Mirae Asset Emerging Bluechip Fund is yet another sought after fund by mutual fund investors. As the name suggests, it is a midcap fund as most investors believe it to be. The question is if it really is a true blue midcap fund? This post finds it out.

To begin with, let’s understand what the fund has set out to do.

The Mirae Asset Emerging Bluechip Fund was started in July 2010 with a mandate to invest in stocks that can be “winners of tomorrow.” To put in other words, it aims to invest in mid size companies with the potential to grow their businesses and hence the return to shareholders.

In its investment objective, the fund states:

To generate income and capital appreciation from a diversified portfolio predominantly investing in Indian equities and equity related securities of companies which are not part of the top 100 stocks by market capitalisation and have market capitalisation of at least Rs.100 Crores at the time of investment. From time to time, the fund manager may also seek participation in other Indian equity and equity related securities to achieve optimal Portfolio construction.

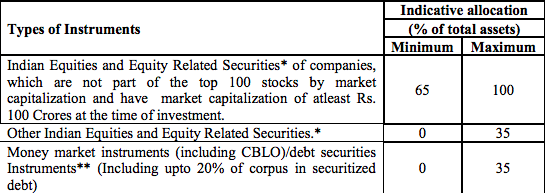

To understand this better, let’s also look at the defined asset allocation pattern of this fund.

Source: Scheme Information Document

Put together, it means that Mirae Asset Emerging Bluechip Fund will invest 35% of its money in the top 100 stocks and the remaining 65% outside of the Top 100.

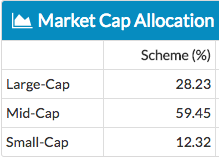

To its credit, the fund has stuck to this mandate. Even in its most recent factsheet, the allocation to the Top 100 stocks and others is roughly in the ratio of 35:65.

Source: Unovest

Source: Unovest

With this definition, Mirae Asset Emerging Bluechip is NOT a true blue midcap fund but a predominantly midcap fund.

Let’s see how.

The condition of investing at least 65% of its money in top 100 stocks takes it into a fairly midcap zone. The other 35% is invested in equity and related securities including debt. Typically, this 35% is in the large cap stocks.

The combination makes it a predominantly midcap fund.

For a true blue midcap fund, I would prefer to see a 80%+ allocation to midcaps.

With this allocation, it resembles quite a bit with HDFC Midcap Opportunities fund. Interestingly, HDFC Midcap Opportunities Fund is more midcap than Mirae Asset Emerging Bluechip Fund. By the way, the sectoral allocation of the two funds look quite similar too.

Here’s the asset allocation of HDFC Midcap Opportunities Fund.

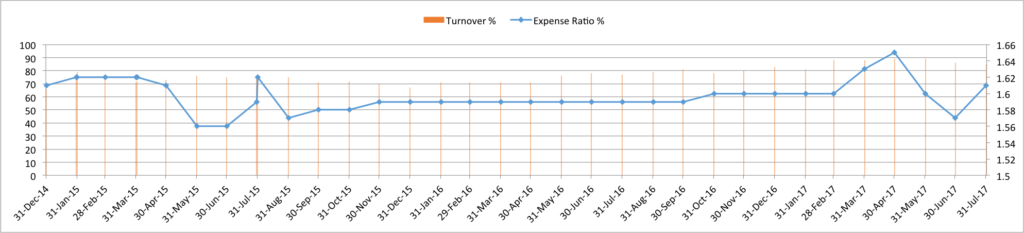

Expenses and Turnover

Here’s a trend chart of expenses and turnover of Mirae Asset Emerging Bluechip Fund.

Source: Unovest Research, Direct plan only. Numbers are from Dec 2014 to July 2017.

As you can see, the expense ratio has been consistent in the range of 1.55% to 1.7%. Compared to category peers, this ratio is on the higher side. The last reported expense ratio is 1.68% (as of Oct 2017).

The number that sorely stands out is the consistently high turnover ratio, closer to 80%. The last reported turnover ratio is 78% (as of Oct 2017). Put it in other words, a stock stays for about a year in the fund.

So, why is the fund growing?

The fund has grown almost 85% in size in the last one year from around Rs. 2600 crores of assets to Rs. 4800 crores now. Why?

The answer is a simple – returns.

