The Budget 2018 has come out with the big surprise. Now stocks and equity mutual funds will be subject to Long Term Capital Gains Tax. But not insurance or ULIPs. And this has got you and me thinking and confused. The question is it time to prefer ULIPs over MFs?

There is a short answer to the question but to the curious, here’s a long one.

Let’s agree first that the long term capital gains tax is applicable only on mutual funds and not ULIPs or for that matter any investment based insurance product. On that parameter alone, the award of most tax efficient product goes to ULIP.

But what about the other parameters? Do ULIPs do equally well there too?

To get a clearer picture, let us again understand how ULIPs are structured with some of their features.

- Type 1 and Type 2 – No, we are not referring to diabetes here but the 2 options that ULIPs offer. Type 1 ULIPs are those which provide you either the Sum Assured (insurance cover) or the Fund Value (the value of the investments) whichever is higher. Type 2 ULIPs provide both, the Sum Assured plus the Fund Value. Of course, the premium in case of Type 2 would be higher too.

- Minimum Sum Assured – The tax benefits are applicable only if the Sum Assured is 10 times of the annual premium in case of a regular policy or 1.25 times of a single premium policy. For example, if you pay a regular premium of Rs.1 lakh per year, your Sum Assured has to be a minimum of Rs. 10 lakhs. This is in case when your starting age is less than 45 years.

- Multiple investment options – A ULIP provides you various investment options which you can direct your premium to be invested in. Most popular ones are Equity fund (where all money is invested into stocks), Debt fund (where all money is invested into bonds, government securities, etc) and Hybrid or Balanced Fund (a mix of Equity and Debt). You can select one or more to invest based on your risk appetite and time horizon.

- Tax Free Rebalancing – From a financial planning point of view, you can maintain your asset allocation by rebalancing your funds into equity and debt (within the fund options offered by the ULIP) in a proportion that is right for your goals. And, you can do this all without incurring any taxes. If you would do the same with individual investments, there could be taxes applicable. All you have to pay is a small fund switching charge.

- Lock-in – All tax saving investments are subject to lock ins and ULIPs are no exception. They have a lock-in period of 5 years from the starting date of the policy. You can withdraw your money only after completion of 5 years. Even, if you discontinue paying your premium before 5 years, you will receive the pay out after 5 years.

- Loads of expenses – I had earlier written about the various expenses charged in a traditional insurance policy. ULIPs too have their own set of charges. These charges include Base Mortality, Premium Allocation, Policy Administration, Fund Management, Fund Switching and Surrender charges. All these are deducted by way of cancellation of your units.

