Following the SEBI circular, Sundaram Mutual Fund has announced the changes in the scheme names and categories, if any. Here is a touch down.

To know about the SEBI circular and what changes it has asked Mutual Fund houses to make, click here.

I found the Sundaram’s communication to be most proper. They have clearly marked as to what schemes have NOT undergone a name change or there is NO change in fundamental attributes.

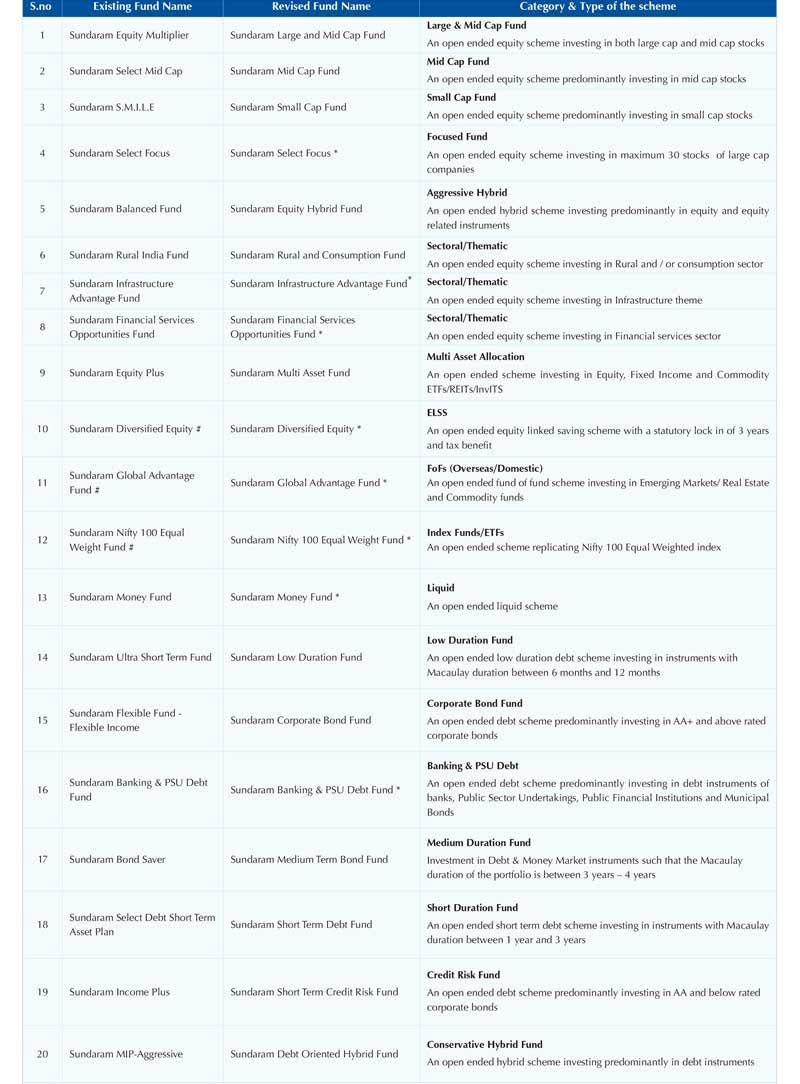

Here is the image that lists all the changes for Sundaram MF schemes.

* denotes no change in Name; # denotes no change in fundamental attributes.

Only 3 schemes have not undergone any change in fundamental attribute, that is, they continue to be managed the way they were before.

For your reference in equity funds, the investment universe of a large cap fund will be the top 100 stocks by full market capitalisation.

A mid cap fund will restrict its investments within 101st to 250th company in terms of full market capitalisation.

The rest can be taken up by a small cap fund.

A large + mid cap fund will have to invest at least 35% in each of large caps and mid caps respectively, as per the market capitalisation universe defined above.

Not just that, a focused fund can have upto 30 stocks only with a defined capitalisation (large or mid or small or multi).

A multicap fund has no restrictions on where to invest.

As you can see, some of the more popular schemes of Sundaram Mutual Fund have to redefine their investment universe. Sundaram Select Mid cap, Sundaram S.M.I.L.E., Sundaram Select Focus etc will have to adhere their portfolio to the new investment universe.

For example, Sundaram Select Mid cap had a mandate to exclude the Top 50 companies from its investment universe. That now expands to Top 100 companies. However, most of the companies it invested in were in any case outside of the Top 100. Only now it is more stricter.

In debt funds, the changes are more pronounced. The existing debt funds across AMCs were managed very flexibly. The 4 walls are quite well defined now.

How do you see these changes? Which of your Sundaram Mutual funds has been cleaned out? Do share your feedback and comments.

Surprised to not see a multicap. With their mid and small cap funds, I’m pretty sure they have a team of analysts researching most of the top 500 stocks. Perhaps they are leaving room for a future NFO.

Large and mid cap seems to be the flavour this season. Unrelated to Sundaram, I was wondering what would fund houses do with their multiple large and multicap funds. They are solving it very easily. Basically, make one a large and midcap fund (most multicaps were like this anyway), keep the other two as large and multicaps. If you’re still left with a fund or two, make one of them a focused/contra fund, and merge the underperformer with one of the smaller ones. Voila, SEBI’s assignment is complete!

Good observation Srikanth!