You believe active investing is overdone. That fund managers are overrated. They use ill-structured index benchmarks to show alpha where none exists. In the garb of this false alpha, they rip investors off with the exorbitant fees. For you, index funds and ETFs are the God’s gift to investors and his Avatar is none other than John Bogle, Founder of Vanguard.

Fair enough! I only have good news for you. An investing opportunity which is not so popular with investors yet and that’s why it deserves the space here today. Heard of Nifty Next 50 index?

I am sure you are aware of the Nifty 50 index, one of the most tracked market indices. Nifty 50 comprises of some of the largest, most liquid bluechips in the entire stock market. The selection to this index is subject to various criteria. One of the key criteria is the free float market capitalisation or the number of shares publicly available to buy and sell (and not locked in with promoters, etc.).

Then there is another index, which again you might not have heard but can relate to. It is the Nifty 100 index. Same criteria as Nifty 50 but applied to the top 100 companies.

Now, what if you take away the Nifty 50 from Nifty 100?

You are left with 50 stocks and an index called the Nifty Next 50, also known as the Junior Nifty.

Think of it as group of companies that are not the largest but large enough. They are not there yet but getting there. Some or many of these will go to become a part of the Nifty 50 at some point in time.

The Nifty Next 50 is a sweet spot for investors.

This is a motley group of companies across sectors, most of them fairly large along with a sprinkling of mid cap companies.

In contrast, Nifty 50 is all large cap, in fact it comprises of the Giant companies in the economy.

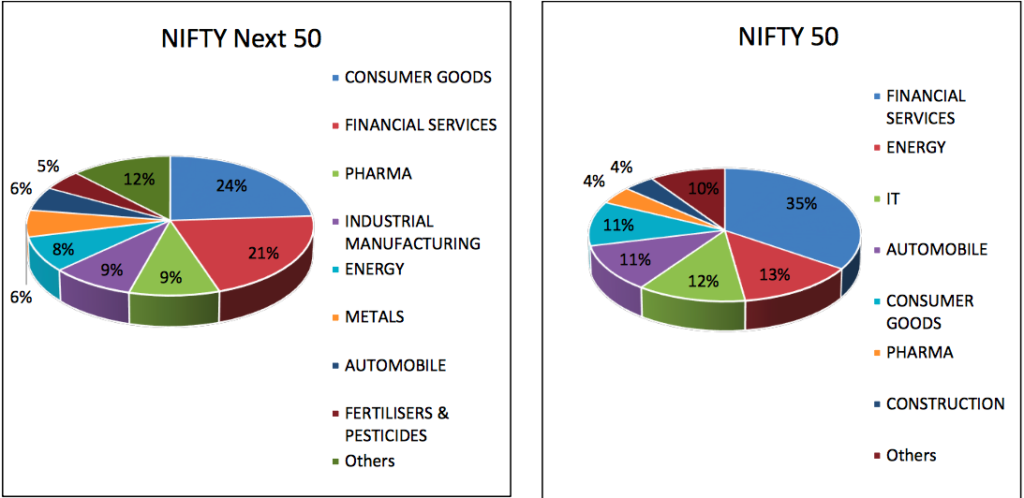

Not just that, Nifty Next 50 as a portfolio structure is quite different from Nifty 50.

Here are a few facts for you to understand this better.

Source: NSE white paper; Sector weightage as of May 2017.

In terms of sectoral composition, Nifty Next 50 is a highly diversified index.

As mentioned before, it is a mix of fairly large, large and not so large companies. The size of the largest company as per the above cited white paper from NSE is about Rs. 32,000 crores. This is quite likely to be the smallest company in Nifty 50.

As per our own workings at Unovest, out of 500 companies 85 companies make up for 70% of the market capitalisation. Next 20% is with about 200+ companies. The rest 10% with the others. You get the perspective.

Even the average weightage to a stock in the Nifty Next 50 index is less than 5% with an average weightage of the Top 10 holdings at about 3%.

For investors who believe in the passive style, Nifty Next 50 offers the best possible opportunity, without the fund manager risk and exorbitant expenses.

How can you invest in Nifty Next 50?

You can invest through an index fund or an exchange traded fund (ETF). The investment objective of such funds is to replicate the index to the maximum extent possible, that is to invest in the same stocks, in the same ratio as the index holds.

Please note the job of an index fund is not to outperform the underlying index. They just copy it and make periodic adjustments to mirror the index.

