Does HDFC Small Cap fund deserve your money? You already have large caps in the portfolio, so are multi caps and mid caps. How about adding a small cap fund? That’s what an investor is asking.

I’m planning to invest in this fund for my small cap portion. Both DSP BR Small Cap (previously DSP BR Micro Cap) and SBI Small Cap aren’t accepting subscriptions as you well know. And Reliance Small Cap’s AUM is too big for my liking (but do let me know if you think this isn’t an issue as I really like the performance and expense ratio of this fund). Sundaram SMILE, well, you aren’t in favour of this one as per your small cap funds review, and I’d definitely not invest in this as I’m already investing in their midcap fund.

HDFC Small Cap fund seems to be managed by a good fund manager. Its AUM isn’t too big. Expense ratio is good. Returns aren’t spectacular compared to its peers, but it’s not bad. Bear market downside protection wasn’t bad. And it uses a proper benchmark, unlike Franklin India Smaller Companies fund. But I’d like to know if you think this is not a good decision, or if you think I can go ahead. This fund wasn’t covered in the Unovest Blog smallcap review, hence my question.

For the retail investor focused on wealth creation, specially via direct stocks, small and micro caps is the most attractive zone. The large caps are done and dusted, the mid caps are covered enough too. It is only the small and micro caps where the “hidden gems and treasures” await.

Now, picking a stock directly is not so easy. So we outsource the job to a manager of a mutual fund – more specifically a small cap fund.

The small cap fund variety has had a charm of its own and it is not an easy one to ignore. There are years when the funds post 100% returns. Yes, in a single year. There are also years, when they fall 50% in a matter of months. But the fall doesn’t seem to matter so much – the rewards are eye popping.

That is where our dear investor too is heading with his own detailed analysis to select a small cap fund.

But just hold on!

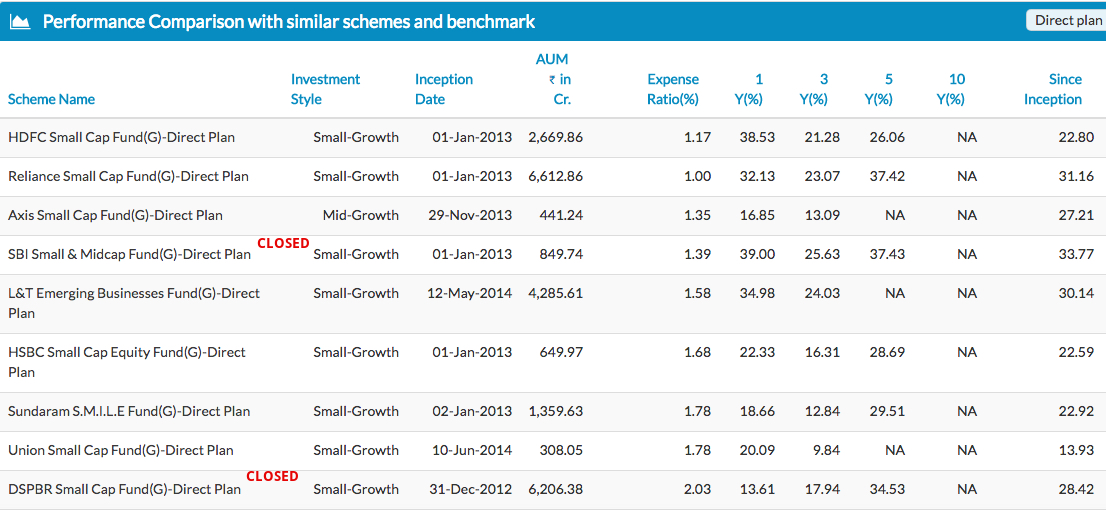

Source: Unovest, NAV data as on March 22, 2018. Factsheet data for direct plans as on Feb 28, 2018.

As you can see, the funds have a remarkable performance streak.

I understand it can be very tempting to have the only (relatively) high performing, low AUM, low expense, small cap fund in the portfolio. HDFC Small cap fund does stand out in a lot of ways.

Yet, there is one thing that is missing in it – the track record!

