With the recent announcement of a long term capital gains tax on Mutual funds, investors have been looking at alternatives to make their investments. An older debate that has surface again is that if it makes sense to invest in NPS. Really?

So, my friend called me again on the weekend.

“Hey Vipin, couple of years ago you had said that Mutual funds, even after paying taxes, are better than NPS. Of course, they were also tax free then. Now that there is a LTCG of 10%, do you want to revise your view?”

He was referring to the additional deduction of Rs. 50,000 from your taxable income if you invest in NPS (Section 80 CCD(1) or the National Pension Scheme.

I wasn’t particularly enthused about the change (didn’t make a difference). But the thought stayed with me. After some dilly dallying, I decided to take a shot at the numbers. Remember, we are primarily talking tax here.

Here’s what I did.

NPS or My own portfolio

For our working purpose, we assume that a 30 year old starts investing in NPS to take the tax benefit on investment of Rs. 50,000 per year. He does that till the next 30 years, that is, till he turns 60 and retires.

On the other hand is ‘me’, a younger me at age 30. I decide to skip NPS, pay my tax on the Rs. 50,000 and invest that money with my own preference. Let’s assume that I do that too for the next 30 years.

Now, I could be in the 10% (currently 5%), 20% or 30% tax bracket and accordingly the amount available to invest with me is going to be lower than Rs. 50,000, because I pay the taxes.

When I invest my own money, my preferred allocation is 80:20 in equity:debt. In contrast, the maximum equity exposure in NPS is 50%.

No bias here. NPS has its limitations and doesn’t allow me to invest as per my allocation.

As a result, the expected weighted return from my own portfolio is 11% while from NPS, the expected returns will be 9.5%. We are not taking into account any deft management skills here but purely index investing ( for equity as well as debt). No alpha only market returns.

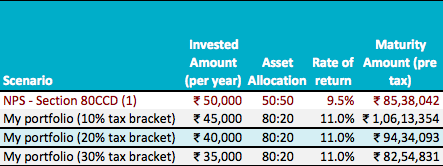

Here’s a summary of the assumptions:

- The amount of investment in my own portfolio is based on my tax bracket. So, we work with 3 scenarios.

- I pay taxes and build my own portfolio with 80:20 allocation to equity:debt.

- The weighted return of such a portfolio is expected to be 11%.

- You invest Rs. 50,000 in NPS every year for 30 years. Maximum allocation to equity is 50%, as per current rules.

Basis the above assumptions, after 30 years of investing, this is what the final corpus of NPS and My portfolio look like.

As you can see, there are 3 scenarios for my portfolio based on the tax brackets. You can pick a scenario that is applicable to you.

Lower my tax bracket, higher the investment I am able to make, higher the maturity amount at age 60. The maturity amount is before tax.

So far, so good.

The fun part starts now.

Let’s effect the curse of taxes on the portfolios

So, I am at age 60 and I now know the current values of my portfolio, NPS and personal. What happens now?

You know the rules for NPS.

- You can withdraw 40% of the NPS corpus as tax free lumpsum.

- You can withdraw another 20% money as lumpsum, after paying tax as per tax bracket.

- You have to cumpulsory buy an annuity with the remaining 40% of the money. It means that you will receive an annual fixed income for the period of annuity.

Again, for the sake of simplicity and understanding, let’s assume that you take out 40% of the lumpsum money today, tax free and buy an annuity with the remaining 60% for 30 years, that is, till age 90.

This annuity income is calculated at 7% interest and does not provide any return of the original investment or principal. So, you get an annuity income till age 90, nothing beyond that.

When you receive an annuity, you also have to pay taxes as per your tax bracket. You can be in a 10%, 20% or 30% tax bracket.

As for my portfolio, the investments will mostly be in index mutual funds. The new capital gains tax rule says that if I sell my equity funds after 1 year of purchase, I have to pay a 10% tax on long term capital gains of more than Rs. 1 lakh. The Rs. 1 lakh exemption limit is for each financial year.

To take the benefit of this rule, I divide my entire corpus into 30 buckets and I will withdraw 1 bucket each year (much like the annuity). I also assume that all the portfolio will be subject to the same 10% gain without indexation. This will result in higher taxes than usual. In reality, my tax will be lower.