Pitting ULIPs vs MFs

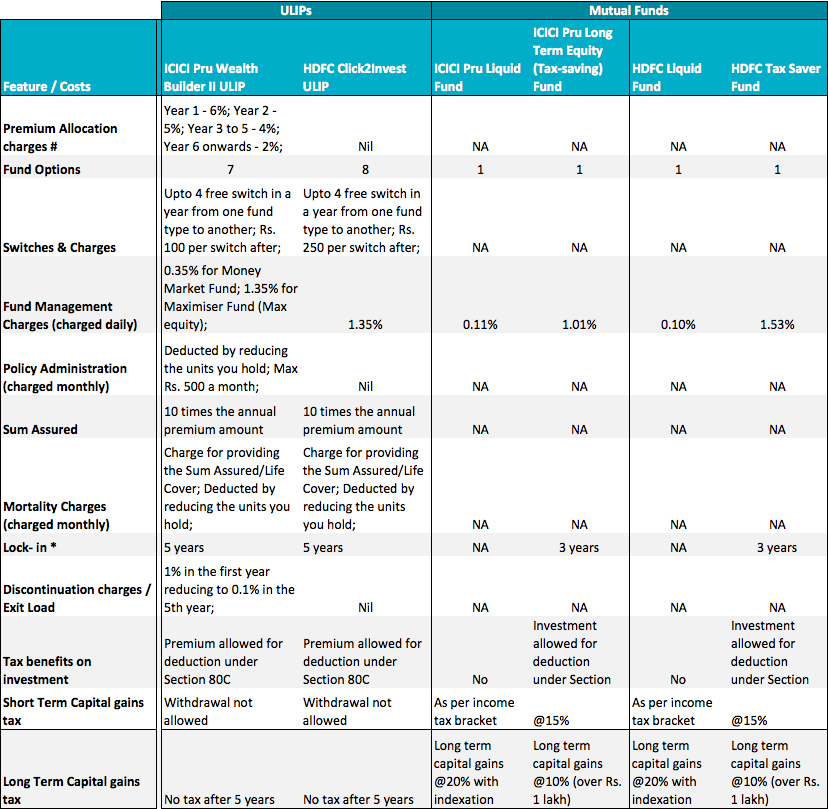

Having understood the broad contours of a ULIP structure, now let’s make a comparison. We take 2 ULIPs from the largest insurance companies and a mutual fund each from Debt and Equity from the largest 2 fund houses. Yes, they are HDFC and ICICI.

Here’s the table of comparison.

Source: MFs – Unovest; ICICI Pru ULIP – Product Document; HDFC ULIP – HDFC Insurance website; Data as on Feb 2018.

#Premium allocation charges are deducted from the premium. It reduces your investible amount.

*Liquid funds do not have a lock-in. Generally, exit load of 1% is applicable on equity funds if redeemed within 1 year.

Only direct plans of mutual funds have been considered. Tax saving mutual funds have been considered for better comparison

Some observations from the table on ULIPs vs Mutual Funds :

- The biggest difference between ULIPs and Mutual Funds is the cost – it goes without saying. If everything else remains the same, including the choice of investments, styles, etc., the costs will reduce ULIP returns significantly. The cumpulsory insurance cover adds another layer of charges in terms of mortality costs, even if you don’t need it. Each of the expense head reduces your investment and hence the final returns.

- ICICI Pru Wealth Builder II ULIP has a range of costs including premium allocation charge and policy admin charges. Between this and the ICICI Pru Long Term Tax Savings Fund, one will go for the latter. The fund management charge of the mutual fund at 1.07% is far less than 1.35% of the ULIP. You get more returns in mutual funds just because of lower fund management costs and zero premium allocation charges.

- The liquid fund option makes no sense in a ULIP. Look at the HDFC Click2Invest ULIP. Why would you pay 1.35% fund management charge for a liquid fund? HDFC liquid fund is a far more cost effective option. In case of ICICI too, it is a no brainer to go for the ICICI Liquid fund. If you go one level up to Ultra short funds, the cost remains within 0.2%. ICICI MF’s own Flexible income plan expenses are at 0.16% for its direct plan.

- Between ULIPs and MFs, MFs offer you far more flexibility as an investment. In a ULIP, you cannot withdraw your investment before 5 years. Even your investment underperforms, you cannot do anything. In comparison, you can withdraw money from tax saving fund after 3 years. If tax saving is not your need, then you can choose any equity mutual fund. Yes, ULIPs offer tax free switches and insurance cover, but losing the flexibility is too big a cost to pay.

The Cost of Insurance cover in a ULIP

So, ULIP also gives you an insurance cover, which is equal to at least 10 times of your annual premium amount. Even if you don’t need it you have to take it, else no tax benefits will accrue.

Suppose you do need an insurance cover too. But how feasible is to take a ULIP for an insurance cover?

For example, you need an insurance cover of Rs. 50 lakhs. In a ULIP, you would need to have a premium of Rs. 5 lakhs annually to get that cover size. A portion of this premium will be used to give you life insurance cover and the rest will be invested in “high expense” funds. In all probability, you will not take a policy with this high a premium and hence leave yourself underinsured.

