Continuing with our series of dissecting funds with large asset growth, today we take up yet another darling of the investors – Kotak Select Focus Fund. This is a fund which has become 4 times in size over just the past 2 years. What is clicking for this fund? Let’s find out.

Let’s start with the usual suspects.

Investment Objective of Kotak Select Focus Fund

As per the Scheme Information Document, the investment objective of the fund is

To generate long-term capital appreciation from a portfolio of equity and equity related securities, generally focused on a few selected sectors.

Actually, it is very opinionated fund as well since it mentions further that the differentiation lies in the fact that Kotak Select focus is the only scheme offered by Kotak MF, which aims to provide growth by taking exposure to a select few sectors that are likely to do well in the opinion of the fund manager. The fund follows a concentrated strategy but managed actively.

Basically, it means the fund is probably managed with top-down stock picking strategy, that is, first the fund manager identifies, which sectors will do well and then goes on to pick stocks in those sectors.

In contrast, a bottom-up strategy means that irrespective of sectors, the fund manager looks for great businesses and companies to invest in. Usually, the latter is preferable.

You can read the detailed investment strategy in the Scheme Information Document.

Asset Allocation

As for the asset allocation, the fund aims to have a minimum of 65% invested in equities and upto 35% of the corpus can be invested in debt. A 65% investment in Indian equities is a minimum requirement for any mutual fund to qualify for the related tax benefits.

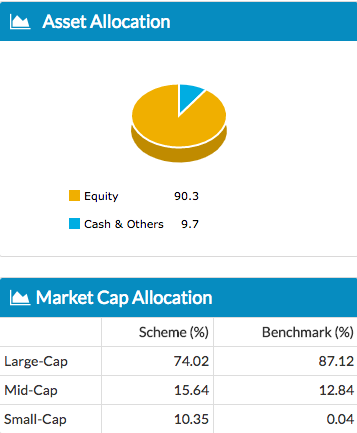

In practice, the fund is invested to a larger extent in stocks. See this latest allocation as of Nov 30, 2017.

Source: Unovest

The fund scheme information document mentions that to achieve its objective, the fund invests across companies irrespective of market capitalisation.

Hence, the Kotak Select Focus Fund has been categorised as a multi cap fund. In reality, it has a bias towards large cap. See the market cap allocation in the above image.

The scheme’s benchmark is the Nifty 200 index. This suggests that the fund intends to act as a predominantly large cap fund.

As the new SEBI categorisation guidelines come into effect and the fund chooses to remain a predominantly large cap fund, then to comply with the SEBI’s norms it will have to change its allocation to large caps to 80%+.

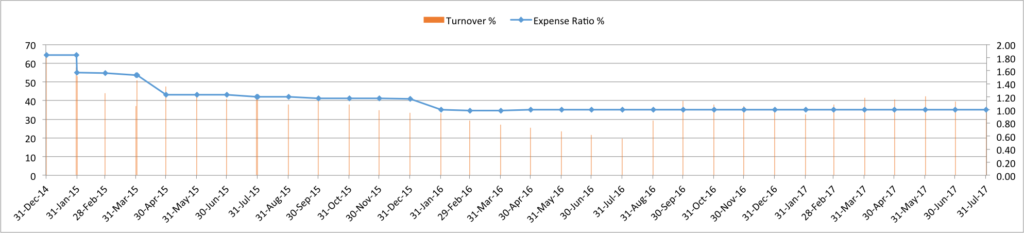

What about Expenses and Turnover?

The numbers on these fronts are good. The fund has reduced its expense ratio over time. The turnover ratio too has been within acceptable limits.

Source: Unovest Research, Data for Direct Plan from Dec 2014 to July 2017

Source: Unovest Research, Data for Direct Plan from Dec 2014 to July 2017

The current expense ratio of the direct plan of the fund is 1% and its turnover ratio is 21% (as of Nov 2017). Given that fact that it has been steadily attracting new money, the low turnover is appreciated.

So, what makes the fund click?

The fund was just about Rs. 400 crores at the end of March 2014. In about 3 years, it has seen a growth of 14 times to grow over Rs. 15,000 crores. This quietly coincides with the joining of MD Nilesh Shah at the helm of Kotak Fund. With his earthy charm and popular speaking style, he is a personal favourite of several million investors.

To point it further the fund has doubled in size over just the last 1 year. Let me repeat this is not the performance of the fund but the growth in its size.

One question that needs to be asked about recent performance of any fund is if it is the result of luck or skill.

The last 1 year has been supremely lucky for most funds. With large amounts of fresh money chasing stocks, directly or through mutual funds, the markets have been steaming up like never before.

Difficult to say for now. The next couple of years will help us understand better.

What’s your reason to consider the Kotak Select Focus Fund? Do share your views.

I was considering this fund, or was at least paying attention (and looking for reasons to not choose like I always do) after listening to Nilesh Shah’s popular speeches on all mutual fund shows (his bit about Sachin Tendulkar not scoring every ball for a six quite amusing but kind of proves his point about long term SIP to an average or even a naive investor).

I must say, after looking at the numbers, I was neither overwhelmed, nor underwhelmed. I was just, uh, whelmed. Choose MOSt Focused 35 Multicap instead.

*chose MOSt…

Too late in the night, and my English is slurring on the keyboard.

And what did you see in the other fund!

Oh, a few things.

1) I was searching a good multicap fund with sharp focus. I couldn’t understand whether Kotak Select Focus was large or multi. Also, the word “multicap” in “MOSt Focused 35 Multicap” was reassuring that they won’t change their mandate at a later stage. The benchmark was also indicative of what each fund’s portfolio ratio is going to be. May be Kotak Select Focus can be called “Kotak Select Focus Large and Midcap Fund”. That would make things clearer.

2) I wanted the fund house to not have more than one fund per category, again to keep their focus narrowed. Not only were the lines blurry with Kotak, they had multiple funds under the same market cap. I didn’t like this. Motilal has just one multicap (and they have just one mid and one large cap fund).

3) Skin in the game. I can’t seem to find that link now, but I think I read in ET (or one of the reliable sources) that the founders themselves have invested quiet a bit of their money in a couple of their funds, and it MOSt Focused 35 Multicap was one of them. I believe Kotak’s fund managers and employees do the same, though.

4) The returns are superior. Of course, how MOSt 35 Multicap will behave in an year like 2008 or 2011 remains to be seen. But, I was making these decisions before reading Unovest blog. Now, I’ll only considers funds that have seen both 2008 or 2011, or at least 2011.

Actually, I’m not invested in this fund — my wife is. But I made that decision for her. I was looking for a single portal from where I can enrol in multiple funds and keep track of them. And of course, I chose Unovest.

There are 2 kind of investors in this mf arena. First one look at the fund with narrow mandate like only returns. and the later one (Vipin) will dissecting fund with all possible parameters . This is the unique character i have ever seen in any RIA/FP. Great job, Keep educating us.

Thanks Vandhi. Hope to continue doing this.