So, I will get to use the Rs. 1 lakh benefit and also deduct the original investment in mutual fund for calculation of capital gains. At the end of 30 years, I will exhaust all the money, no principal left.

NPS vs My Portfolio – What do the numbers look like?

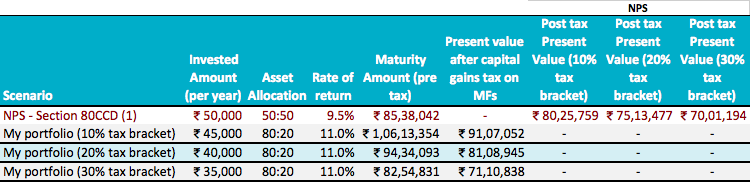

Here’s a table that summarises our discussion so far.

As you can see, based on the tax bracket you fall in, the investment in my portfolio changes. The 3 different rows represent my current 3 tax bracket scenarios.

Also, for NPS, since there will be annual tax liability post retirement based on the tax bracket, you can see 3 different columns for the 3 tax brackets. These are the post retirement tax brackets.

Since the annuity in NPS and withdrawals from my portfolio are cash flows in the future (over 30 years), I calculated their present value using a common rate of 7%. This keep the numbers comparable.

For the annuity, the 40% tax free lumpsum is added to the present value of the post tax annuity receipts.

What do the numbers say?

Purely from a numbers point of view, if you are in the 30% tax bracket now and hope to be in less than 30% tax bracket later, an NPS may make sense.

The numbers present no significant benefit of investing in NPS.

And I am not even taking into account the benefit of a better management of my own portfolio.

But is that the real reason for not investing in NPS?

As you can realise, tax savings was never my main reason to invest in NPS.

If lower tax is the only reason of making investments, I would rather take up agriculture and enjoy 100% tax free income.

The single biggest reason I don’t invest in NPS is its inflexibility.

With NPS, investments continue to remain behind bars for a lifetime – not just during the investment but also after. I have no choice but to live with the shoddy annuity product for a substantial part of the portfolio and over which I have no control. It feels like I will be on ration.

As an individual, that doesn’t work well with me. I continue to skip NPS.

What about you? I am happy to read your side of the argument.

Click here to read more of my thoughts on investing in NPS.

Note: You can take a return of principal option for annuity, but then you will get a lower annuity rate of say 5% and hence lower income every year.

In NPS, there is an auto allocation option, the aggressive mode of which has 75% allocation to equity till age 35, after which it reduces 4% every year. Even for this option, an average of 50:50 allocation works out to be a reasonable assumption.

Thanks Vipin for all information. Really it changes my mind again to not go with NPS.

Thanks for reading Tarun.

Hi Vipin,

This is very informative. but, would the asset allocation for your portfolio stay the same i.e. 80:20 for 30 yrs till retirement? Won’t the equity investment be reduced to take into consideration one’s age and time to retirement? if this is done, then am sure the portfolio value would be much lower as the return would be lower than 11 percent as assumed. I do agree that even the assumption of 11 percent is quite conservative but the quantum would still be lower with active allocation and lower equity holdings as one ages.

Thanks

Well, it will depend on the individual’s profile. For me, I don’t mind that asset allocation and prune it over the rest of the years. I don’t need all the money immediately. This has been factored in post retirement returns.

Is it like for LTCG apart from the invested amount , 1 lakh for each financial year can also be deducted from gains and then 10% tax is calculated? I didnt get your point on this. Can you clarify?

Thanks

Yes, every year when you sell, upto Rs. 1 lakhs is tax exempt and you pay 10% on the remaining realised gains. Remember capital gains tax is on the realised gains, that is, investments that you have sold and have a gain on.

Hi Vipin – I liked the way of your calculation but just a small correction. NPS has introduced Aggressive Auto Choice option which gives equity exposure upto 75% hence RoR of NPS will change from 9.5% to 10% or 10.25% which will make NPS proposition better for tax bracket of 20% or 30%…Thoughts??

Hi Kunal, I believe the auto allocation reduces over time, so it won’t remain the same as you are closer to retirement.

