I am sure you have read the newspapers about how some debt funds have lost value courtesy their holdings of various group companies of IL&FS. As a result you too see a loss in the current value of your investment. You were not prepared for it.

To quickly summarise, a rating agency questioned the financial strength of these companies and downgraded the credit rating.

Various mutual funds had extended credit to these companies for different time periods. The schemes that hold these investments include liquid funds, ultra short term funds, credit risk funds, hybrid aggressive funds, etc.

Since the repayment of these ‘loans’ to the companies became a little doubtful, the mutual funds had to make relevant accounting adjustments (downward) in their books.

The individual investments lost value and thus the NAVs of these funds were negatively impacted too. Based on what we see so far, most of it is temporary. The reality will play itself out.

The question most investors are asking is how can a debt fund lose money?

The fact is a debt fund can go into negative territory.

Let’s refresh 2 key basics about debt funds first.

- One, debt funds operate on ‘mark to market’ principle. They take stock of their investments daily and then adjust the values based on the current market price of such investments. This value is reflected in the NAV or Net Asset Value per unit.

- Two, in case of debt funds, the price of any security is inversely correlated with interest rates. Simply put, if the interest rates go up, the value of that investment will come down and vice versa. This will get reflected in the NAV.

In the case we are discussing, the downgrade in credit quality raised expectation on the interest rates of a lower credit quality instrument (higher the risk, higher the return expectation) and hence the drop in value.

This fall could be temporary. While the accounting reasons have forced a mark down in the value, if the fund scheme receives its money back from IL&FS on the maturity date, the NAVs will adjust back up, hopefully.

The other question is did the mutual funds not know about the credit quality issue and if yes, why did they invest?

As you know, investments took place across including the liquid and ultra short funds. Frankly, this happening in case of a liquid or ultra short duration or low duration funds is horrible.

Now it is for the individual funds to question and revisit their shortlisting and investing process.

However, in the case of credit risk or longer duration funds, with a stated mandate to invest in such securities, this should not be a big surprise. They will invest in non-investment grade securities.

As for the investor, you probably latched onto a debt fund because you were tired of the low interest Bank FD with high taxation. You got into all kinds of debt fund investments hoping to get a higher guaranteed return.

You also picked a ‘credit risk fund’ or ‘corporate bond opportunities’ (also a credit risk fund now), without understanding what you are getting into.

So, what to do now?

Well, it is never too late. This is a good time to revisit the core concept of investing in debt funds, their safety, returns, taxation and how they work specially in contrast to Fixed Deposits. This should help you reset your expectations and your portfolio.

Debt Fund vs Bank FD – Understanding realities

Here we go.

- Guarantee of returns– Debt mutual funds do not guarantee returns. Fixed Deposits do. If an FD says 6% interest when you sign up, it will pay you 6%. Period. Debt mutual funds returns can vary.

- Safety of Capital – Debt mutual funds take their own risks including credit risks, interest rate risks, etc, which can impact their performance. There is no capital risk with FDs except when the bank goes down.

- Variety – Debt mutual funds come in a variety and you can choose one based on your time horizon and risk taking ability. There are liquid funds, ultra short term, short term, credit risk funds, corporate bond funds, dynamic bond funds, gilt funds, etc. In case of FDs, it is plain and simple. You only have a choice of interest rate and time period.

- Dividends/Interest Payout – With debt mutual funds, you can choose to have a dividend option. However, dividends are not guaranteed. With FDs, the interest payout as specified is guaranteed.

- Taxation – Debt funds are treated as a capital asset. The gains are taxed as per your tax bracket if you sell in less than 3 years of purchase. The gains are taxed at 20% after cost indexation, if sold after 3 years. Just this one factor, gives it a significant edge over Fixed Deposits. Know more here.

- Investment Portfolio / Transparency – You don’t know what happens in a Fixed Deposit or how is it managed. Neither the associated costs. In case of a debt mutual fund, the exact portfolio is disclosed on a monthly basis as well as the costs of doing the same. Click here to view the factsheet of a debt mutual fund.

- Market driven – There is no market value to an FD. You have a principal amount which you invest and you earn interest on it. The debt mutual fund has a market value calculated in the form of its daily Net Asset Value or NAV. This value can go up and down.

- Interest rates and prices – There is an inverse correlation between bond prices and interest rates. So, if the general interest rates in the economy go down, prices will go up and vice versa. Debt funds are affected by this and it reflects in their prices or NAV. This may make the value of the investment to go up and down too. With FDs, once you have fixed your interest rate, it is assured to you till the maturity.

Journey with Debt Funds

Once you have gone through this, you may also want to see how the investment charts of various debt funds look like.

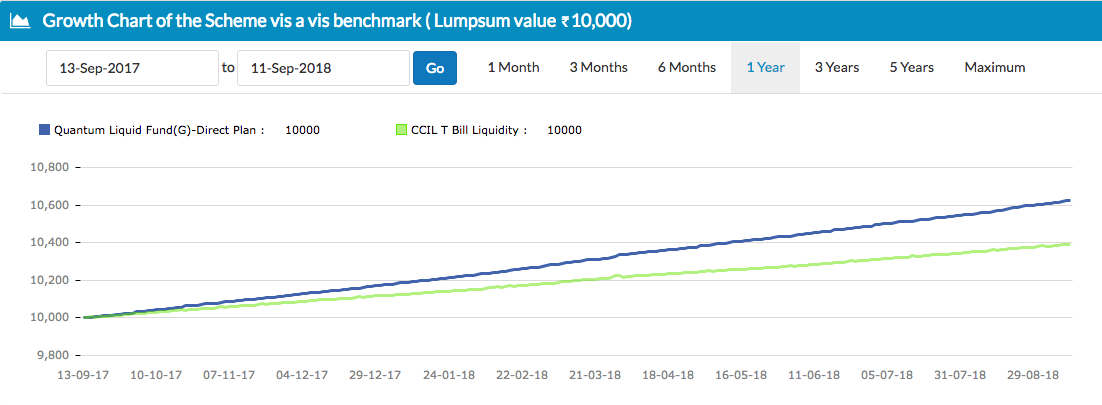

First off is a liquid fund, which has a larger aim of preservation of capital and then generation of returns. Data for 1 year.