In contrast, as a 35 year old, you can buy a term plan for your insurance cover. You can get a risk cover of Rs. 50 lakhs for a premium of Rs. 5,000 approx. per year.

Isn’t that interesting?

Calculate: How much life insurance cover do you need?

What about the long term capital gains tax?

I can still see the light in the eyes of several investors. I guess these investors are behaving like Rajeev, the character of Shashi Kapoor in the 1978 social drama movie Satyam, Shivam, Sundaram. Rajeev (played by Shashi Kapoor) falls in love with the melodious Rupa (played by Zeenat Aman), and wants to marry her. Though every one thinks that she is “manhoos” or “bad omen“, he says he doesn’t care and his love is pure and true. But, reality strikes. Read more here.

Yes, the returns from equity mutual funds will be impacted by the long term capital gains tax. Accept that.

But you should see the whole picture and then take a call. To me lower costs and more flexibility more than make up for the new tax.

Beware! The marketing machinery of insurance companies is now active overtime to ensure that you know ULIPs are tax exempt and attract your money.

A Unovestor just shared this in a comment:

Since mutual funds are taxable, HDFC started pushing ULIPs saying that there is no tax on returns under section 10 (10)D & only 2.5 % & 2 % charges for first 2 years respectively & none thereafter.. but beware since I have already burnt my fingers with ULIPs & will not touch even with a 10 feet pole considering the flexibility with mutual funds & low cost.

So, what choice would you make? ULIP or Mutual Fund? Do share your thoughts.

Hi Vipin,

Nice article. My dad was also a victim of ‘marketing machinery’ of an insurance company and had bought ULIP almost a decade ago. We payed premium for 7 years. Then I came across your article on how to calculate XIRR on your investments. We calculated the XIRR for the ULIP and to our shock, it was negative. We surrendered the policy a couple of years ago and invested the money in mutual funds.

So, my choice will definitely be Mutual Funds.

Thanks Kruti. You probably know that you or your dad are not alone. Several ULIP investors have fallen prey to the marketing.

Even with current 10% tax, I am going ahead with mutual funds. I am a young investor and my goals aren’t until 8 years from now. I am hopeful that by the time I need to withdraw, LTCG may get reformed or at least allow indexation for very long term investments.

Do you think LTCG tax may get abolished by then? Or, conversely, can it go up?

Great decision Amit. I have no idea about what will happen later. Thanks for the comment.

Hi Vipin,

Thanks again for the nice article. After i’d burnt my fingers in ULIP policy once, i’d been sticking with MFs for almost 8+ yrs now. Even i chose MFs above than NPS. but the recent 10% LTCG tax without indexation has really dented the returns of MFs. I calculated the maturity value for both ULIPs and MFs in current scenario and it is shocking to see that MFs maturity value is only marginally higher than ULIP maturity value. In-fact when i consider term insurance premium along with MF SIP, MFs SIP maturity value shows lesser value than ULIP after 15 yrs with tax on MFs. I desperately want to be proved wrong as i cannot believe my favorite asset category MF now stand lesser to ULIP after 10% tax scenario. can i share my excel sheet here somewhere to show what i did in my calculation or email you?

I compared ICICI’s Elite life super plan and MFs for 15 yrs period. included all the cost of the ULIP plan. Premium paid Rs.2lac per annum(16667 per month), equity plan assumed in both the products with conservative return of 13% per annum. In case of MFs, i assumed the SIP of same amount Rs.16667 per month.

In my calculation, ULIP maturity value after 15 yrs came to 85,10,680 tax free. In MF SIP after 15 yrs, after tax it comes to 86,45,386. Just 1.3 lac difference. In-fact if i deduct from MF SIP,the premium amount needed for term insurance, MF maturity proceeds are even lesser than ULIP. All calculation done for 35 yr old, healthy male.

Thanks,

Senthil

Senthil,

why are you focused only on returns? For me the bigger issue is that of flexibility. Why don’t you share your calculation?