My friend Vineet’s question got me thinking. He asked if NPS Tier 2 account, with all its benefits, specially super low cost, can be used for investment instead of in a mutual fund. I decided to explore this.

Now, you have mostly likely read through my earlier unpopular views on NPS. Those views were primarily for the Tier 1 Account or the Retirement Account. Today we explore the other one – NPS Tier 2 Account.

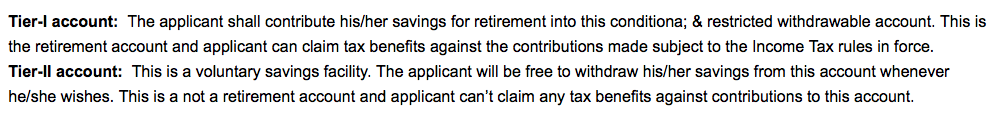

Source: pfrda.org.in

Let’s first get a few things clear about the NPS Tier 2 Account.

- NPS Tier 2 Account is not a retirement account like NPS Tier 1.

- It is a voluntary contribution account. No minimums or maximums.

- You need to have an active NPS Tier 1 Account before you can start a NPS Tier 2 Account.

- There are no tax benefits on NPS Tier 2 Account. Not on investment, not on withdrawal. None.

- There are NO guaranteed returns

Well, you are probably thinking why even start the discussion? Well, there’s more to it.

My friend reasons to invest in NPS Tier 2 Account

The point my friend Vineet made is that NPS Tier 2 Account may have all the above disadvantages, yet there are some advantages. They are:

- Super low cost, as low as 0.01% in some cases.

- Renowned fund managers such as SBI, HDFC, ICICI, UTI, etc.

- Flexibility of withdrawal, any amount, anytime. No restrictions.

- Choice of investing in Equity, Corporate Bonds, Government Securities and the newly introduced, Alternatives.

- And the best argument, it has delivered better returns compared to MFs.

“With all these benefits and flexibility, why can’t I use it as a liquid or debt fund?” Vineet was confident about his argument.

The counter point

First, a principle. We have to match our investment horizon with the relevant investment tool. Not vice versa.

NPS was created as a long term savings tool specially to help people prepare for their own retirement.

Given the nature of NPS, the investments made in its portfolios too are long term in nature. And this can affect the way the portfolio behaves.

While equity is known to be volatile asset affected by market movements, even for Government and Corporate categories, the investments are fairly long term in nature. The typical maturity periods of such bonds is 5, 10 or 15 years. In case of Govt securities, it could be even upto 30 years.

Now as you know there is an inverse relationship between interest rates and bond prices. For long term bonds, such as those in the NPS portfolios, the effect of change in interest rates makes the prices or values of the portfolios change quite a bit too.

There is quite a possibility that you may invest Rs 100 to find it go down to Rs. 99, specially with the Government Securities or Equity option.

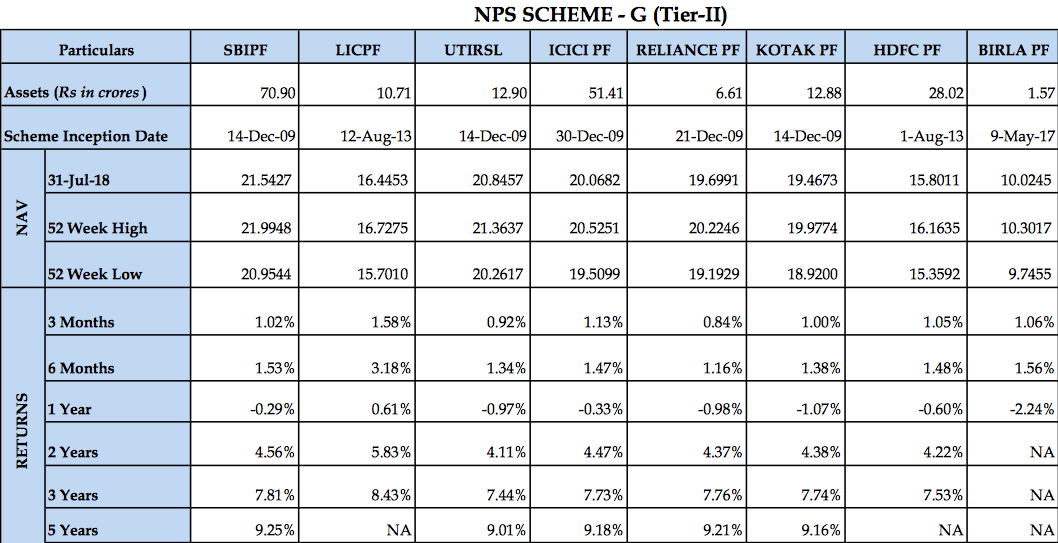

Notice the negative values for 1 year returns in the table below. This is just for the Government Securities option in NPS.

