Can a small mutual fund scheme set the benchmark on industry norms, practise value investing in its truest form, does not have a rockstar image fund manager and yet deliver meaningfully for its investors?

Warren Buffett laid out 2 rules with respect to investing.

Rule no. 1 – Never lose money;

Rule no. 2 – Don’t forget rule no. 1.

A mutual fund scheme that follows this to the T, is Quantum Long Term Equity Value Fund. QLTEVF practises value investing.

This is how it puts the definition of value investing on its own website:

“An investment strategy where stocks are selected that trade for less than their intrinsic values. Value investors actively seek stocks they believe the market has undervalued. Investors who use this strategy believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond with a company’s long-term fundamentals, giving an opportunity to profit when the price is deflated.”

The fund prides itself to be driven by a well defined process and no single individual calling the shots (basically no star fund manager). Read its equity investment philosophy here.

Turnover or holding period of a stock

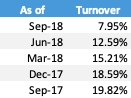

One of the big tests of a value style fund is its portfolio turnover or churn. Basically, how long do they end up holding a stock in their portfolio.

Let’s look at their turnover ratios .

Source: Fund factsheets. Month end data

In the past 12 months of quarterly observation, the churn in the portfolio has not exceeded 20%, which means that on an average a stock stays for 5 years. Once again a test of conviction in one’s investments.

The iconoclast

Since its launch in 2006, the fund house is known for its various firsts. Take a few examples:

- launching direct to investor plan of a fund scheme (exists since launch)

- choosing a total returns index to benchmark its performance (Sensex TRI, in this case, again since launch)

- reducing fund expense ratio over time (currently at 1.25%)

- reinvesting the exit loads back into the scheme so that investors benefit and not the AMC (contrary to earlier industry practice)

Each one of the above is now mandated by SEBI except for expense ratio, on which the guidelines are out.

It has deliberately kept high exit loads to desist investors coming in with a short term outlook.

Cash Holdings

The Quantum Long Term Equity Value Fund tends to hold cash as much as 25 to 30%. Now, there is a general view that cash can seemingly hurt at times to investors who keep comparing with other funds racing past, specially in a bull market.

However, when the tide famously goes down, the fund is fast to jump back as it deploys its cash into viable opportunities.

Several times, the fund has taken a beating on its ratings from the ranking companies but no sooner the market correct and it regains the top slots. (I am not a fan of fund ratings/rankings at all)

Read more: Does cash holding hurt?

What does the fund not do?

The fund seems to be okay closing any doors that are likely to bring in risks to the investment portfolio.

The fund is not a big fan of mid/small cap category. It continues to believe that there is enough quality opportunity and money to be made in the universe of top 200 listed stocks in India.

The fund avoids investing in companies with known issues of corporate governance or mistreatment of minority shareholders.

Fund Manager Insights

Here is an interview of the fund manager, Atul Kumar, we did 2 years ago. Read this first.

Recently, we took an update from the fund manager who answers some more questions for you.

Q: The fund categorisation along with market cap segmentation for various funds has happened. Is there any change with respect to stock selection strategy or investment universe in your fund? Any other changes you have made?

A: No change at the broad level,we are keen to invest in companies which have strong corporate governance, capable management teams and not too much debt leverage. And finally, the stock should be available at a reasonable valuation. We have welcomed the Categorization and Rationalization of Mutual Fund Scheme by SEBI as we are and have always been following the value style of investing since our inception in 2006. Our investment philosophy or strategy has not changed since then and will not in the foreseeable future!

Q: You follow a strict discipline in terms of research and stock picking; does this restrict your investment universe?

A: We have a liquidity filter of at least $1 mn daily trading volume in the stocks that we own; apart from that we do not have any market capitalization or sector bias. Companies with weak corporate governance and a history of treating minority shareholders poorly do not come into our portfolio.

Q: Too much money is flowing in to the stock markets and there are various kinds of conflicts world over. What are the challenges you expect in the current investing environment? How difficult is it to find opportunities?

A: Significant increase in share prices over the last few years devoid of any earnings growth made valuations across most companies expensive. Rising global liquidity lowered risk aversion. Downside risks became higher since 2014 when lot of money was chasing stocks. We saw some of our portfolio stocks breaching our sell limits forcing us to sell them raising cash levels in the fund. However we may just be entering a phase where global liquidity recedes, making valuations a lot more reasonable. Over the long term, we remain optimistic on Indian equities. India is likely to grow faster than many nations.

Q: The observation made by some investors is that despite a significant cash holding and a conservative investment approach, the fund tends to fall as much as the market, while it lags in the recovery. How do you explain that? Some specific examples will be helpful.

