So, here we are in April of 2018! As you know the long term capital gains tax comes into effect starting April 1, 2018. But that’s not the big story. This is also the start of the period when you can use Long Term Capital Loss to your benefit. Just as Kapil tried to but…

Some of the investors I spoke to have been holding on to their MFs and waiting for April to sell. Why?

Some background is required.

The new LTCG tax has come with one benefit. All gains till Jan 31, 2018 are exempt from LTCG tax. Basically, for the purpose of calculation of your gains, you can take the higher of your actual buy price or price as Jan 31, 2018 as your actual cost and calculate your gains / loss accordingly.

Now, we all know that Jan 31 was a peak date for most prices/NAVs. In fact, post Jan 31, prices have only gone down. This presents an opportunity to the investor to sell at a price lower than that on Jan 31, 2018 and book a notional long term capital loss.

This long term capital loss can be used to set off any other long term capital gains that might accrue during the rest of the year or in the next 8 years and thus save some taxes. Some smart tax planning helped by the IT department. You see Income Tax laws allow you to carry your losses forward to set off against gains in future years.

The investor who thought he has long term capital loss

My friend, Kapil, also took this opportunity to book some losses on investments he anyways wanted to sell.

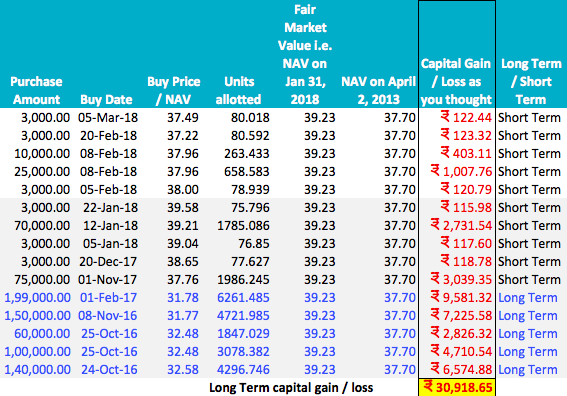

He had made investments in one of the schemes of a fund over the past year or so. He now planned to sell it. Based on his calculation, if he sold some of his units as of April 2, he would be able to book long term capital loss of Rs. 30,918 immediately and more during the course of the year.

When he showed his calculation to me, I could only shake my head.

Correction: It is NAV on April 2, 2013 2018.

“That’s incorrect Kapil. You don’t have any loss to book.”

He was taken aback.

“Dude, you need to clean your glasses. Look at the numbers.”

“I know what you have done Kapil. You have used the higher of the price as on Jan 31, 2018 and the actual buy price as your cost and deducted it from your actual selling price.”

“Yes, that is how it is supposed to be done.” he was confident.

“I guess you have missed out reading the FAQs issued by the Income Tax Department. It clearly says that you since gains are exempt for Feb and March 2018, you cannot book losses too for those months.”

As the exemption from long-term capital gains under clause (38) of section 10 will be available for transfer made between 1st February, 2018 and 31st March, 2018, the long-term capital loss arising during this period will not be allowed to be set- off or carried forward. (From the FAQs issues by IT department)

“What?” He was quite confused. “When did this happen? Now, how do I calculate my gains or losses?”

“The devil is in the details, Kapil. Let me show you how. But first see the input provided by the IT department.”

The cost of acquisition for the long-term capital asset acquired on or before 31st of January, 2018 will be the actual cost.

However, if the actual cost is less than the fair market value of such asset as on 31st of January, 2018, the fair market value will be deemed to be the cost of acquisition.

Further, if the full value of consideration on transfer is less than the fair market value, then such full value of consideration or the actual cost, whichever is higher, will be deemed to be the cost of acquisition. (From the FAQs issued by the Income Tax Department)

How to calculate long term capital loss or gain from April 1, 2018

So, the key conditions for calculating the capital gains for purchases made till Jan 31, 2018 are the following.

- They are applicable on sales made on or after April 1, 2018.

