Recently, Unovest was covered by YourStory, a startup platform and I had shared some of my thoughts about why we started, journey so far and what do we plan to do? While I did that, I made some notes which I am reproducing here. Hopefully they will help you know and appreciate Unovest’s story and purpose.

Here’s the link to the YourStory coverage.

Below is the detailed story.

Why does Unovest exist?

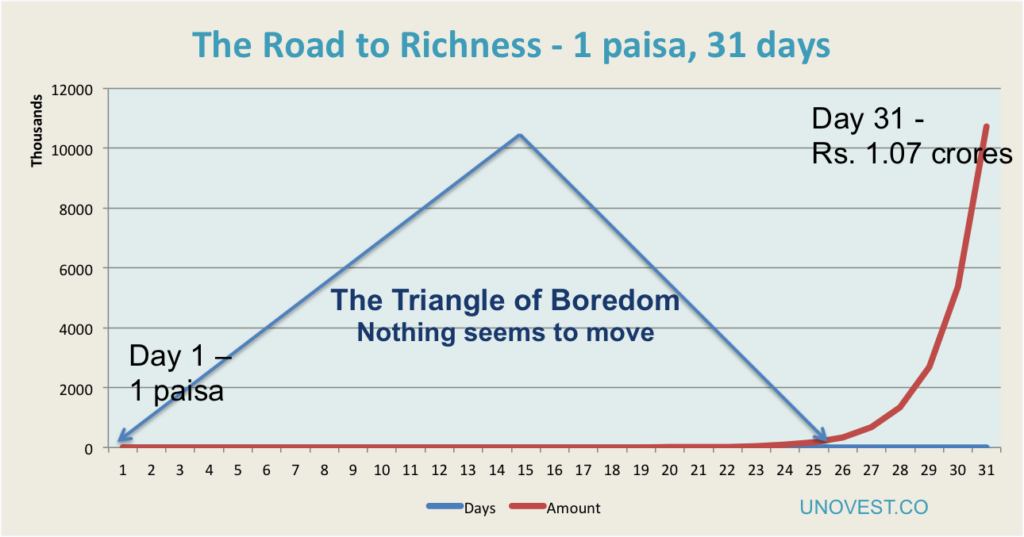

Too much money has been lost chasing short term returns / performance, in other words, alpha. By using simple tools, investors can achieve another signficant alpha. We call it behavioural alpha. It is a low hanging fruit which most investors tend to ignore.

With Unovest, investors can achieve this alpha with low cost, low risk and low churn investment advice and unlimited support. This can make a difference of a few extra %age of returns in the portfolio and give a boost to the power of compounding.

Not just that, an investor can invest in direct plans of mutual funds, do goal based investing & tracking and seek investment advice and support.

A stream of relevant content enables investors to filter out signals from noise and prevent them from taking a short term approach.

This also reflects in the way Unovest is being built. Essentially, what we have picked up is a real long term challenge.

When several investors believe long term is 1 to 2 years (with the taxman supporting that thought process too), and some best cases may go upto 5 years, we are asking you to think 30, 40 or 50 years.

We are not working on a commission model (which can be a source of instant, quick revenue), but charging fee for advice and tools. Paying for advice, specially in India, is still at a nascent stage.

From a regulatory point of view, we are aiming at a long term model, though in the near term we may look like fools.

Just to clarify, we are not a full robo-advisor as many people like to believe. We are using tech and algorithms but every piece of our advice is handpicked by real people. In fact, a combination of tech and real people (advisors and support) in our case is our preferred approach. The investors, that is you, like it that way.

To understand and serve our customers better, we have even done things that prima facie appear unscalable. For example, personally handholding the customer through and through, answering every query, etc. In fact, we wanted to experience how the customer thinks and acts. Today, we have a much better idea of what the investor goes through, what she wants and how we can help.

So, yes we have had challenges. Initial challenges included finding the right capabilities and resources. The industry still operates in a 90s mindset, specially from a technology point of view and hence, everything we wanted to build required 10x more effort and resources.

We have learnt a lot and hope to put it into practice over time.

