In Part 1, we noted that SEBI has now defined 16 categories for debt mutual funds hoping that it will allow retail investors like you and me to be able to select debt mutual funds with more ease.

I believe the new classification will do the job to some extent. The number of funds (in open ended space) will reduce dramatically with more clarity on what’s offering what.

But 16 categories? I mean if even 40 (out of the 44) fund houses decide to launch a fund for each category, that is a total of 640 debt fund schemes. So, good luck!

How can we make it a bit easier to select debt mutual funds?

This can be answered in 2 parts:

- Based on your purpose and time horizon, pick the relevant category.

- Apply additional parameters to select a fund within that category.

Let’s first take up the part of picking the relevant category.

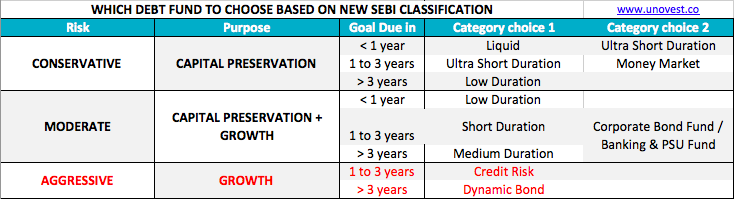

Frankly speaking, no investor needs 16 categories. In fact, the retail investor needs just about 2 or 3 of them. For reference, I made this matrix.

This matrix uses 2 factors – Purpose and Time horizon – to help you pick a category.

Purpose includes plain capital preservation, capital preservation with some growth and finally, just growth. With growth, the element of risk also comes in to influence the decision.

Time Horizon or the period in which the goal is due has 3 options: less than 1 year, 1 to 3 years and more than 3 years.

As you will notice, for capital preservation, an investor can use liquid, ultra short term, money market or low duration funds for various time horizons.

You are not taking on interest rate risk here at all.

Read Part 1 to understand the difference.

Next along with capital preservation you don’t mind some extra return. You are OK taking some risk. However, this will not be credit risk or a lower portfolio quality. So, you work with the interest rate risk (with low, short and medium duration) as well as some high quality corporate bonds / government bonds / PSU bonds, which have the potential to offer better returns.

Finally, there are some adventurous investors who want to use debt funds but expect high returns. They are not satisfied with capital preservation. Credit risk and interest rate risk both seem fine to them. That’s where the Growth section of the table comes in.

Please see carefully the Growth section in the matrix. The colour is RED. Hope that serves as an adequate warning.

10 things to know about debt mutual funds

So, now that you have your category based on purpose and time, how do you go about picking a specific fund?

First remember that when you invest in a debt mutual fund, you invest in a market linked investment. The portfolio is valued daily to arrive at a current price. Any market news including changes in interest rates affect the price or the NAV of the fund.

FYI, there is an inverse relationship between price of a market traded bond / debt fund and the interest rates.

Here are some specific parameters that can help you narrow your shortlist.

Important parameters to select debt mutual funds

- Expense Ratio – Debt funds are not equity. Good debt funds keep their expenses low so that investors can get the maximum benefit. A high expense debt fund will leave you with very little. So, pay attention to this very critical factor.

- Fund size – Size has an important role to play. A large size fund can withstand any adverse movements in its investment portfolio (for example an investment turning bad or unrecoverable). It can also participate in various investment opportunities available in the market where a minimum size restriction applies. Ideally, consider a fund with at least Rs. 100 crores in assets. More the better. A larger size also allows the fund to bring down its expense ratio.

- Portfolio Quality – This specifically refers to the credit quality of the portfolio. You are better off choosing a significant allocation to top rated instruments (Sovereign, AAA, AA, etc.) Good credit quality ensures that your fund scheme is safer. This may reduce the returns a bit but a little greed can destroy a kingdom.

- Investing strategy – Debt funds tend to work with 2 predominant investing strategies. One is accrual, where they intend to hold an investment and earn the interest and receive the principal back. The other is duration management. Here the fund manager understands the interest rate environment and then positions the portfolio to benefit from changes in interest rates. This enables him/her to generate capital gains. (In the last couple of years, many funds including hybrid funds were working with this strategy. As interest rates fell, the value of their portfolio went up thus clocking significant capital gains. No room left now.) However, it is easy to go wrong on this subject and hence you are better off working with the safer accrual strategy. Basically, focus on capital preservation. That’s what you FDs do for you, right! The scheme information document is where you an locate information about the investing strategy. Remember the greed and kingdom statement.

- Track record – Take a magnifying glass and go looking for any wrongdoing by a scheme. Investing in rogue companies, setting inflated expectations, too many write offs, etc are red signals. A fund house and a scheme with a track record of managing money, without taking undue risks, is very important.

All this is fine. What about specific fund scheme names?

Well, here starts the new problem. Several funds will now undergo changes to adhere to the new SEBI category classification. We even expect some schemes to get merged into the schemes too. So, we will let this settle for a while and then start reading the updated schemes on offer to find out which ones deserve your money.

In the meanwhile, to select debt mutual funds, Unovest recommended schemes and portfolios is your answer.

Leave a Reply