Source: Unovest

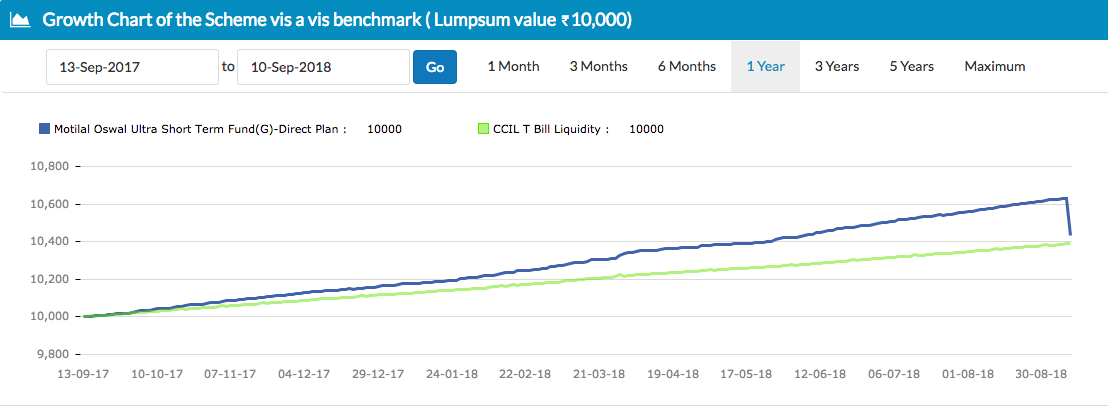

Then there is the Ultra Short Bond Fund impacted by the recent event. Data for 1 year.

Source: Unovest

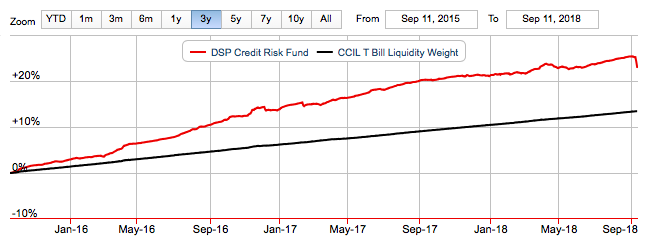

Next, is a Credit Risk fund, also impacted by the recent event. This is over 3 years

Source: Valueresearchonline.com

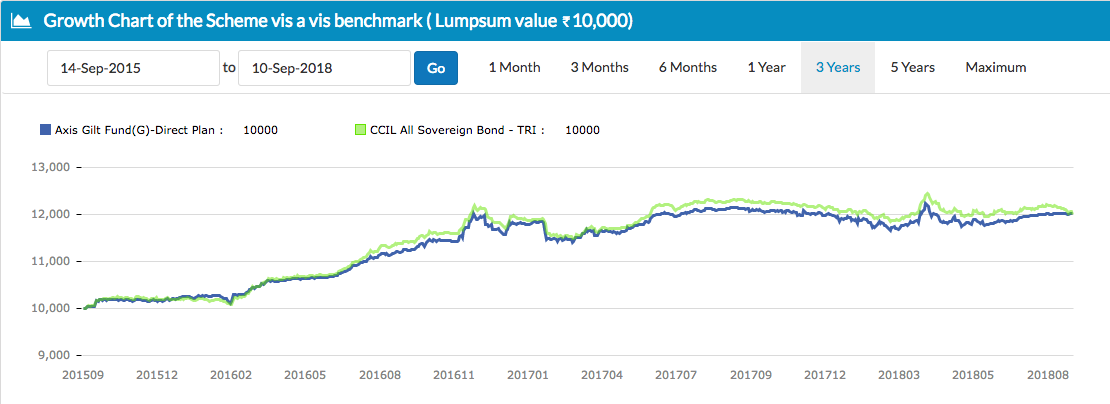

Finally, a Gilt Fund. Just look at the volatility here over 3 years.

Source: Unovest

What should you do as an investor?

It is easy to get lured by high returns. But these high returns demand a lot of patience and typically come at higher risks including temporary loss of value.

When you choose your debt fund, know the expected journey. The smooth one or the one with the ups and downs. The credit quality that the fund chooses for its investments is important too.

SEBI has further streamlined the classification of debt funds making it easier for you to compare and pick.

Revisit the SEBI driven new classification of debt funds here and which debt fund to pick, here.

This is quite a lot to take in. Hopefully you are not rushing through this note and absorbing it slowly so as to make the right decisions.

Is there a debt MF (preferably a liquid MF) that invests exclusively in t-bills? I like that there is no credit risk and the duration risk is quite small in t-bills. I’d rather take the slightly lower interest rate than worry about what liquid funds are holding.

The case for FD is still not very strong. Even if one is concerned about credit quality, there are gilt funds and banking/psu debt funds that have high credit quality that offer better returns. 10-yr g-secs are currently trading at higher rates (over 100 basis points) than most FDs.

Quantum Liquid Fund, as far as I know, invests only in Govt Securities and PSU debt.

Thanks.

It does have a huge concentration risk in psu debt. Not that PSUs are likely to default, but a credit rating downgrade can hurt this fund a lot.