A: In recent market fall, we did much better than our benchmark. Traditionally we have held stocks which are very liquid. When markets fall, people find it easier to sell such stocks than mid/small caps. Later the fund manager will sell small/mid caps after liquid names.

While in very near term our performance is in line with market, as time passes, quality stands out. We saw that happen in 2008-09 period.

Q: Given that India forms a small proportion of world GDP, why not invest outside India? Especially for the fact that, some of the finest companies are outside.

A: We understand Indian markets and companies operating in India. It is difficult to understand fully and evaluate companies which are 1000 miles away. It is easier for our analyst to travel locally, meet and evaluate companies here.

Q: Going forward, what should investors expect from Quantum Long Term Equity Value Fund?

A: Recently there has been a reasonable correction in stock prices. Many stocks which looked highly valued now seem to come within reach. We are likely to find new stocks for our portfolio and cash level can fall further. Over the long term, we remain optimistic on Indian equities. India is likely to grow faster than many nations. Investors can expect decent return from equities over a long period in future. Investors should take advantage of recent fall in stock markets and put more money. Equities now appear less risky than they were earlier.

<end of interview>

So, who should be investing in this fund?

This fund is likely to suit an investor profile who is looking for exposure to equity and yet have peace of mind knowing that the people managing the fund will put your interest above all else and not be chasing the highest return at any cost.

Anyone else may feel disappointed.

I am impressed with downside capture ratio of this fund but at the same time how long it take to recover after market correction .

Need to know the real meaning of value investing. How long should i wait to know its upside capture ratio which is better than benchmark( i am not comparing with other funds here!!!!).

If i look at the 5,7 and 10 years returns , the fund easily beating it benchmark . So my query is, All value investor need to wait for a long periods to know this fund will give some decent return. At the same time other non- value funds which is easily beating benchmark with decent return with in short span of time.

Vandhi, I just looked at the SIP returns of this fund vs the other large caps — over 3, 7, 5 and 11 years timeline. Here are my observations.

* This is the best one among all others at 11 years; DSP Top 100 is the worst

* Over 7 and 5 years, HDFC Top 100 and SBI Bluechip are pretty close at Quantum’s returns; ICICI Bluechip is doing the best; DSP is worst again with ABSL being mediocre as well

* Over 3 years, we have equivalent direct fund offerings. This is where it’s getting interesting. The best ones are again ICICI, HDFC and SBI. The worst is again DSP. But Quantum and ABSL are in the bottom half as well

There’s one key difference. Quantum is sitting on cash, so when there’s a crash or a huge correction, they’ll be able to do better than most others. But the difference may not be significant among the large caps anymore. ICICI and HDFC aren’t that bad and their direct offerings may even be able to beat Quantum going forward. Another take away is to not invest in DSP 🙂 In fact, I’ve been observing this. They have funds with long history but mostly bottom quartile performance in most categories except their small cap, which is not doing well since the last few years so it might catch down as well 🙂

Bottomline. Large cap is hard. If one does not want to buy the multi caps, it’s better to go with index funds, like 50% in Nifty and 50% in Nifty Next 50 and be done with it. We’ll all have peace of mind and most likely, we’ll beat these funds, or at least most of them, which is should be the best case scenario.

Superb fund among those benchmarked against Nifty 50 or Sensex. I had a hard time choosing not to invest in this one — felt even guilty because they are the ones who took care of my full KYC.

My reason for not choosing this was because I still have a long way to go before retirement or my child’s education/marriage, and all the other long term goals. So my risk taking ability is still high (or so I think, we’ll find out in time). So I’ve heavily invested in small, mid and multi cap funds (in that order).

Another reason being growth vs value style of investing. India is still in growth phase, so going heavy on growth or blend style funds is better, is my feeling. So I’ve restricted my value funds to around 20%, and went with a value fund that has a go-anywhere mandate, even international. Most readers of Unovest know which one that is 🙂 So I had give this one a skip.

When will I start investing in this fund? When I’m around my retirement age and my ability to take risks is low. By then, India should be a developed economy and value stocks may start becoming more relevant than growth stocks. And I hope to see both PPFAS and Quantum around live and kicking with the same passion and spirit. Of course, I also hope to see index investing taking over, with a Nifty 500 index fund with 20+ years of history; being similar to the S&P 500 in the US now.

Sreekant sirjee,

your comments are valuable on the index side.

Nifty 500 is multicap whereas sp 500 is an only large cap index, so the equivalent is nifty 100. The equivalent of Nifty 500 is Rusell 3000.

Though to correct this.

A relevant observation Vasu. Thanks

Thank you, that’s a good point.