How did it all start?

In April/May 2015, I had started my journey as a Independent Investment Adviser. This was not my first stint as I had done this before in another role in an organisation from 2006 to 2011.

However, it was the first time, I decided to offer completely fiduciary, fee only investment advice.

At that time, there was not a single platform to invest in direct plans of all mutual funds. One had to go to each and every mutual fund website to make a transaction or at best use one of the 4 registrars. This was very inconvenient for the investor.

That was a time when we saw the gap and decided to build a platform where an investor could invest in direct plans of mutual funds all in one place. Unovest was thus born.

To begin with, we put up a single page site and announced. It was very well received by investors and the community. Back then, we were the first ones to announce such a thing.

In a matter of days, there were more than 600 signups wanting to know when the platform launched. That was quite a Eureka.

We started to build Unovest.

Our vision is to build a single point platform that enables investors to not just think long term but actually helps them to put it into action. The elusive alpha is finally in the investors control.

How far have you come?

We launched in March 2016 and today Unovest has over 3600 registered users. There is a gradual, consistent growth primarily through word of mouth and referrals of committed users like you.

This is after a massive clean up of inactive accounts, something we keep doing regularly as a best practice.

Not to mention we have some awesome users and clients who have become personal friends and feel that they have a stake in Unovest. That in my view is the biggest success for Unovest and me.

What do we try to do differently?

The one thing is we don’t charge for online transactions in mutual funds at all. Investors can do unlimited transactions in direct plans of mutual funds for free on Unovest.

So, yes, as long as they don’t need Unovest advice or support, they can use it for FREE and do unlimited transactions.

Having said that, we also don’t receive any commissions. We charge a fee for advice. There are various options including do it yourself features, portfolio advice with support and personalised advisory services.

One of the best things at Unovest is that you can upload their existing mutual portfolio in a simple 2-step process. You can then start investing in direct plans right from there.

Not just that, you can see a variety of reports and analysis, which can help you take the right decisions either by themselves or with the support of an advisor.

How does Unovest service work? What is the experience path of the user?

Unovest is a content driven initiative. One thing to be noted is that anyone looking to prepare oneself as an serious long term investor can rely upon our free content delivered via blog articles, eGuides and courses.

Subsequently, as you become ready to invest, you can sign up for a free account on Unovest (smart.unovest.co) platform.

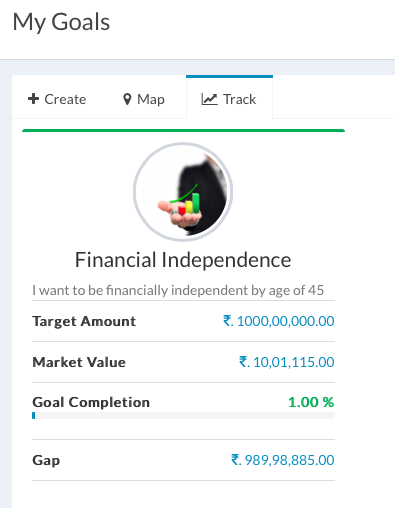

You can also upload your existing mutual fund portfolio and view quick actionable reports and analysis. You can map the investments to the various financial goals and track progress of those goals.

You can further know the current portfolio composition, allocations and portfolio returns in an instant.

For tax purposes, the capital gain/loss report comes in handy.

Even investing is a simple process. After you input your CAN or Common Account Number on Unovest, you can start transacting in direct plans of mutual funds. Direct plans are no-commission plans and coupled with the right advice about which funds to invest in, can provide an instant boost to portfolio returns.

You can do transactions in your existing investment folios as well as buy absolutely new funds as one time or SIP too.

With a premium account, you can get family portfolio tracking, unparalleled support as also portfolio insights to find answers to the following questions:

- How are my investments doing?

- Have I chosen the right funds? Am I diversified enough?

- Do I need to make changes to my portfolio, if any?

- How likely am I to meet my goals?

- Have I been investing consistently?

With our handpicked and ready model portfolios, you can choose to invest for various investment periods matching your risk tolerance.

