One of the key outcomes driving investor behaviour is “how to reduce taxes”. It is an obsession. Now, how many of you know that the Income Tax department itself gives you ways to reduce your taxes on certain capital gains. Let us see how.

For starters, when you sell assets such as equity, mutual funds, gold or real estate, you realise capital gains/losses.

Except for stocks and equity mutual funds, all other assets are allowed the benefit of indexing the cost. Simply, it means that you are allowed to increase the cost of the purchase of the asset broadly in line with the inflation.

The applicable rate of tax is 20% on post indexation gains. If that sounds like a lot to you, just wait before we take up an example.

Note: For availing the benefit of indexation while calculating long term capital gains, you have to hold real estate for minimum 2 years, Gold and Debt mutual funds for at least 3 years.

To make matters simpler, the Income Tax department publishes an annual index value to help you do this job fairly quickly.

So, let’s work with an example.

Calculating indexation and capital gains for a real estate investment

Suppose I bought an apartment in June 2013 for Rs. 40 lakhs. I sold it in Sept 2017 for Rs. 52 lakhs. My question is what is my capital gains and how much tax do I have to pay?

Here’s how we go step by step.

First I have to index the cost of my purchase.

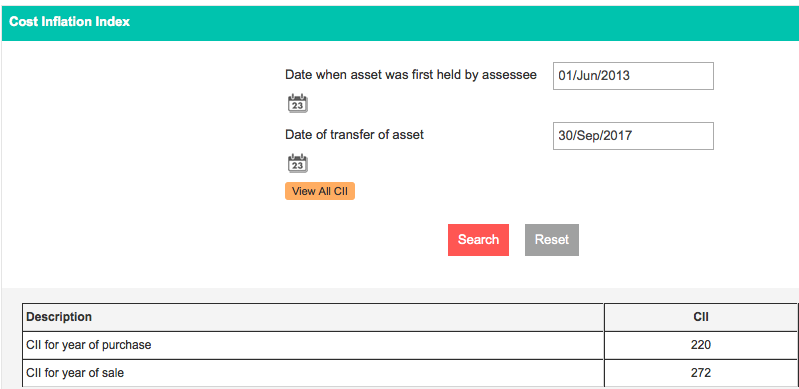

To do this, I go to the Income tax department website on this link.

There I enter my date of buy and sell and it shows me the Cost Inflation Index or CII applicable to the respective years.

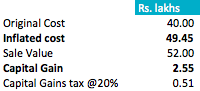

In the specific example, after applying the CII, my new inflated cost is Rs. 49.45 lakhs. I divide 40 lakh by 220 (CII of the buy year) and multiply by the 272 (CII of sell year) and thus get this revised cost.

Now, my capital gain is not Rs. 12 lakhs (Rs. 52 lakhs – Rs. 40 lakhs).

The taxable capital gain is Rs. 2.55 lakhs (Rs. 52 lakhs – Rs. 49.45 lakhs).

On this I pay a tax @20%. This tax turns out to be 0.51 lakhs.

Even though the appreciation in the asset was Rs. 12 lakhs, by allowing for increased cost benefit, your taxes reduced dramatically.

Now, let’s discuss the topic of double indexation.

Using Double Indexation to reduce taxes

You probably have read this phrase in advertisements of Fixed Maturity Plans (FMPs) of mutual funds. FMPs are debt funds with a lock in and are structured in a way that you get to take benefit of 3 indexations over 4 financial years.

For example, Best Mutual Fund has launched a 1136 Days Best FMP. The date of allotment is June 8, 2017 and the date of maturity is July 17, 2020.

As you realise, the year of buy in this case is 2017-18 and the year of sell is 2020-21. In a series, it looks like this:

- 2017-18

- 2018-19

- 2019-20

- 2020-21

While you will be invested for roughly 3.11 years (1136 days), you can take indexation benefit of 4 financial years, courtesy the years over which the buy and sell happens.

We now know the CII for 2017-18 is 272.

Assuming that the CII will grow at average inflation rate of 5%, the expected future value of the CII in 2020-21 will be 331.

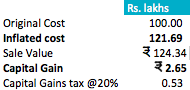

If you had invested Rs. 100 in the Best FMP, in 1136 days, you will get a value of Rs. 124.34, assuming a growth of 7% per year.

The inflated cost though will be Rs. 121.69 (100 * (331 / 272)).

The capital gain is Rs. 2.65 and your tax on this at 20% is Rs. 0.53 or 53 paisa.

If you had invested Rs. 1 lakh, then this tax would be Rs. 530 on a total gain of Rs. 24,340.

Isn’t that wonderful?

How do you see this benefit to reduce your taxes? Do share your comments and feedback.

Wow..that’s an eye opener..Thanks for sharing Vipin

Thanks for reading!