Starting April 2018, the scope of capital gains tax has increased. Even your direct stocks and mutual funds are now subject to long term capital gains tax. There was no long term capital gains tax till March 31, 2018.

So, real estate, gold, bonds, debt funds, etc have always been subject to short and long term capital gains tax. Since gains are taxable, you are also allowed to set off capital loss (as per conditions) to reduce your tax liability.

A lot of financial plans demand that the right kind of capital gains tax efficiency is also built into the structure.

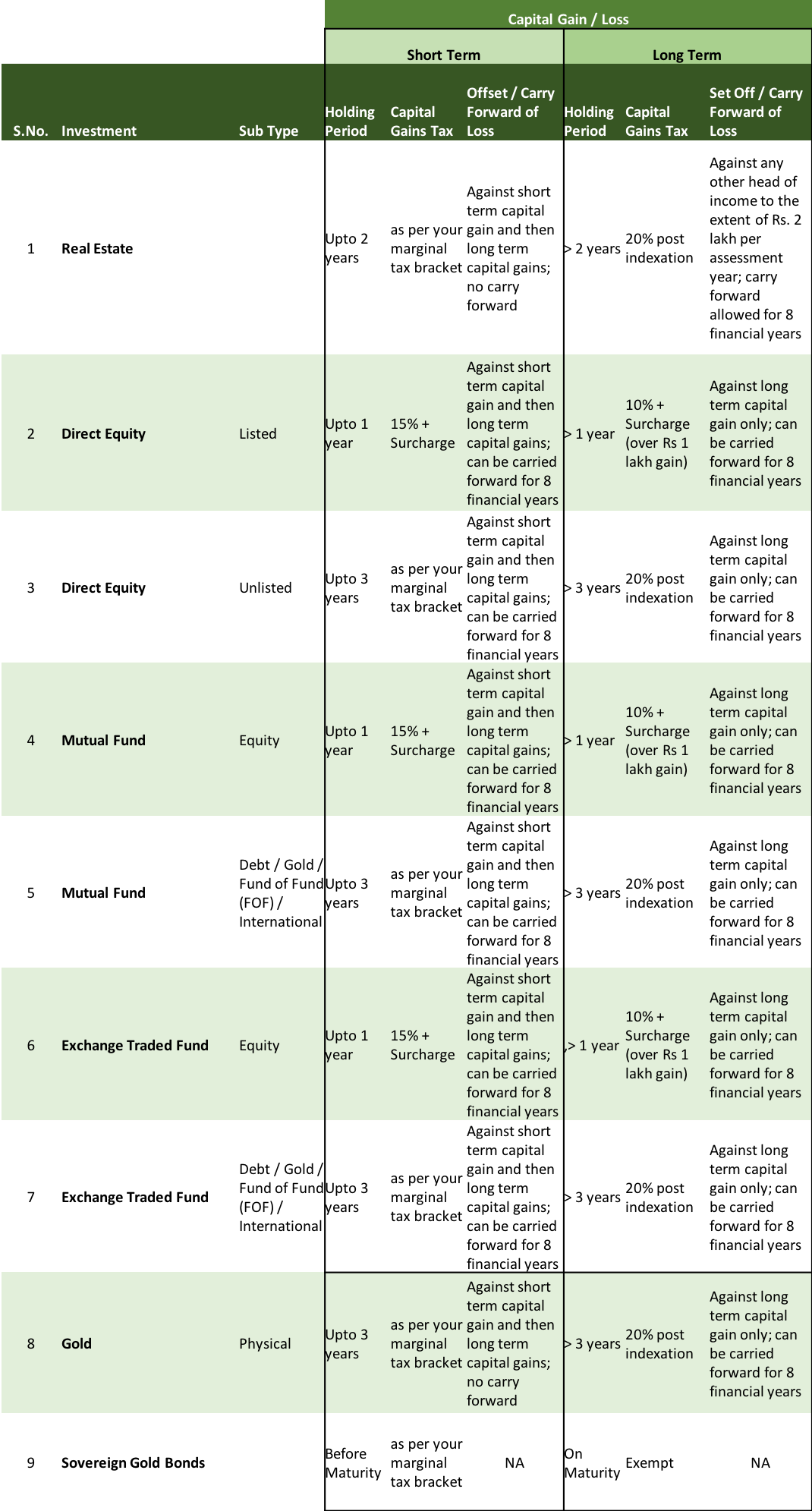

It has been confusing to hunt down information about various capital gains taxes. So we decided to create a quick reference table for you and us.

All the capital gains tax on various assets in one place.

The below image lists all the assets that are likely to invest in and have capital gains tax implication. For every asset, we have mentioned the short term and long term holding period and the tax rates.

Finally, we have added the offset allowed in case of a capital loss, in what manner and if you can carry forward the loss for offset against gains in future years.

Here it is. Feel free to download and keep a copy for yourself.

As you would notice, most short term capital gains are taxed as per your marginal tax rate, that is, the rate of tax applicable in the particular financial year in which you sell the asset.

In case of long term capital gains, you have the benefit of cost indexation available to you. To understand the concept of cost indexation, read this note.

In case of long term capital loss, you can even carry forward your unadjusted losses to future financial years (upto 8 more years).

Capital gains tax and TDS

There is one more aspect of TDS or Tax Deducted at Source that you need to be aware of. This is specially applicable to Non Resident Indians (NRIs) / Persons of Indian Origin (PIOs).

- Real Estate – For Resident Indian, the TDS is 1% of the registered sale amount. For NRIs, it is 20%.

- Debt Mutual Funds (including FOFs) – NRIs are subject to TDS of 20% for long term capital gains and 30% for short term capital gains. No TDS for Residents. Residents have to calculate their own tax liability and pay.

- Equity Mutual Funds – TDS is 15% for short term capital gains and 10% for long term capital gains for NRIs. No TDS for Residents. Residents have to calculate their own tax liability and pay.

Surcharge on TDS is extra.

So, that was all about capital gains tax.

How are you making your investments to build tax efficiency?

Disclaimer: This information is sourced from the documents of the Income Tax Department of India. While we have taken adequate care to verify the relevant tax rates and offset conditions, it is best that you clarify with a professional chartered accountant before making a decision.

If you think there is something else that can be added to make this more relevant, please feel free to share.

Thanks.

Is there any way to get consolidated capital gain statement for all mutual funds in excel format? I know Cams and KARVY pdf copy.

You can upload your CAMS consolidated transactions statement on Unovest and get the Gain/Loss report for the financial year relevant to you.