Indeed. But for equity as well, exposure should decrease as person is reaching near retirement. That’s the same philosophy applied by NPS

If a person chooses auto- aggressive mode in NPS, the equity- debt will be 75-25% till age 35 and changes 4% every year. In this way a higher allocation to equity can be maintained. There are also talks that this ratio will be introduced in manual choice going forward. So a person can be 75-25 in equity-debt till retirement once the changes are introduced. There is also possibility of tax laws tweaked to favour the NPS when the 30 year old retires in another 30 years and that would be a huge opportunity loss.

All that’s fine Sir. But you will still be locked in. 🙂

The key point to note here is your very conservative estimate of return on your actively managed equity of 11%. You should have added another one with a 13.5% (for 15% returns which is still reasonable in a decent multicap type of fund).

But overall, you’re right. The point still stands — your money is locked up, you’ve very little choice in where your equity can go, and a lousy annuity product after all that waiting that you’re forced to buy. Also, I didn’t know that NPS equity investments are in index funds. If that’s the case, this is a huge no (at least, for me and those who believe in actively managed funds thus far).

Yes, that low return argument has been stated. But for pure comparison sake have kept it similar for now.

NPS seems to be a decent default for individuals not interested in actively managing their investments and who let tax benefits dictate their choice of instrument. However, I too like you prefer having the flexibility of managing my investments / withdrawals over the slight gains NPS might offer in the 30% tax bracket.

Good to see you on this side 🙂

Hi Vipin,

Your articles are always a joy to read. I try to model the calculations that you do, make my excel better 🙂

I have noticed that =FV(11%,30,-35000) evaluates to Rs. 69,65,731 but in your case it is Rs. 82,54,831. How have you calculated maturity amount pre-tax?

Thanks Rajat. I am so glad you are asking this question. I have used monthly basis numbers to calculate. =(11%/12,360,-35000/12)

Since you mention it, you should check out: http://unovest.co/course/money-master/

There is a full section and more on improving excel skills.

Hope to see more of you around.

Dear Sir

In support of your views.

Refer your comment just before the second table, that you will divide the corpus into 30 buckets, withdraw 1 /year, and at the end of 30 yrs (age of 90) NO PRINCIPAL LEFT. However if You consume 1/30 of your corpus at 61st year than remaining 29 /30 continue to earn/ appreciate . At 62 year You consume 2 of 30, and the remaining 28 will continue to earn/ appreciate , so on and so forth. So probably at 100, YOU WILL LEAVE SOME CORPUS BEHIND.

Nice and informative article.

Hello Anand, thanks for the comment. I assume that the inflation will force me to withdraw the growth amount too every year.

But you may be right. There might be some corpus left.

Hi Vipin,

Very clearly explained article. Thank you for that. but my calculation doesn’t match with your numbers on MF after LTCG tax.

For example, in the 10% tax bracket case,

(a) Pre-tax Maturity on MFs = 1,06,13,354

(b) Investment = 45000*30 = 13,50,000

(c) Net gains = (a)-(b) = 92,63,354

(d) Gains After deduction of 1 lac = 91,63,354

(e) 10% Tax on (d) = 9,16,335

(f) Post tax maturity value on MFs with 10% tax bracket = (a) – (e) = 96,97,019

But your calculation shows as 91,07,052. Where did i go wrong in my calculation?

Thanks,

Senthil

Hello Senthil, Thanks for reading and the comment.

You are assuming that you are selling your funds at your retirement. I am doing it over the next 30 years. Accordingly, the burden of taxes shift to those years.

Hello Vipin,

Just to point out that regular churning (moving to different mutual funds)during accumulation phase of your retirement corpus will also attract LTCG and hence the calculated return over the 30 year term could be much lower than the assumed/expected 11% return.

Additionally, Mr. Jaitley have told that this 10% LTCG is also CONCESSIONAL in nature. That means that there is a possibility of increased LTCG rate in the future. Refer below quote

Quote :

“Capital gains in excess of 1 lakh arising on sale of listed shares or units of equity-oriented mutual funds held for over 12 months will be taxable at a CONCESSIONAL rate of 10% without indexation benefit.”

All these uncertainties are affecting retail investors like me who can forsee a huge negative impact on the planned RetirmentCorpus prior Budget 2018.

Could you please care to look into this and estimate an expected rate of return if one has to churn mutual funds at least once in 3 to 4 years ?

We are working with an index fund here Avinandan 🙂 (no active, no alpha, no churning) Ongoing rebalancing can be mostly taken care of by channelising the incremental investment accordingly.

Thanks.