HDFC Small Cap Fund – a brief history

HDFC Small cap is a recent entrant to the HDFC MF stable. The fund was started in April 2008 by Morgan Stanley as the Morgan Stanley ACE Fund – a multi cap fund.

In 2014, when HDFC acquired Morgan Stanley’s 8 schemes, this too came in. The ACE fund was repositioned as HDFC Small & Mid Cap fund with a focus on small and mid cap stocks.

However, HDFC probably realised that this was working against its own HDFC Mid cap Opportunities fund and once again in November 2016 renamed it as HDFC Small Cap fund with a focus on Small cap stocks.

The fund now has a mandate to hold a minimum of 80% of its money in small caps.

(source)

So, if you understand it, the fund in its current avatar of a pure small cap fund is just a little over an year old.

How is that for a track record?

Not sure about you, but for me this one doesn’t have enough of its own.

–

Let’s talk about the size issue.

The investor understands the downsides of a large size in a small cap fund. Too big a size can work against the fund. However, this one doesn’t seem to be so large yet.

Here’s a perspective. The overall universe of stocks and opportunities available in the market are the same for every fund scheme. Now, when there are a dozen funds, which have grown big in size over the past couple of years and chasing the same limited quality universe of small cap stocks, what is going to happen?

A mad race where the managers are likely to overpay for any fresh purchases.

Hence, I respect the decision of some of the fund houses to close the doors. Others are just riding the greed of the investors to make more money. Who will end up making money is anybody’s guess.

HDFC Small cap Fund – Size growth

The fund was just about Rs. 927 crores in November 2016, when it last changed its positioning. Today, it stands at approx. Rs. 2700 crores. Almost 3 times in 15 months.

I am sometimes amazed, if this was a stock, I would be so happy to buy it. 🙂

But for a mutual fund scheme which plans to invest in small cap stocks…..the question remains.

What about other ratios and ratings?

Frankly, you can throw out all ratings, ratios and performance statistics of the HDFC Small Cap fund out of the window.

The fund has a lot to see and prove before we can call it a track record. The ratios come in only after that.

What is your view on this fund? Do share in the comments.

Thanks for HDFC Small cap Review. I was thinking of asking this query, but some one already so eager to know from you 🙂

Well, Why Franklin smaller companies not in your Small cap review list. Is it because of the size or Not fully invested in small cap space (less than 65%).

To me, its not so aggressive Small cap fund in the list.

Thanks Vandhi. Currently, I consider Smaller companies fund a confused one, which calls itself smaller companies fund but has most investments in mid caps.

Thats true. It has equally distributed with mid and small cap. May be post funds Rationalization will clear this confusion.

Reliance small cap stopped taking lump sum. Strange Franklin smaller has bigger asset size than Reliance small cap , but still its accepting lump sum 🙂

Vandhi, the investor mentioned in this post is me ???? Good to know you were thinking of this same fund for investment as well. We’re all in the category of expert novice, a dangerous place to be. Without his expert opinion, I’d have surely invested in this. Now, it’s wait and watch.

As for Franklin Smaller Companies Fund, I didn’t like it for several reasons. The name suggests small cap, but it’s a small and mid cap fund, a category that SEBI has abolished for now. It also benchmarks against a mid cap index; so they are unsure of their own performance. Its AUM is too big, as big as DSP BR Small Cap and Reliance Small Cap, and as you rightly pointed out, still merry and happy to take investors’ money.

I’m generally not a fan of Franklin and ABSL, along with ICICI and HDFC. They have too many funds, their benchmarks are contrary to their fund names, and it’s too hard to find out their funds’ history. I actually find HDFC least obnoxious, which is surprising.

Srikanth, I suspected it was you 🙂

Well, actually i was asking Vipin why still small cap fund in missing in the Unovest portfolio. So i also eager to hunt a small cap ,but DSP micro cap is only the best fit . Lets wait for AMCs Category rationalization, and i am sure Vipin will come up with new Post on this topic. Over to Vipin 🙂

Yes, I thought the deadline for SEBI categorisation was March but looks like it’s not. Most big ones haven’t done their reorg.

