Mr Sharma is getting retired. His responsibilities are over, children are settled abroad with their jobs and families. He is happy that finally after working for so many years, he is going to spend some time in peace with his wife.

Mr Sharma has total portfolio of Rs. 1 crores, which he thinks is enough to meet his retirement goals. The only issue is that financially he is grossly underprepared. The problem – he doesn’t know that!

It is important to note that he does not have any pension coming to him and has to generate income from the portfolio to meet the retirement needs.

He asks me, “how best to invest this money?”

But I ask him a different question.

“Mr Sharma, will this money be enough to last your entire retirement?”

“I think so. Dividends from Mutual funds should help me ” He is quite confident.

“Ah!” is my short reaction.

But given my work, I see problems. I am prone to ask questions and run scenarios with numbers. This is how it goes.

Me: What are the living expenses you will have per month?

Mr. Sharma: Rs. 60,000!

Me: Any other special needs such as traveling, medical, etc that you need to plan for? May be an yearly expense.

Mr. Sharma: No, 60k includes everything.

Me: What is the life expectancy you are planning for? I mean how long will you need the money coming in?

Mr. Sharma: I don’t think we will live beyond 75. I don’t want any more years.

Me: Sure. At what rate do you think inflation should impact your expenses?

Mr. Sharma: 6% inflation is a good rate. We have a very modest living.

Me: Finally, what is the expected rate of return on your portfolio?

Mr Sharma: (after some thought) 12% should be easy to get. What do you say?

Me: That sounds a bit aggressive to me.

Mr. Sharma: OK, then let’s keep it at 10%. (itna to hona hi chahiye!, This is the least expected.)

Me: OK.

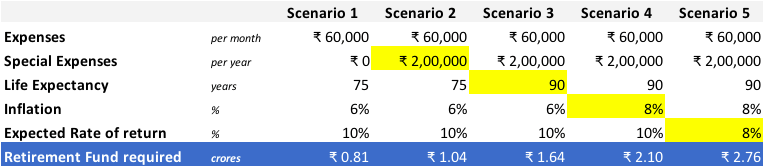

I used the numbers to show him the retirement fund he required as of today and then added few more scenarios to show him “what can go wrong”.

Retirement scenarios – What can go wrong?

Mr Sharma was happy to see the first 2 scenarios. He had enough money to take care of his needs.

But I wasn’t. The first 2 scenarios were optimistic in my view. He was overestimating the upsides and under estimating the downsides.

I was looking at the other 3 scenarios, which had a higher likelihood of occurrence.

“Mr Sharma, while I understand that you have a view on how you see your lifestyle, expenses and portfolio working, I think they are quite optimistic.” I tried to put my point across without taking away the smile on his face.

“It will be good to understand the risks that can impact your finances and accordingly the plan has to be adjusted for the same.”

“Sure. Help me understand.”

The first big risk is that of life expectancy itself. You and I know that we don’t control it as much. Life expectancy is steadily rising and you are better off planning for a 90 kind of a scenario than 75.

Just with this change in life expectancy you will need 1.64 crores today to provide for all expenses in the retirement lifetime.

You are clearly underestimating the power of inflation too. 6% is a very conservative figure and looks good in government reported statistics.

For people like you and me, we are better off taking a minimum 8% rate. It can be higher based on the lifestyle you have.

With this change in inflation, the requirement retirement fund goes up to Rs. 2.1 crores.

Even on the portfolio returns, your expectation is similar to an aggressive portfolio. Since you are retired and need more certain income, you need more certain sources of income, which may yield a lower rate of return.

You want to invest your money in equity / hybrid funds with dividend option. Putting your money to risk with higher volatility and ups and downs of the stock market can lead faster depletion of your funds. Of course, the dividends are not guaranteed too. From this year onwards, there is also tax on dividends from equity funds at the rate of 10.4%.

I suggest that you work with an assumption that your portfolio will only cover for the inflation and protect the purchasing power of money. That is equal to an expected annual return of 8%.

If we adjust the expected rate of return, the amount comes goes up to Rs. 2.76 crores.

“But I don’t have that kind of money.” Mr Sharma was a tad worried.

Not to worry. We will have to figure out the best course of action to ensure that you are able to meet your needs.

“OK. Let’s do it.”

Sure.

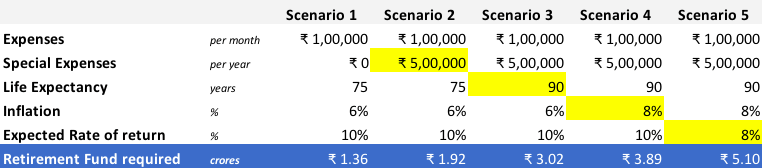

Different people, different retirement needs

That was Mr Sharma.

However, different individuals have different needs which can change the retirement fund requirements.

Just for expenses, what if they are more? You may like to travel more often. Medical expenses can be unforeseen. Or, you may need to take up senior care in a retirement home later in your life.

Here’s another set of scenarios that you can identify with. Assuming, you had expenses of Rs. 1 lakh a month and need another Rs. 5 lakh a year for special additional needs.

You see the difference.

Again, these numbers are relevant assuming you have retired today. A future retirement scenario will have a different set of numbers.

Now start planning and investing accordingly. Don’t let your assumptions derail your retirement plan.

Note: All calculations done with Unovest Retirement Planning calculator.

How prepared are you for your retirement? Do share with me in the comments.

That retirement planner is the most simplest and the most powerful table I’ve seen. You have a way of simplifying things, Vipin ????

While things may not go wrong for everyone, when planning for life (and also death here) where things are not in our control, it’s better to err on the safer side. The trickiest part is saving enough for future and still enjoying the present. I’ve seen far too many people doing all but struggle for a better future only to never see it themselves. Though we shouldn’t be only living in the present even though it might seem like a profound thing to say to always live in the present, we must take little pleasures in every day life. It’s a delicate balance.

These numbers are always huge, but I guess that’s the reality. Worst case, we will be leaving behind a good sum of money to our kids or spouse. What better gift than that when we’re gone!

Thanks Srikanth. Relevant point – err on the side of caution.

Normally most of the online retirement calculators are using fixed asset allocation till the end of goal tenure. I think its not good idea, we need to have reducing equity allocation as we progress towards to goal end date. Again if we make the calculator with reduction of Equity exposure and increase in Debt , then the monthly required will also shoot up.

So my take is we can not predict the 100% correct calculation for required corpus with the volatile asset class (Equity) and fixed income products. All i can do is, invest as much as possible (easy to say but hard to follow 🙂 )

For longer periods, an overall average should just work out Vandhi. And you are right, there is no real substitute to saving more.

Even after retirement, I think one should have a certain percent in equity. That 100 minus or, sometimes I see 110 minus age, formula should be kept running on the corpus. I also read the 4% withdrawal rule being suggested.

4% withdrawal rule is more like a thumb rule. In most cases, the portfolio has to be managed to ensure that it feeds the retirement expenses well. That can include an exposure to equity too.

Wow.This article is eye opener.Even though i am planning for my retirement but to be prepared for every scenario is a need of the day. You present the facts in a very simple and powerful way.

Thanks Himani. Glad that it pushed your thinking.

Very impressed simple and meaningful points. Pl suggest retirement corpus investment for monthly 1 lacs expenses. First 3 yrs expenses i have kept separately in ultra short term fund. I want to invest 1.5 crs ,50%in large cap andc50% in debt fund and withdraw @7%per anum from 4th year. Pl revert if its correct strategy and recommend good funds for each category. If you feel to change the strategy. Pl share the correct one. Regards