There are just a handful of funds in the MF industry which can claim to truly stand for their investors. Parag Parikh Long Term Equity Fund is one such fund.

We covered this fund almost 2 years ago. It’s time we revisited the fund and check if it continues to stand for the investors and deliver on the expectations it has set for itself.

To name a few, the fund house PPFAS still has only one equity fund. The only other fund is the Liquid fund started in May 2018. There is still no dividend option.

To me this translates as fewer distractions and more focus on fund management.

This is a multi cap fund or a go anywhere fund since it is not afraid to pick opportunities to invest outside India too.

The fund continues to invest in international stocks (yes, it does). On an average, about 27% of the fund portfolio is invested in stocks such as Alphabet (Google), Facebook, UPS, Apple (past holding), etc.

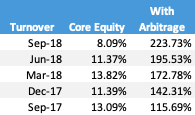

We also observed that the fund witnesses one of the lowest churns as represented by its turnover ratio in the core equity holdings.

Source: Factsheets; Month end data.

The fund is not averse to holding cash when it does not find the right opportunities. The cash is sometimes deployed in arbitrage positions to help it maintain the required equity allocation of 65% of domestic equity. To take tax benefits as an equity fund, this is the required minimum threshold.

Over the past 1 year, the turnover has not exceeded 15%. It has been similar over earlier periods too. This represents an average of close to 7 year holding period. That says a lot about conviction in one’s process and decisions.

The expense ratio of the fund has also been reduced over time. The current ratio stands at 1.5% (excluding GST). The fund house has given a roadmap to reduce it further as the fund size increases.

We reached out to Rajeev Thakkar, the CIO of PPFAS Mutual Fund, first in Sept 2016.

Here is the link to the previous interview with him where we covered some of the basics of the equity fund, why it existed and why did it operate in the way it did. You must read this first.

Recently, we picked his brain on some more questions that investors have been asking about its international investing mandate, changes based on SEBI rationalisation, etc.

Rajeev Thakkar answers them for you.

Q: The fund categorisation along with market cap segmentation for various funds has happened. Is there any change with respect to stock selection strategy or investment universe in your fund? Any other changes you have made?

A: No changes. It is more of the same! The only change is that the name of the scheme changed from Parag Parikh Long Term Value Fund to Parag Parikh Long Term Equity fund post the fund categorisation circular.

Q: You invest close to 30% of your portfolio outside India. Has that strategy worked out for the fund?

A: That strategy has worked quite well. While both Indian markets and the global markets offer good return potential, combining the two gives far more flexibility and a greater opportunity set. Also when Indian markets are volatile, the benfits of diversification come to the fore as is seen currently.

Q: There are hardly any China stocks in the portfolio, which is considered as one of the big growth economies. Why is that so?

A: While we have a global mandate, we are restricting our investments to countries in North America, Western Europe and select developed countries like Japan. These countries have a good track record of protecting minority shareholder rights and stock market capitalism is well established. We stick to simpler and safer opportunity sets.

Q: Too much money is flowing in to the stock markets and there are various kinds of conflicts world over. What are the challenges you expect in the current investing environment? How difficult is it to find opportunities?

A: This was the case in 2017. Our cash + arbitrage positions had gone very close to 30%. In the current volatile environment, we hope to deploy most of our money in the coming 6 to 12 months.

Q: You increased your exit load period from 1 year to 2 years. Some investors have not liked it. What triggered that action?

A: The change in the exit load period was in June 2014 and it was quite a while back (more than 4 years ago). The first thing to note is that the money received by way of the exit load gets credited to the scheme and the Asset Management Company does not get this. In a way, the short term investors pay the long term investors. Our entire communication to investors and potential investors is that the scheme is suitable only for long term investors. The minimum investment horizon that one should look for is 5 years. Despite this some investors in the past had a lot of churn. The load is to discourage such investors.

Q: Going forward, what should investors expect from Parag Parikh Long Term Equity fund?

A: Investors should expect consistency in behaviour. We are not trying to maximise returns and in periods of strong upward momentum or where Indian markets are going up sharply, the scheme may underperform. On the other hand, during periods of sharp downturn in Indian markets, the scheme has done well in terms of protecting the downside. We aim to deliver good risk adjusted returns over the long term.

The AUM of the fund is currently at around Rs. 1300 crores – this is over 50% more than a year ago.

To know more about this fund, you can

- Visit their website amc.ppfas.com

- Read their factsheets

Do you have any other questions on your mind? What are your points of concerns about this fund? The comments section is open.

Note: This post is purely for educational purposes and is not a recommendation to invest in the fund. You should consult your investment advisor to understand if this fund is to be included in your portfolio.

It is indeed a great fund. After few years once i am done actively looking at Mutual funds i might consolidate everything to PPFAS and forget it. 🙂

Well, that’s quite a vote for the fund.

May you find out why they don’t hVe any exposure to insurance sector ? Would expect them to atleast test the waters via hdfclife about which they had spoken highly during on if the meetings present in their YouTube channel

Let me send that across to them.