BTW, a bit unrelated. I saw your comment on the Aadhaar linking post that you had trouble with linking on Sundaram BNP Paribas, even though you had your email and mobile number properly with them (and that there were SMSs and mails whenever units are credited on those email and mobile). I’m facing the same issue. How did you get it sorted?

Actually Sundaram AMC replied very late and it sorted out . I do not remember how did they fixed. But keep pushing them by e-mail.

Vipin, thanks for this wonderful post and helping me out in avoiding a potentially high risk investment that can turn out to be a mistake.

In this conversation, I realised I don’t really understand why bigger AUM is bad for small cap funds — it looks like I simply accepted that as an axiom. And I found your point about considering not only the fund’s AUM but that of all the funds’ combined AUM vs the market cap of the small cap universe very intriguing. But I’m afraid I don’t fully understand that. Can you explain this? Also, is this something I need to worry about the mid caps as well?

Basically for a lot of folks like me who are in it for the longer run, we are often wondering why we should even invest in large caps, when mid and small caps can deliver 5-10% higher returns (all based on past performance). And now I feel both this doubt and the combined AUM bit you talked about are sort of related. It looks like there’s something basic that we’re missing. Can you shed some light on this?

If this requires an entire new post, we’re ready to wait ????

Sure Srikanth. Let me see what I can get across.

Briefly, of the Nifty 500 stocks, close to 250 of the bottom stocks by market cap provide just 10% of the total market capitalisation. These are the small and micro caps.

In contrast, just about 80 stocks provide 70% of the total market capitalisation.

Then the quality of businesses/stocks in the small cap space is mostly questionable. So, an increasing AUM means a lot of money chasing very few and very small stocks.

Any fund scheme cannot hold more than a specified % of any company. Schemes have their internal controls too where they won’t hold more than say 5% of a company.

Put all this together and you realise that not all may be hunky dory.

Thanks, Vipin. Makes better sense now. A good exercise for me on a weekend may be to find out the free float market cap value of mid and small cap and the combined sum of all mid and small cap funds.

Srikanth,

Please Do post your findings after your weekend research over 🙂

Reading here n there about the tax treatment of the two options from this budget onwards, and specifically some blogs mentioning that Dividend Reinvest too will now be taxed ,,,, is it ??? Please educate …..

1. What is the taxation treatment of Dividend Reinvest by MF AMC.

2 What is its linkage to the 1 lakh relabe?

Apologies if you have already covered this elsewhere

Sir

Thanks for the prompt reply one to one . I had posted this query on several forums but havent heard from anyone else so far. Kudos.

2 Though I think I went rather cryptic with my question and your ans is equally so. So let me ask again

1 Is the dividend reinvest being taxed. 2 If yes at what rate.

2 The gains there ( redemption reinvested) , whether they are part of the exemption limit of 1 lakh or will it be over n above this.

3 And finally the basic question … with new rule on MF/ EQUITY being taxed even after one year should we now change the holding from Dividend Reinvest to GROWTH.

4 An URGENTreply is requested as one may have to take necessary action in the couple of days left in this financial year

Thanking you a lot and wishing you a great day

Sapana

Vipin,

What will be the % of allocation to Small cap fund in overall portfolio. If mid cap funds are already invested with 30% allocation.

That is a very personal choice. I could keep it at 50% while someone may not want it more than 10%.

For safer allocation, some people are suggesting 10% to small cap in overall portfolio.

50% is very aggressive allocation and too risky – Its my understanding.

Do you mean only small cap for 50% or combined Mid and small cap funds to 50% .

Only small cap 50%.

Vipin, Are you serious. 50% only for small cap allocation .

Just curious, though it your personal choice. , what makes you to invest in half the portfolio into Small cap.

Hope you do not mind my query as it is for my learning purpose.

It is not about SMALL CAPS. but about good businesses that are expected to deliver for the investors. I would venture to that large a proportion only when I see that the portfolio can find as well as accommodate good businesses at the right price aspect. Of course, the kicker is that some of these small businesses have a potential to grow really big.

As an expert its easy for you to find such a fund. But what about a novice investor like me. So i can limit myself to 10% allocation.