Axis Focused 25 Fund was started in June 2012 with its regular plan option. In the first 4 years, till June 2016, it managed to get just Rs. 468 crores in management. Today it is a 5-star rated fund which attracts money like a magnet.

By Nov 2018 the fund size had grown to a stupendous Rs. 6,454 crores, a 13 times increase over 2.5 years. Some investors see it as the next HDFC Equity

Axis Focused 25 Fund intends to be an open ended fund investing in upto 25 stocks of large, mid and small size companies. As per its investment objective –

It aims to generate capital appreciation by investing in a concentrated portfolio of equity & equity related investments of upto 25 companies.

As per the new equity categories defined by SEBI, the fund falls in the Focused category, wherein the maximum no. of stocks that the fund can hold is 30.

The Scheme Information document states that that any point the minimum investment in equity will be 80% of the portfolio, with no less than 20 stocks. As per factsheet dated Nov 30, 2018, the number of stocks that the fund currently holds is at 23.

The fund says that the portfolio companies will be selected from the top 200 companies as per market capitalisation. In fact, 90% of the portfolio will be constituted from the top 200 universe. A clear indication that size and liquidity are big criteria in the stock selection process.

This reflects in the choice of the benchmark too. The primary benchmark of the fund is Nifty 50. The secondary benchmark is S&P BSE 200. The latter is the more relevant benchmark for the fund.

So, what is working for this fund?

Well, it is actually the question of who?

To come to any conclusion on this, the fund deserves to be studied in two time periods. One from June 2012 to June 2016 and from there on. In other words, you can call the former period as before – Jinesh Gopani and the latter with – Jinesh Gopani.

Who is Jinesh Gopani?

Jinesh Gopani is the current fund manager of Axis Focused 25 Fund. He started managing this fund from June 2016 along with the erstwhile fund manager Sudhanshu Asthana, who in a couple of months, quit the fund house.

Here’s a better recall. Jinesh is the fund manager of Axis Long Term Equity Fund – the star ELSS fund from Axis MF.

Since the time Jinesh took over, two things happened.

One, the fund has raced itself to become super big – almost a 13 times growth in the size since he took over. It was a mere Rs. 468 crores in size when he joined. Now it is Rs. 6,454 crores. Jinesh’s reputation in managing the tax saving fund – Axis Long Term Equity, has made investors flock to this one too hoping that he will create the same magic.

So far they have not been disappointed. He has brought not just his stock picking style but also the stocks to this fund too.

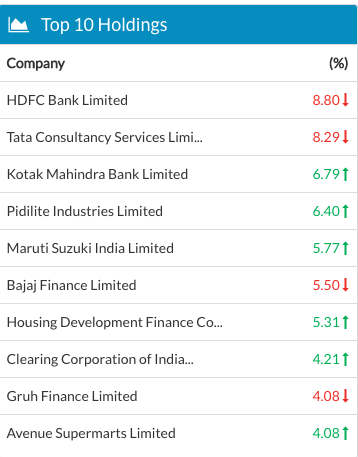

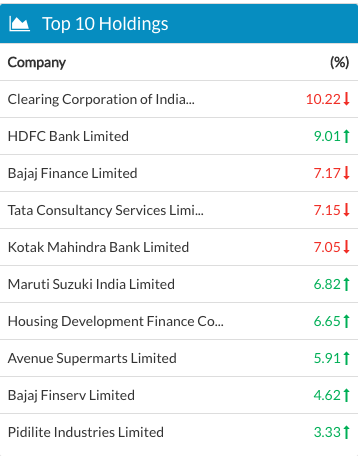

If you look at the two fund portfolios, they appear to be similar.

Top 10 Holdings of Axis Long Term Equity Fund – as on Nov 3o, 2018

Top 10 Holdings of Axis Focused 25 Fund – as on Nov 3o, 2018

Note: The Clearing Corporation of India represents the cash holding in the Axis Focused 25 fund and not a stock.

Two, the fund has consistently shown a turnover ratio of over 120% since Jinesh took over its management. To a lay eye, this means a stock is held for less than 1 year in the portfolio.

Now, this is slightly tricky. It does not really mean that the fund manager is trading day in day out in his funds.

To calculate turnover ratio, one takes the higher of the buying or selling numbers to divide by the AUM. In this case, clearly the buying due to fresh inflows is influencing the ratio. What with the fund doubling over this year itself.

The factsheets also confirm that the fund has been holding its stocks for over quite some time and not resorting to any churning.

Is this a star Manager phenomenon?

In the context of Axis Mutual Fund, it appears to be a case of star fund manager running the show. Now, one can’t deny the role of a fund manager in its performance but to what extent?

Here’s the thing. There are only 2 equity funds talked about from Axis Mutual Fund – the tax saving, Long Term Equity Fund and the Focused 25 Fund. Incidentally, both managed by Jinesh Gopani.

If you look at other equity funds from Axis MF including the Axis Bluechip Fund or Midcap fund, they are fairly muted in terms of size or other comparable numbers.

Here’s what John Bogle has to say about star fund managers.

The problem with Star Managers is two-fold. One, no one can tell in advance who the star is going to be. Two, Star Managers never stay in the same organisation, except a few.

No doubt Axis Focused 25 Fund has been managed quit consistently by Jinesh Gopani. So, if you are an investor in this fund, you can hope to have a good going with your investment as long as the fund manager continues.

Make hay while the sun shines!

This is one of the reason ,why Index funds are better choice. No need to fear whether the captain(FM) of ship stays in or jump out 🙂

As Bogle pointed out “Star Managers never stay in the same organisation, except a few.”