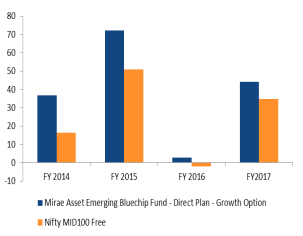

Here’s a chart of its financial year wise performance.

Source: Scheme Information Document, Benchmark data is based on price and does not include Total Returns.

With annualised returns (point to point, lumpsum investment) of 25% in the last 3 years and close to 40% in just last 1 year, it is difficult to ignore the fund.

For its mandate, the fund has delivered very well.

Here’s the regular warning. Past performance may not be sustained in the future and should not be used to make investment decisions.

Not hungry for AUM

A yet another good point about this fund is it doesn’t seem hungry for AUM. The fund stopped accepting lumpsum investments from Oct 25, 2016. Only SIP, STP with a cap of Rs. 25,000 per instalment is allowed. This goes on to show that the fund cares about its existing investors and is not greedy to grow its assets.

Update: W.e.f. Dec 15, 2017, the fund will allow only STP / SIP restricted to Rs. 25,000 per PAN (not instalment). There will be only one SIP date in a month – 10th. (h/t @invest_mutual)

Conclusion

The fund has quite a few things going for it.

If you are looking for a mandate of a fairly diversified fund with a larger investments in midcaps, which sticks to its mandate and yet delivers the goods, Mirae Asset Emerging Bluechip Fund seems to fit the bill.

The step to curtail inflows to the fund is a positive one too.

It is also one of the few schemes that is already in alignment with SEBI’s new guidelines on scheme categorisation.

Mirae Asset is not a part of any financial or business conglomerate and has its core interests in investment management. That makes it a professional fund house.

Just to take note of the other side, it is not a true blue midcap fund, as is popularly believed. The turnover in the fund is a question mark.

So, make your choice.

Disclosure: I am not invested in this fund.

What is your take on the Mirae Asset Emerging Bluechip Fund? Will you invest in it as a midcap fund or a multicap fund. Eager to read your feedback.

Interesting article Vipin. Thanks for the insights. I am interested to know from where do you generate the graph with expense ration and turnover ?

Thanks Sahil. It is quite a bit of work aggregating the data and putting it together. 🙂

There should be a like or Thanks button to convey regards.

Mudit, your words do the job well. Thank you!

V-PIN Thankss now days i m geeting worth reading articles in my inbox only from u. keep it up. occasionaly do stockk disection also.

Thanks Raj for reading and the kind comment. Stocks will take some more time.

There are two things I look forward to the most on the Internet and that are worth the wait: a new Game of Thrones episode, and a fund review on

Unovest.

I’ve been looking forward to your review on this fund. Another concern that I have is the fund manager dependency. I have no idea if Neelesh Surana has processes in place that will ensure the smooth functioning of the fund even if he chooses to leave the fund house. May be he has. It is Mirae’s job to communicate this, like how Quantum has done. And I haven’t seen that.

Considering the last 5-6 years’ performance, would you favour Sundaram Select Midcap or this one? Do you think Sundaram will continue to deliver such stellar performance in the long run as they have done?

Srikanth, your comment makes us feel super awesome 🙂 Thanks!

You have rightly pointed out the focus on the fund manager than the process. Infact the fund house too seems okay with the manager being talked about instead of the process. I would agree that the process should be highlighted more. Of course, the the credit to the fund manager remains too.

If I am looking at a pure midcap fund, this one wouldn’t make the cut. As for Sundaram, I cannot comment on the future. I like the focus and the way it has been managed so far.

“Just to take note of the other side, it is not a true blue midcap fund, as is popularly believed. The turnover in the fund is a question mark.”

Let’s not get hung up on mere labels and quantum of trading activity. The funds long-term, risk-adjusted performance speaks and it needs no stamp of approval from Unovest or anyone else.

Thanks for the insightful review. Is Mirae AMC now on the platform? I have been waiting for this.

Thank you Santosh. It is still time to have Mirae on the platform.

Thanks vipin for the as usual awesome article. Very insightful, short and scrip.. Your articles is something that I look forward in my inbox.

Question, having sundaram into portfolio already and this MF, would you recommend to keep Both?

Thanks

Thank you Prashant 🙂 We will talk about the aspect you have pointed out.