The small cap investor in mutual funds is once again spoilt for choices. The old, the new, the big, the bad and the ugly – every one of the funds out there is now open to take your money and multiply it. At least that’s your expectation.

In the past couple of years, most of the small cap funds had restricted fresh inflows. They talked about valuations being stretched in the mid and small cap companies and hence limited opportunities to invest.

Then in May 2018, SBI Small Cap fund, which had remained fully closed from Oct 2015, opened up to SIPs with a limit of Rs. 25,000 per month per PAN.

Earlier this month, DSP Small Cap (formerly DSP Micro cap) too opened up (after Feb 2017) for SIPs/STPs, without limits.

HDFC Small Cap Fund, having recently declared itself a small cap, milked on this opportunity and garnered assets fast.

So, what has changed?

Since June 2018, there has been a sustained correction (read fall) in the stock prices of mid and small size companies. Enough to get the fund managers to say that now the valuations are attractive than before and hence opportunities to invest are available.

Now, I am quite sure some of you have already started your investments in your favourite small cap fund or may thinking to do so. Before you do that, some thinking.

Small cap funds

I had written a note on “taking stock of small cap funds” earlier in May. Here is additional data for your consideration. Before you make commitments, please do go through this.

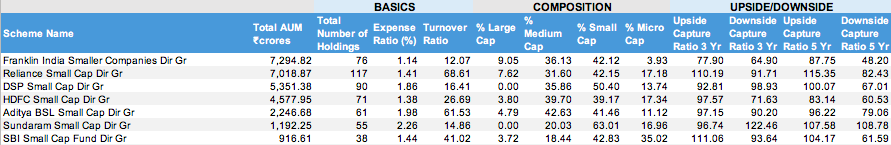

See table below. Some of the popular small cap funds with data that you are probably not looking at.

Data Source: MorningStar, as on Aug 31, 2018. For direct plans only.

When ranked by market cap, the stocks in the bottom 10% typically represents the small cap space, and the last 2 to 3% as the micro caps.

Now, some questions that you may want to ask.

- What is your fund really about? Is there a stated strategy of the fund that differentiates it from others?

- What is the experience of the fund? How long has it been into existence?

- How small cap is your fund really? Look at the composition of the portfolio – % large, % mid, % small, % micro.

- Is the presence of large cap justified in a small cap fund? Or, is it a downside of the increasing size?

When you do decide to commit your money, ask one more question.

How much will I commit?

If you are not ready to commit at least 10% of your investment portfolio into the fund, you might as well stay away from it. If you want the investment to make a difference to your portfolio, let it have a visible presence too.

Did you say yes?

Then put the seat belts on. It’s going to be a rough ride.

Leave a Reply