As the tax season races fast to closure, one of the key tools that should focus on is a life insurance cover. Interestingly, the premium on a life insurance cover not only saves you taxes but also provides a solid low cost foundation for your financial plan.

It has been said enough times by enough people. A life insurance cover for your financial dependents is one of the first things that should enter your financial life.

Unfortunately, most individuals still think of insurance as investment and not as a risk protection tool. A big mistake.

At other times, we tend to rely on simple rules of thumb, which are fine but if you have access to a better method why not.

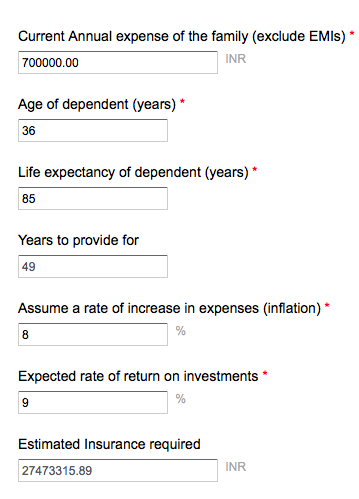

So, today I am sharing with you the life insurance calculator from Unovest that uses a very simple method to help you figure out the cover that you need for your family.

It is called the Expense and Liability replacement approach.

In case something were to happen to you, how will your dependents pay off the loans and be able to maintain their day to day living along with providing for the future goals.

The calculator also allows you to specify

- any current loans you have

- value of current investments

- any existing insurance cover

Here’s a partial snapshot.

So, no more delay.

Click here to start using the calculator and find out the amount of insurance you need.

And remember, a low cost term plan is the best way to go for a life insurance cover.

Save your taxes through the premium and protect your dependents too.

All the best!

In case you haven’t signed up for Investing 101 series, here is the link to the article that gives out the details.

Leave a Reply