Read more: Active vs Passive Investing – a primer

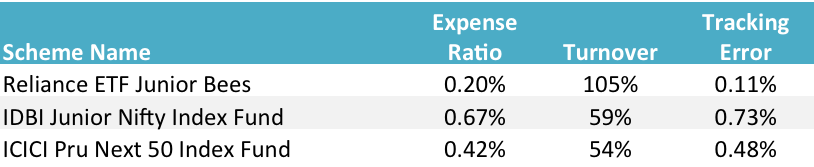

Here are a few options to invest in the Nifty Next 50.

Source: Fund factsheets for Nov 2017 for direct plans

SBI and UTI are others with ETF offerings based on the Nifty Next 50 index.

Tracking error is the margin of underperformance of an index fund from the actual index. There are 2 big reasons for error or gap. One is the expenses of the index fund. The other reason is that the index fund doesn’t invest 100% of its money in tracking the index. It maintains some of its holdings in cash to deal with short term requirements.

For reference, the lower the tracking error the better it is.

You are not really spoilt for choice but there are quite a few to pick and choose. Amongst the choices, Reliance ETF Junior Bees stands out with a lowest expense ratio and lowest tracking error.

Note: To buy an ETF, you need a demat account.

How do the Nifty Next 50 index funds compare to actively managed funds?

Good question and an obvious one too.

Frankly, given the way markets are running up and resultant gains to the investors in active funds, this is probably a bad time to even talk about an index / passively managed fund, but I took a chance. It has turned out to be a discovery.

As for performance, a comparison would make sense right?

With the multi cap fund varieties of the same fund house?

Let’s do it.

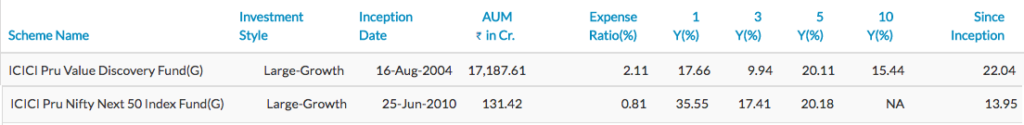

First off, ICICI Pru Next 50 Index Fund vs ICICI Pru Value Discovery Fund

Up next is Reliance ETF Junior Bees vs Reliance Equity Opportunities Fund.

Source: Unovest; Regular plans data is used for longer period comparison.

The numbers say it all, I guess.

What’s your view? Where would you invest your money? An actively managed multi cap fund or the Nifty Next 50 index fund / ETF. I look forward to your views.

Note: None of the above is investment advice. I do not hold any of the funds mentioned in this post.

Wonderfully written article Vipin. I can relate more to it since I’m invested in this index fund for some time. The comparison with ICICI Discovery Fund and Reliance Equity Opportunity Fund is even more interesting and validates my faith of putting my investments in Nifty Next 50 Index Fund. The only thing I could not understand is the difference in turnover between the three funds mentioned. 105% turnover in Reliance Junior BEES seems to be on the higher side considering that it’s a passively managed mirroring the actual index.

Hi Vipin

The 105% turnover is only for the recent month. In previous months, it is in line with the other funds. It is quite possible that someone approached the fund directly for new UNIT CREATION. It is further proven from the fact that the AUM of Junior Bees has jumped from Rs. 38 crores in May 2017 to 223.51 crores as of Nov 2017. Now since turnover is calculated by using higher of the buy or sell figure in the last 12 months and divided by the average AUM, the result is what you see.

Hope this helps.

Thanks for awesome article! In additional to lower expenses and fund manager risk, I think index funds have other advantages:

– Less time spent agonising over which fund to invest in. One of the main reasons to invest in an MF rather than stocks is that investing in MFs saves time, but with 100s of actively managed funds, selecting a fund can be frustrating. Index funds keep things simple.

– It could generate behavioural alpha. It’s not easy to decide when to exit an actively managed fund. There’s always a temptation to switch to the fund that gave the highest returns in the recent past. This, I think, is easier to resist if one is investing in an index fund.

Based on the expense ratio, it looks like Reliance Nifty Junior ETF is better than the index funds, but how are the trading volumes? How much of a premium does one end up paying because of the lack of liquidity of the ETF? Additionally, ETFs do not have SIP as an option, which makes them less convenient. Given all this, would you recommend an index fund or is the ETF still better?

All valid points Sagar. I love the ‘behavioural alpha’ aspect.

As for ETF vs Index Fund, I think to each, his/her own. I would opt for an index fund.

Just curios, How many funds are using Nifty Next 50 as base index .

If you consider the downside protection (how much the funds fell when the index fell), then many active funds have performed reasonably well . Its my view.

