bringing in the element of risk.

Edelweiss Group has a history of growing business and managing risk effectively. It has acquired a reputation of sorts in the financial markets. This is an uncertain world and everything needs to be taken with a pinch of salt.

Going entirely by the past history though, the company has honoured its interest payments. The NCD is also backed by company’s assets, that is, in case of non repayment, lenders/investors will have charge on those assets to recover their money. How much and when remains a question mark?

If you are considering the NCD as an alternative to your Bank Fixed Deposit, know that while it offers a higher return, it comes with a higher risk.

#2 In terms of liquidity, you can offload your investment anytime through your demat account. However, there can be thin trading of these NCDs and you may not always find a buyer or a price that you like.

See the page here to understand the how an Edelweiss NCD stands in terms of trading. You can choose the max option for period in the chart to see the price movement.

For all practical purposes, you should consider yourself locked-in with this NCD.

Debt funds seem to be a better alternative with higher liquidity. You can buy them without having a trading account.

#3 In terms of taxation, since these NCDs will be compulsorily listed and if you exit before maturity, you will be liable to long term capital gains tax (post 1 year) at 10% of the gains.

If you exit before a year, short term capital gains tax have to be paid.

Bank FD interest is taxed at marginal rate and so is an NCD’s interest. A debt mutual fund with a growth option can use the cost indexation benefit and offer a far better tax adjusted return.

#4 For those investing in an NCD to diversify, a debt mutual fund yet again turns out to be a better option with a diversified portfolio of various fixed income instruments.

In fact, there can be quite a chance that your debt fund may be holding this Edelweiss NCD too. As per the prospectus, UTI Treasury Advantage Fund and DSP Ultra Short Term fund currently hold NCDs from Edelweiss.

If you are not holding a debt fund at all, then the NCD does bring in a different instrument to the portfolio.

#5 Finally the expenses. A Bank FD presents no additional expenses on trading on on an annual basis. The current NCD, given the compulsorily demat form, forces the expense of maintaining a demat account, if you already don’t have one. A debt mutual fund has daily expenses of fund management and operations.

All in all, if your portfolio demands more fixed income instruments and you have an active demat account with willingness to take moderate to high risk to earn the additional return, you may consider investing in the current Edelweiss NCD.

Choose your tenure wisely too. You should not block any money for 10 years, which you may need in 5 years. Don’t over expose yourself by putting a large amount of your portfolio in one NCD.

A very good analysis covering all aspects. It should guide the investors to take an informed decision.

Hello Vipin,

If Credit Risk Funds holds investments in higher yield bonds which gives 10-12% interest then it’s returns should have been as such. But for last 1-2 yrs I see returns from most credit risk funds are below that of a liquid fund. They are showing between 5-7% return while liquid fund are showing above 7% return. Why is this so???

Thks & Regds

Sonit

Sonit, the mark to market principle makes debt funds volatile. If they hold a higher yield paper and the interest rate rises, the value of the fund will fall in the interim. Vice versa is also true. In case of liquid funds, the short tenure of the holdings more or less keeps them aloof from such impact.