As a step further, you can also go for personalised advisory services, where a dedicated advisor understands the complete profile and helps build a plan that can be actioned to achieve specified goals. There is unlimited one-to-one support and advice with personalised services.

Not just that, do it yourself investors who are interested to take the guesswork out of investment decisions and build up their own investment quotient can take up our premium online course – Money Master.

What does Unovest stand for and what are the future plans?

Unovest is here to help investors think long term and generate behavioural alpha for them. Most investors miss out on this and it can make a significant difference to their returns and how fast they reach their financial goals.

We want to use a mix of content, data, technology and human advisory to enable the investor to achieve this alpha.

Visual tools using past data and future investor requirements can help identify the right action points across an investor’s financial life.

Currently, we are offering only mutual funds for transactions. We would like to add other investment instruments too.

We hope to make good investing a habit for the investor. This simple step can bring additional returns and, not to forget, peace of mind.

Let me reaffirm that we can’t do any of this without you and your support. To be short and precise, Unovest exists for you and because of you.

Do you feel Unovest is on the right path? How do you see the Unovest story unfolding? Do share your thoughts, feedback and suggestions.

Vipin – I am perhaps an early bird to use your service. I really like it and wish your website all the success and longevity that it deserves

Regarding the free service – i would hate the see the quality of free service drop. Frankly speaking, I would be willing to pay a small annual fee to be able to use your service, analysis and customer support. As you don’t charge for it, I actually subscribed to a small service of yours which I do not use – because I felt I was cheating if I did not pay for the quality service I get

There are various ways to grow your outreach. Your platform is so good, that you should think of partnering with some other MF sites that offer complimentary services. I am sure you will find a lot of suitors who would be interested

Wish you all success

Thank you Mr Arora. Indeed you are one of the earliest users and I appreciate your feedback. Glad to have you as a witness through the journey so far and further too.

Thanks once again.

Dear Vipin,

Firstly congratulations on getting covered by Yourstory!! This is well-deserved coverage of person who has tirelessly spent so much of time & energy in building Unovest as well as bringing personal finance awareness.

I have been following Unovest since mid 2016 more as occasional user but also on & off usage of the Portfolio Analysis. But recently have started it for transactions and did I say “it is breeze compared to MFU online”.

The features which you have provided even to Free user are quite top-notch and they serve full purpose. It is delight to learn that you have not tried to hide behind fine-prints and limit the usage of features…the way most other platforms are working today wherein they claim free use but with caveats / constant nagging to subscribe to paid plans.

The article has been an interesting read and was good to know the underlying philisopy to correct “behavioral alpha”.

Kudos for all the good work and wish all the very best. As an active user of Unovest I look forward to more updates / enhancements / blog articles.

Dear Gagan, Thanks for this encouraging response. It is nothing less than an award. And yes ‘behavioural alpha’ is the thing.

Thank you again.

Dear Vipin,

First, thank you very much. You, truly, are an honest professional. Hard to find these days (or perhaps in any days).

The premium service is worth every paisa for the simple fact that the users can select one of your hand picked mutual funds depending on their risk appetite. This beats every robo out there.

But after having subscribed, I realise the superlative support that you folks provide can not be matched as well. Never change this about Unovest.

Lastly, not only am I looking forward to continue with accessing your MF portfolios for the next 40 or 50 years (I’m still waiting on a small cap rec in the aggressive 10+ one), I sincerely hope you reach your million premium users target.

All the very best to your team!

Dear Srikanth,

Can’t thank you enough. You drive me to be better and do more with less.

Thanks for being around and the support.

Cheers

Dear Sir,

I just came to know you also provide direct plans.

I have invested through paisabazaar

and they have provided me director growth plans too.

I am little in confusion.

I have done any mistake.

Whether there is any hidden charges there.

do you know anything about it?

could you guide me what should I do now?

They have suggested to invest in 8 different elss funds each with 15000/-

please reply

Dear Binod

There are no commissions paid out in direct plans. However, if paisabazar is charging you any fee, I have no idea. As for the no. of funds, that’s too much to add. One ELSS fund is good enough.