- Any gains that you made till Jan 31 are exempt. In fact, you are allowed to take the higher of the fair market value as on Jan 31 or the actual cost of buying, which is higher as your cost price for the purpose of calculation of capital gains.

- Because of the above grandfathering clause, you cannot apply indexation to calculate your gains.

- Such long term capital gains (over and above Rs 1 lakh in any financial year) will be taxed at a special rate of 10% + surcharge, total of 10.4%.

- There is one more condition attached to the point 2. If your actual sell price is lower than the market value on Jan 31, 2018, then you will have to take the higher of the actual cost of buy and the actual selling price as your cost of acquisition.

This last point is the one you missed out on.

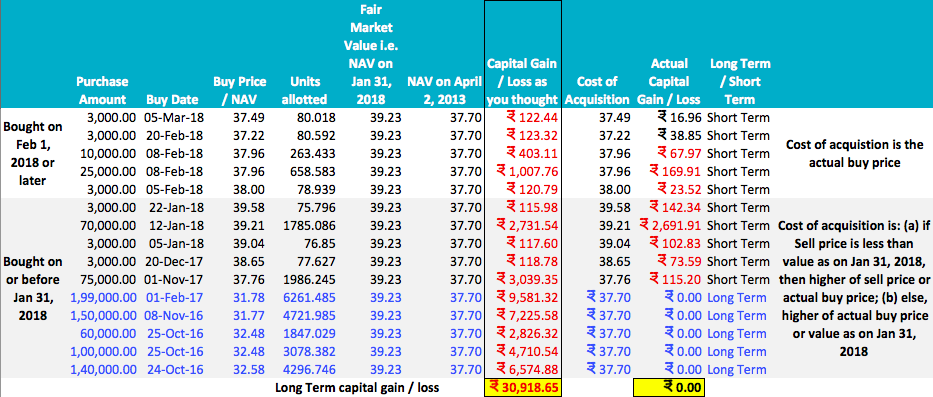

Using the above inputs, this is how your calculation of long term capital loss will look like.

Correction: It is NAV on April 2, 2013 2018.

As you can see, for your long term holdings your current selling price is less than the market value as on Jan 31. Hence, you will have to take the higher of selling price or the actual buy cost as your cost of acquisition.

Using that method, your calculation of long term capital loss doesn’t hold. Your real gain/loss is ZERO or NIL.

You will have to apply the same method to all your purchases made upto Jan 31, 2018, whenever you sell them.

“Ah! I get it now. This is so confusing. What about purchases made from Feb 1, 2018?”

“It is simple in that case. Your actual buy price is your cost of acquisition.”

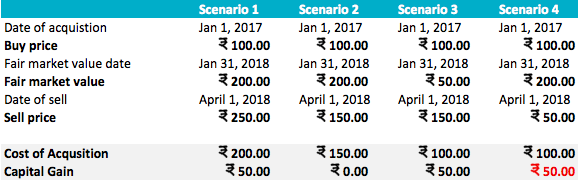

Here are more example scenarios from the Income Tax Department FAQs.

Here is the link to the Income Tax Department FAQs

Were you also planning to book some long term capital loss? Do you think there is a better way to deal with this? Do share your views and feedback.

As always, enlightening!

Vipin, a feature request for Unovest! There are several places where current value of a fund or portfolio are displayed — folio wise / scheme wise grouped by CAN or for all CANs. It would be great if you can also show the current value after tax if redeemed at the current NAV all at once. This is especially beneficial in the goals section.

Noted, most likely in a new version . Thanks.

Nav on April 2 ,2013 ????????

Table

That’s a typo. It is 2018. Thanks for pointing out.

there is also a scenario 5 –

Jan 1 2017 price of acquisition – 200

FMV on jan 31 2018 – 100

Sale price today – 50

What will capital loss be in this scenario?

As per the rule, since the sell price is less than the value as on Jan 31, 2018, the higher of sell price and the buy price will be the cost. In this case – 50 vs 200; So, Rs, 200 is the cost of purchase.

There will be a capital loss of Rs. 150.