Vandhi

Just 4 funds use it, all index/ETFs from ICICI, SBI, UTI, Reliance. There is no question of downside protection in case of an index fund.

Eye opening article, Vipin. I follow you like Eklavya did to Drona; just that I am not even a tenth as good as Eklavya

You are very generous Vineet. Thank you! Don’t underestimate yourself. 🙂

He’s the best, isn’t he?

Awesome post, as always. I’m seriously looking forward to the day where we can invest in an index fund and get on with our lives. May be another 15 years away? Who knows. The future either arrives too fast or too slow, never on time. I’ve been waiting for the aliens since I’ve known myself, trust me on this. So the future of index funds could be either 10 years or never in our lives.

Fun side, I’m really impressed seeing the TRI of junior nifty. And the Reliance fund has been pretty good at replicating the index, they’ve even shown the comparison of their fund against the TRI here: https://www.reliancemutual.com/FundsAndPerformance/Pages/Rshares-Junior-BeES.aspx

Most funds don’t. I’d say SEBI should enforce comparison against TRI index only for growth option (or at least sites like Value Research should show it for comparison). That will give the true picture of many funds versus the index.

Unovest should take a clue ????

Thanks Srikanth. Generosity should be your second name. The best statement I read today is “The future either arrives too fast or too slow, never on time.” I believe we will reach there sooner than later. Pure Large cap funds are already feeling stifled. With SEBIs new categorisation, there can be further pressure.

Some fund houses have now started following TRI. Quantum was the first one and has been doing that since inception for its equity fund.

You are right that all funds should use TRI for correct comparison and Unovest is completely aligned to it. Read our previous notes on this topic here – http://unovest.co/2017/01/passive-index-funds-comparison/ .

Cheers

Thanks for the link, not surprised you’ve covered that topic as well ☺️. Nice tip there to compare against index funds as they take expenses in to account.

I should dig more in to Unovest SIP growth comparison chart. I might have a couple of minor feature requests there.

Sure Srikanth. Do share your feedback. Lots more to do.

Even though returns of passively managed funds over 1,3,5 years are better than actively managed counter parts, why is the return since inception of passively managed funds is less than actively managed funds?

Because, there was higher outperformance in those earlier years. The gap is reducing only now and in some cases ETFs are doing better.

Hi Vipin

Very good analysis. Agree that Nifty Next Fifty funds certainly deserve a place in most investor’s portfolio.

Cheers

This has been the most eye opener post I read in the recent times on any Index fund/ETF story, I am really looking up for index/etfs, The future belongs to them, I am really fed up paying through the nose for pathetic gains in the active side and I also worry if the fund manager will retire/go to the next fund shop, too many uncertainties. Would rather punt my money on Index(NN50) and N50

Thanks for the comment Sujata. “Punt!”

Any extreme emotion may not be good for an investor.

Index funds are one of the safest ways for new investors to invest in stock market if they don’t want to go with mutual funds. I knew about Nifty next 50 index but never had analysed it deeply. I really enjoyed your article and found it very useful. Thanks for sharing this article vipin 🙂

Good to have your comment Sparsh.

NIFTY NEXT 50 | JUNIORBEES are arguably some of the most coveted ETFs in the market. Historically, NIFTY has tracked companies that were believed to be quite stable, which is why these stocks were perceived as the ideal ones to buy and hold. They were even consequently marketed as “one-decision” stocks, implying that investors can literally buy them and keep them for large durations while their value grows. This perception also stems from the fact that such companies are known for showcasing not only a continual earnings growth but also high P/E ratios, attracting investors from both, the active and passive investment groups.

As a result, the term NIFTY 50 has become synonymous with great wealth creation, however, it pays to know that ETFs that track these companies do fall under moderate risk and high-risk categories, depending on the way the funds are structured. Within the Indian context, when you invest in NIFTY 50, your funds are spread across a range of sectors like information technology, energy, financial services, media, entertainment, pharmaceuticals, and more… Within this vein, the NIFTY NEXT 50 ETF has surged in popularity amongst investors as it invests in companies that are believed to be the next top 50 companies in India, following the ones already tracked by NIFTY 50.

Awesome article! The information will undoubtedly help many investors make their investment decisions. It is very difficult for a beginner investor to select the best stock to maximize the returns. Thank you for helping new-age investors like me.

Just started my stock market journey through Kotak Securities app. I didn’t even knew what is nifty 50 stocks. But this article guided me in very much basic language.

Now I can figure out best stock for me and filter them according to my budget.