Source: NPS Trust website, returns as end of July 2018.

In contrast, a liquid mutual fund is mandated to invest in upto 91 days residual maturity. The effect of changes in interest rates on its portfolio is insignificant. Of course, there is no equity in the liquid fund portfolio.

This probably settles the alternative to liquid fund argument. Liquid fund, given the needs it serves, is a far safer one compared to the NPS option.

Next, you might argue that you want to build your long term fixed income portfolio for your emergency funds. No equity. Will not the low cost advantage work in your favour?

Well, it does look probable, specially if you remove the more volatile equity and government securities options and invest only in Corporate Bonds.

However, tax rules play the dampener here. The income tax is likely to take away any additional return benefits compared to mutual funds.

In mutual funds, if you end up holding for 3 years of more, you cross over to long term capital gains and can also claim indexation benefits.

As an example, for a 7% annualised return over 3 years, in an ultra low duration fund, you end up paying just about 0.6% in tax. So, your net take away is 6.4% annualised.

Compare this to your 30% income tax rate in NPS Tier 2 Account, Fixed Deposit or Savings account. Even if you get 9% in the NPS Tier 2 account, after 30% tax, you are left with just 6.3%.

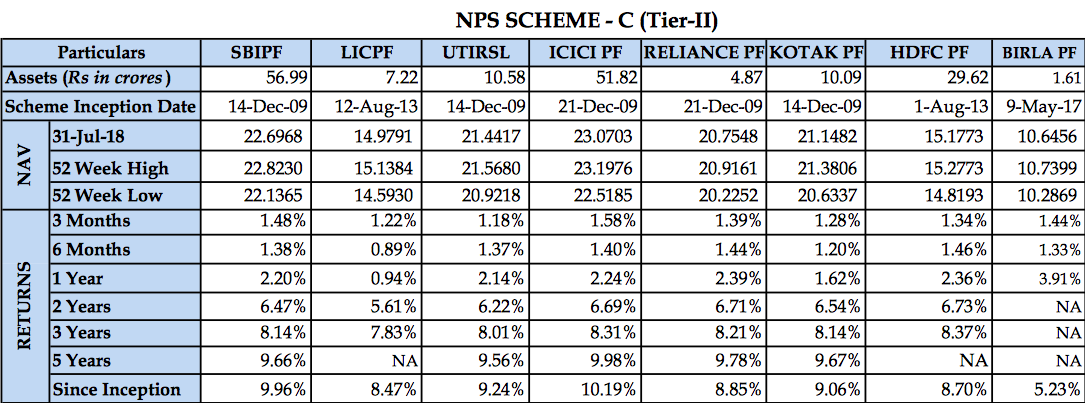

If you look at the actual return numbers below, the assumption of higher returns in NPS seems to be misplaced. They aren’t very different from Short term, low duration category mutual funds.

Source: NPS Trust website, returns as end of July 2018.

Source: Unovest

Unless, there is a significant change on the taxation front, I guess you can give it a pass.

“So, basically you are saying I have far more flexibility, options and tax benefits being in mutual funds.” Vineet seemed to be changing his mind.

Yes. And frankly one less account type to take care of.

Finally, remember the rules of asset allocation to diversify and build a portfolio that works for your goals. Just because something is available, does not mean you have to have it.

Between you and me: I have seen some people write about NPS Tier 2 Account as the best kept secret in savings products. I don’t think so.

What is your view on the NPS Tier 2 Account? Do share in the comments section.

So lucid, so well researched and insightful

Thanks Vineet 🙂

Taxation on withdrawal of an tier 2?

Please guide.

As currently understood, you have to pay income tax on the gains.

I did the same study 2-3 yrs back. I was looking for balanced fund alternative. But i came to the same conclusion due to taxation.

If govt could make taxation easy, I will invest. Hence waiting patiently till then.

Good to know Gaurav

I have already invested in NPS..tier 1 and tier 2 both.

what to do now?

should I exit, if yes, then how?