SBI Small Cap Fund, which has been closed for fresh subscriptions since October 2015 is reopening its gates for fresh SIP investments. As one of the best performing small cap funds, should you start your SIP too with this fund scheme?

Let’s take it step by step. Let’s first look at the history of this fund.

SBI Small Cap Fund – a little bit of history

SBI Small cap fund was originally known as the Daiwa Industry Leaders Fund before it was acquired by SBI and in 2013 changed its fundamental attributes and renamed it to SBI Small & Mid cap fund.

As the Daiwa fund, which was started in 2009, it was originally a large cap fund.

In its new small/mid cap avatar, it made a killing during FY 2014-15, much like many other funds.

Now with SEBI’s reclassification norms coming into force, it is once again undergoing a name and characteristic change. It will now be known as SBI Small Cap fund.

While earlier, the fund had a mandate to invest 50 to 70% in small cap stocks (401st onwards rank of market cap), now it has to invest a minimum of 65% in small caps (251st onwards in market cap rank).

It is interesting to note that the fund has a self imposed limit of Rs. 750 crores AUM. From the Scheme Information document (March 2017).

Given that the AUM is still at Rs. 771 crores (as of March 2018), what made the scheme open up? Markets have evolved probably. Or, the investors pestered SBI MF to open up the scheme. Anyways.

Why are you looking for a small cap fund?

One of the oft asked questions recently is why doesn’t Unovest give out a small cap fund recommendation.

Specifically: “Can you please share a name of a small cap fund for 10+ years horizon?”

I understand the anxiety. Given the past performance of the small cap funds, it is but natural to ask for one small cap fund that will invest in those hidden treasures that in turn will make your portfolio soar.

On top of that when a fund such as SBI Small cap fund, which had been closed so far, the investor is bound to view as a signal that markets are ready to take in more small cap investments and your portfolio too should not miss out.

But what if I told you that your existing funds are providing you the relevant small cap exposure already. You don’t really need a dedicated small cap fund.

Don’t believe me. Believe the data.

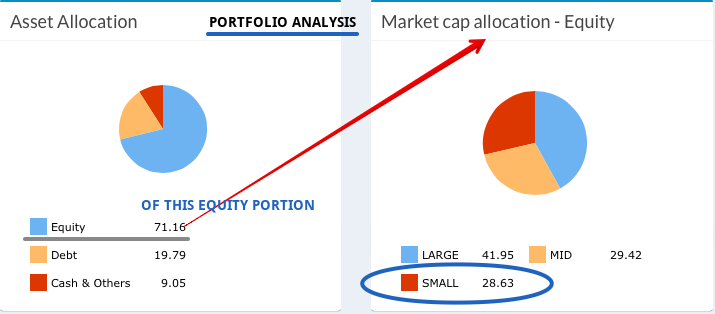

Below is an image from an investor’s actual portfolio on Unovest.

She has very little exposure (about 7% of the overall portfolio) to a small cap fund that happened to be our recommendation in the past. Currently, she is not making any investment for the past 1 year plus in a small cap fund.

Yet, if you see, she still has a 28%+ exposure to small caps in her equity portfolio.

Unovest counts stocks in the bottom 10% of market cap ranking as small caps.

How did this come to be?

The fact is that your other funds including multicaps and midcaps have the mandate to invest in small caps too. It easily fills in the gap for a dedicated small cap fund.

Check out the respective multi cap or mid cap schemes you invest in and you will see a decent allocation to small caps too.

Why no small cap fund?

We are NOT recommending any dedicated small cap fund for now. Some reasons are:

- As you are aware, small cap investing is no cake walk. The universe of good quality small cap companies is limited, much smaller. They are highly illiquid (less traded). Some of the companies are so small that if the fund plans to make any significant exposure to even one company, it could end up buying the whole company. Though it is not going to happen because mutual fund regulations don’t allow that.

- Then comes the current size of existing small cap fund schemes. One of the largest is at Rs. 7000+ crores. You know which one I am talking about. Put this size along with the previous statements about restrictions and get the big picture. How easy or difficult is the fund making it for itself given the limited universe of good companies?

- Finally, most small cap schemes (including your favourite ones) have stopped taking fresh subscriptions or restricted them. The fund managers themselves believe that the current market is not suited for channelising more money toward small caps. I don’t want to second guess that assessment.

However, as mentioned there are always those good companies (even the small ones) that deserve to be invested in. There are other funds in the portfolio doing that job for you and me.

What should you do?

Check out your own portfolio exposure first. You can check out this report for your own portfolio on Unovest under My Reports->Portfolio Analysis.

You may just realise that you already have enough exposure to the small cap space and you don’t need a small cap fund at all.

Of course, if that is not the case, you can still go ahead and invest in your favourite small cap fund.

A word of caution: If returns is the only thing you are going after, be ready for a topsy turvy ride and bring down your returns expectation.

Good insights Vipin, thanks for the information

Thanks Girish for reading.

Great Insight Vipin. So do you sugegst only 25-30% exposure should be in Small cap considering an aggressive appetite or risk profile?

Difficult to pin a number as such. Totally depends on you as an individual. For the lady in the note, she thinks it is little on the higher side. 🙂