I received an email from Franklin Templeton India about their debt fund schemes – a reckoner of sorts. Frankly, I was expecting information on their scheme rationalisation. Looks like they need more time. Anyways, here’s how I see the schemes change after the AMC implements SEBI’s circular for scheme rationalisation.

So, this is what I did.

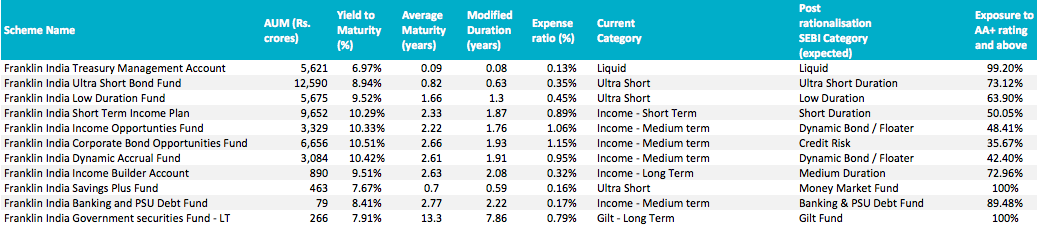

See the image below.

Expected categories of Franklin India Debt Funds

(Click on the image to see a larger version or download it to your machine.)

Source: AMC communication, Unovest. Data as on Feb 28, 2018

There is a list of fixed income schemes on offer by Franklin Templeton India. The yield to maturity, average maturity, modified duration and expense ratio have been provided as well. The current category of the fund is mentioned too.

Finally, the question was which is the most likely new category for the scheme? Based on the definitions and the characteristics of the category, the most likely category of the fund is identified.

To know the category details as per the new SEBI circular, read this note.

As you can notice, Franklin India has multiple schemes in the same category. For example, there are 4 schemes in Income – Medium Term category. They may follow different strategies but it is not easy for the investor to find out.

That fact doesn’t come out clearly in the current category structure. However, the new category gives a lot more information and makes the job easier to identify the right fund for a particular goal / time horizon.

Note: As mentioned before, the SEBI category I have mentioned are what I expect to happen. The fund house may take a totally different view on its schemes and choose a different category.

Now this was easier to do with Franklin since the no. of schemes is not that large. I couldn’t get the courage to take up a fund house like HDFC, Aditya Birla or ICICI given the massive no. of schemes they have.

It is surprising the fund houses are taking so much time to decide and get approval from SEBI. But then, there is so much to clean up.

As an investor, we can only wait for now. Unless, you have chosen Unovest recommended fund schemes.

What do you think of the expected changes for Franklin India debt funds? What’s your take?

When is the last date for AMC to announce their rationalization of funds as per SEBI mandate.

As it states, it is within 6 months of approval by SEBI to the fund house for scheme rationalisation. So, a little grey area there. Hopefully, it should all be sorted in the next couple of months

SEBI circular of 6th Oct ’17 says

” Mutual Funds would be required to analyze each of their existing schemes in light of the list of categories stated herein and submit their proposals to SEBI after obtaining due approvals from their Trustees as early as possible but not later than 2 months from the date of this circular. ”

“Subsequent to the observations issued by SEBI on the proposals, Mutual Funds would have to carry out the necessary changes in all respects within a maximum period of 3 months from the date of such observation. ”

So by above calculation AMC’s must have submitted proposals before mid december last year, but still may AMC’s have not categorised their schemes. Is SEBI taking time to observe the proposals? Or AMC’s negotiating and buying time to categorise?

I guess some bit of both. It has not been easy for AMCs to let go their prized jewels. So, even if they submitted their proposals in December, some to and fro with SEBI has consumed time and delayed the final outcome.