HDFC MF launched its brand new HDFC Housing Opportunities Fund last week. The opportunities fund only represents the opportunity for the fund house, not for you. Here are the reasons you should stay away from this NFO.

Now, it wasn’t long ago that SEBI issued guidelines about rationalising the number and types of schemes that mutual fund houses have loaded themselves with confusing the retail investor to no end.

Some loopholes (such as closed ended funds excluded from the purview) still existed but I thought that things would change for the better. I was so wrong!

The first attempts to kill the spirit of these guidelines are already happening. The loophole that is being exploited is the closed ended funds to which the guidelines don’t apply.

Can you beat that?

Which fund houses are doing it?

Not difficult to guess. Rattle out all the popular names – HDFC, Aditya Birla and ICICI. They are experts at this manipulation and they prove it once again.

Anyways, here I am talking about the fund from HDFC Housing Opportunities Fund – Series 1.

So, I wasn’t too sure about covering the new HDFC Housing Opportunities Fund until I received a message from an investor asking how can he subscribe.

What on earth inspires the need for a new thematic fund?

If you are to believe what HDFC MF says, it is the wave of “Housing for all” and the push by the government that will propel this theme.

By the way, they don’t plan to invest in only “housing” companies but all the allied sectors and companies – retail, banking, cement, electricity, etc. etc.

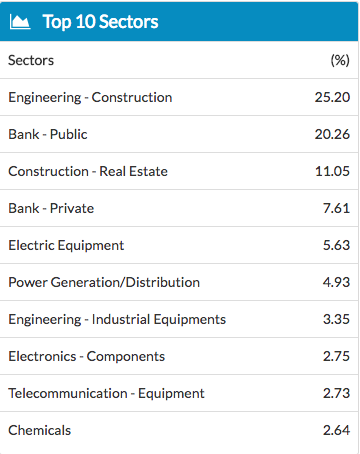

The sector break up of the funds investments could look something like this.

Guess what?

This is the actual break up of top 10 sectors of none other than the HDFC Infrastructure Fund – another thematic fund from HDFC MF but focused on the infra theme. Just to rejig your memory – this infra fund was launched in Feb 2008.

The difference with the new HDFC Housing Opportunities Fund is that it is a closed ended fund. That is where the loophole was exploited. If you subscribe now, you can forget your money for 1140 days, that is a little more than 3 years.

The choice of the index of the fund is pretty lame. It is India Housing and Allied Businesses Index created and maintained by IISL, known for the Nifty series of indices. You can read about it on this link on HDFC MF’s site. The Nifty 500 was a better choice for a diversified portfolio like this.

So, why HDFC Housing Opportunities Fund or series of funds?

Let’s invert and seek an answer from a different point of view – HDFC MF’s.

I guess the thinking in HDFC MF went something like this.

- The theme is a killer idea. Everyone wants to buy a house and if we tell an investor that the fund intends to make money from that idea itself, few will say no.

- The lure of the low Rs. 10 NAV of an NFO is difficult to beat specially to new investors in smaller towns.

- The market is approaching tight valuations, there is enough new interest in the market and it is the right time to lock in fresh investment money from retail investors.

- (And the big one.) We have to merge several similar schemes, might as well launch a new fund that does not get covered by the SEBI guidelines and move the money from other funds there. Voila! Kill two birds with one stone!

You see HDFC MF is looking at it purely from business reasons and retail investors are falling for it for all the wrong ones.

The opportunities fund only represents the opportunity for the fund house, not for you.

You have great funds available with an existing track record that you can give your money to. A good business will be invested by any investor / fund. We don’t need a new fund to do that for us.

Stay away from HDFC Housing Opportunities Fund – NFO.

What’s your take? Are you investing or not? Do share with me in the comments space.

Bulls Eye.

This is a ridiculous NFO and an assault on sensible investing.

Yup!

Thank you for such a forthright analysis.

Thanks for reading!

I fully agree with you.Even a layman like me can make it out.These fund houses are misleading the investors.

Certainly! But while you realise several others will fall prey! Sad.

Is the time ripe for index funds in India?

It’s not RIPE yet. 🙂

Thanks

well clarified

well explained ” opportinities”

Thank you!

Very well explained. Bull Markets, along with some SEBI changes might have led to this. I see atleast one email daily about some NFO.

One which stood out was this -:

https://invest.dspblackrock.com/campaigns/ace-fund-di/

This looks better than others, but they are cashing in on the sentiment that markets are at all time high, and may correct. Any thoughts on this?

You are right! Too many are chasing the available money. Will look up the fund you have mentioned.

Nicely explained….but also should appreciate the ingenuity in finding a product gap and the market is all about riding the momentum, currently the housing sector as Govt. policies – De-mon makes land affordable, Building affordable housing – builders pay no tax, for buyers interest subsidy of 4% on 1500sq ft apartment……HDFC Infrastructure has also Energy, a little bit of communication and automobile stocks too. But, the main differentiator is the Debt portion of 15-20%. I would anytime look at “theme” then a sector fund. My vote, not bad to put a small % of overall market linked investment. After all fortune favours the brave.

I am fully Agreed with you. The Portfolio should be diversified with quality Stock,that are already exit in the market.This one is increase the fund to make foolish to the Retail and small investors.

How much annual return percentage is expected in HDFC housing mutual fund?

No idea Sir. You can take the expectations broadly in line with equity as an asset class.

Duped into this fund in December 2017

They have bleed out the capital systematically and kept changing fund managers Mr Prashant Jain had rewarded himself a pay package of 300 to 450 crores in 2019 while the investors are being robbed

Would anyone have a better definition for the term ‘rascals’, that describes these guys

That’s bad! To add to the misery, it is a closed ended fund for 3+ years. Hopefully, you have adopted a more considered approach for your other investments.