Do you know which is the largest mutual fund scheme in India? No, it is not an equity fund, not even a debt fund. The largest scheme by size is HDFC Prudence – a hybrid equity fund. And it is not alone in the largest funds for this category. There is HDFC Balanced, ICICI Pru Balanced, and SBI Magnum Balanced Fund to give it company.

The lure of the balanced fund is quite well known. But this year, it has been taken to a whole new level.

Most first time investors in 2017 have invested via Balanced Mutual Funds. The FD investors who were disappointed with falling interest rates were looking for newer avenues to park their money. Then there was the push of savings from informal to formal (cash to bank) economy.

The investors had few options. Since these were first time investors, the AMCs got their distributors to pitch the ‘returns+low risk’ combo of balanced funds. On top of that, there is the 1% monthly dividend bait that most investors (new as well as old) too fell for.

If SEBI’s new categorisation rules are taken into account, most of these ‘balanced’ funds will be known as Aggressive Hybrid Equity Funds.

Investors came in hordes with their money. One of the big beneficiaries of this momentum has been the SBI Magnum Balanced Fund, which is probably the third largest hybrid fund now.

The fund has grown from Rs. 4,000 crore in size in April 2016 to Rs. 10,000 crore in April 2017 and now at Rs. 18,000 crores. That is a 2.5 times in one year and then another 80% rise in just last 8 months.

What’s happening? Are investors going blind?

Let’s look at some details of the fund.

Investment objective

As any other hybrid fund, it states:

To provide investors long term capital appreciation along with the liquidity of an open-ended scheme by investing in a mix of debt and equity. The scheme will invest in a diversified portfolio of equities of high growth companies and balance the risk through investing the rest in a relatively safe portfolio of debt.

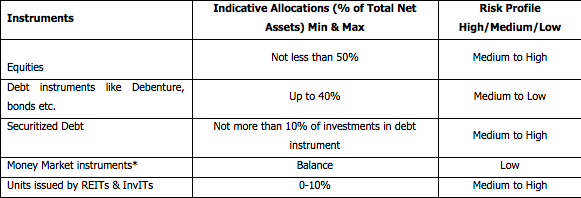

This clearly reflects in the desired Asset Allocation stated in its Scheme Information Document.

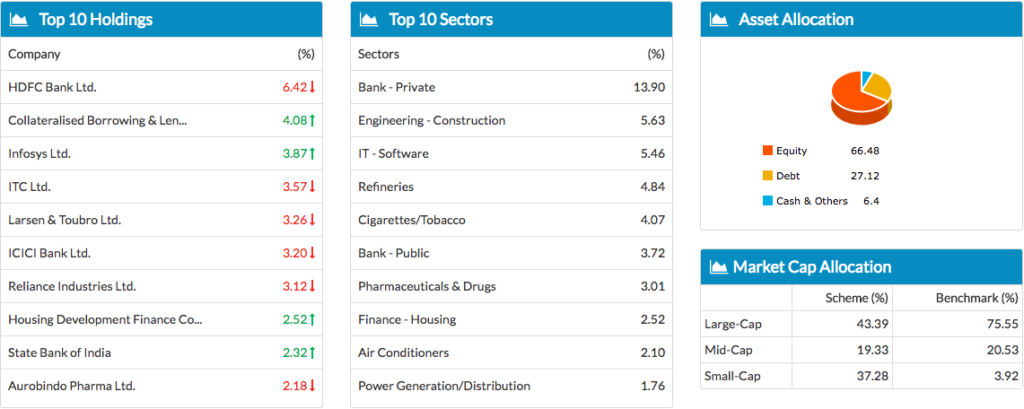

How does it reflect in its actual portfolio?

As you can observe, the equity portion of SBI Magnum Balanced Fund resembles a multicap fund with allocation across the market cap. In fact, there is larger mid and small cap allocation making it an aggressive fund.

The performance is out there in public for all to see and is one of the reasons for attracting all the money into its folds. No one is complaining for now!

So, what’s so special about SBI Magnum Balanced fund?

Prima facie, nothing. It is blessed with the largest branch network of its parent SBI and the trust of millions of customers of the bank. (An elderly person tells me that she wants to deal with SBI for investing because she feels her money is safe there.)

Unfortunately, this trust comes at a huge cost.

The Cost of Trust – Expense Ratio

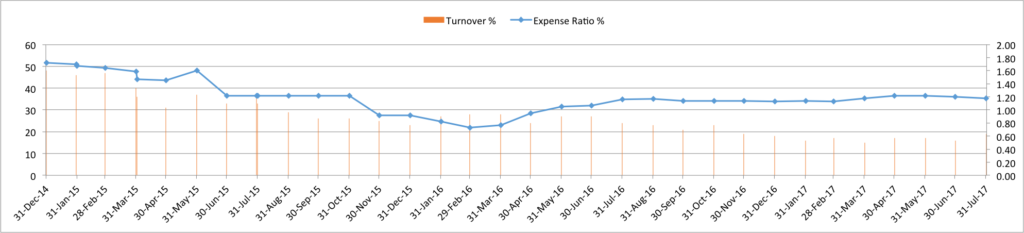

At Rs. 4,000 crores of size in March 2016, this fund was charging 0.76% expenses, today with Rs. 18,000 crores, it is charging 1.23% in the direct plan and close to 2% in regular plan.

I specifically mention regular plan because that is what the bank, as the distributor of the fund, is pushing to you.

Source: Unovest Research, Factsheets, From Dec 2014 to July 2017, Direct plans only

As you can see, as the fund’s assets went up, it increased its expenses too.

While the AMC is free to charge what it wants, what makes the managers feel they deserve this high an expense ratio. In fact, if you look at similar funds in the industry, they charge much less.

Just look at HDFC Balanced Fund, a fund with a similar allocation and profile but expenses at 0.82% (as of Nov 2017, direct plan).

Market vs Skill

Any of the investors worth their salt agrees that the current market rally, this bull run, is a result of liquidity provided by SIPs, NPS, EPF, Life Insurance companies, etc.

Even the dumbest funds are witnessing a lift in what Warren Buffet said famously, “a rising tide lifts all boats.”

A large proportion of mid and small caps in the portfolio of the SBI fund have brought gains from the market driven rally. No particular skill matter at this time except risk management.

The question is what makes the fund manager deserve this additional charge on investors money? I don’t feel entirely sure.

One thing is clear, the AMC is using this unhinged bull market to build its own profits. The investor doesn’t understand this and is under a false belief that high returns are a result of skill.

I believe with AUM growing multi fold, the expenses should ideally go much below 1%.

But then, I go back to the title – investors are blinded by the trust and are paying a high price for it.

What do you think?

Investor is only looking at the performance of the fund, never look at ER, Process of Fund, Mandate of Scheme – whether following or not.

Regarding allocation across the market cap is arbitrary choice of Fund manager even for Multicap/ Balanced fund.

If we need to manage on our own, only choice is we have to select a one large cap and one mid cap fund with allocation of our choice (say 70:30) to keep stable portfolio. What do you say.

Well, we do get a sense of the way allocations are made with some true to label funds. Which we can then use to allocate in the portfolio.

Not just these guys. Even PPFAS’ Parag Parikh Long Term Value fund, the same fund house that seems to align themselves with the principles of proper value investing, etc., is charging an expense ratio of 1.99% for the direct plan. I don’t know what explains that. Quantum with the same kind of AUM is charging reasonably.

Yes Valid point, Why PPFAS charging more ER for the managing a smaller AUM compare to other big AMCs.