SBI Mutual Fund, like other mutual funds, has announced its scheme rationalisation and categorisation as per SEBI circular. While SEBI thought that as a result of the rationalisation of schemes, several schemes would be merged and go away, the AMCs have done some fine act and ended up retaining almost all of their schemes in some form or the other.

The latest act is from SBI Mutual Fund. While it too has retained most of its schemes, the fundamental nature of these schemes have undergone changes.

Take for example, SBI Magnum Equity Fund. This was sort of a multi cap fund. Now, this will be a thematic fund with a focus on investing in companies with the ESG them. ESG stands for Environmental, Sustainability and Governance.

Bravo! This makes it a brand new fund.

SBI Magnum Emerging Businesses Fund, which by name conveys a midcap orientation, will now be SBI Magnum Focused Fund with a limit of 30 stocks in its portfolio and can invest anywhere. That’s a new fund too.

SBI Magnum Global Fund is now a thematic fund, which will invest in MNCs. Wouldn’t it be simpler to call it an MNC fund?

SBI Magnum Balanced Fund is now SBI Magnum Equity Hybrid Fund reflecting its aggressive 65%+ holdings in equity.

SBI Magnum Multiplier Fund is now SBI Large & Midcap Fund. Basically, it has taken over the mantle from SBI Bluechip Fund.

That brings us to the star fund – SBI Bluechip Fund. The fund house had earlier categorised this fund as a large cap fund and it continues to remain in the same category.

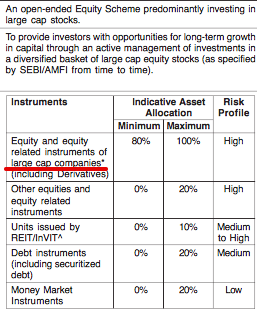

But what has changed is the way its portfolio will be reorganised. Given the new SEBI guidelines on categories, the fund will now have to be more large cap than before with 80% invested in large cap stocks compared to 70% earlier.

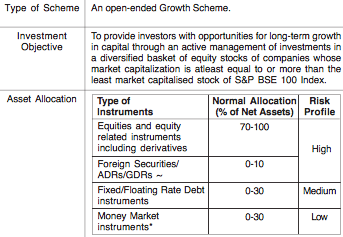

Here are the old attributes/features of SBI Bluechip Fund.

Below are the new attributes/features of SBI Bluechip Fund.

Here’s the link to my earlier note on SBI Bluechip fund

Another of the darlings of the investors – SBI small and mid cap fund had the mandate to invest 50% to 70% in small caps. The new rules ask it to invest minimum 65% in small caps.

Of course, it also has a large universe available now to invest. Small caps, as per the new rules, are largest stocks from 251st onwards in ranking by total market capitalisation.

The previous categorisation had small caps as 401st stock onwards in market capitalisation.

The slew of SBI Funds in Pharma, Infrastructure, Commodities, IT and FMCG will continue as Sectoral or Thematic Funds.

The debt funds of course will undergo massive overhaul. All fund houses including SBI have had to rename their corporate bond funds to credit risk funds. The world risk finally makes an entry into debt fund segment.

Whatever I might say, there are die hard fans of SBI and then those who believe that as a government owned institution, it will always protect their money.

For others, there is an exit window till May 15, 2018 during which you can redeem your funds without any exit load. Here’s a link to the detailed document about rationalisation published on SBI MF’s website.

Welcome dear investor, to the new world with the same number of funds but new labels!

Which fund are you willing to put up with and which ones you are letting go? Do share your comments.

Hi Vipin,

Agree with your point that AMCs have done a fine job of skirting around SEBI reclassification rules and kind of defeated its purpose. Investors are left more confused than ever. I am invested in SBI bluechip fund SBI gilt short term fund(now named Constant maturity fund investing in govt securities of 10 year duration). As I understand the modified duration of the new gilt fund will be ~10 years and highly sensitive to interest rate fluctuation. The average maturity of the fund currently is about ~1.5 year. The mandate now will be drastically different from earlier. I am thinking of moving out of SBI gilt short term fund due to this change. Am I missing something?

Hi Pratik,

Not sure why you are invested in a Gilt fund in the first place.

I invested in May 2016 when the interest rates cuts were expected and I was using this fund a temporary parking space for the down payment on my house. About 2 years later I am still looking for my ideal house. Meanwhile the fund has served me well and given me about 9.15% annualised returns(pre tax). Now the dilemma I have is to redeem the fund and pay 30% tax( my tax bracket is 30%) due to change(I have no need for the money unless I finalize a house) or wait another year and then redeem the fund and claim indexation benefits. The reclassification has somewhat derailed my plans and now I am unsure what to do.