Aditya Birla SunLife Pure Value Fund is a recent attraction amongst investors courtesy the stupendous returns. As a result it has been growing its size substantially. Now, how pure is the value in the fund? Let’s find out.

The beginning

Let’s take a quick look at the history of this fund.

Aditya Birla SunLife Pure Value fund made its beginning in 2008 as a closed ended fund for 3 years and subsequently was converted into an open ended fund. It means that starting 2011 you could invest in or sell out from this fund anytime.

The fund languished for a few years after that.

However, in 2014, it gained focus.

The CIO of Birla Sunlife mutual fund, Mahesh Patil was made a fund manager of the fund and it started to deliver, at least on the returns.

The growth was not difficult to come. From just about Rs. 400 crores size in March 2016, it rose to about Rs. 1,000 crores in March 2017. Since then, in just 7 months, the fund has doubled in size to about Rs. 2,020 crores (as of Oct 2017).

Of course, the fund has had the benefit of tailwinds in the form of rising markets along with the investors suffering from recency bias that has delivered this growth for the fund.

What does the Aditya Birla SunLife Pure Value fund seek to do?

The investment objective of the Aditya Birla Sunlife Pure Value fund is

to generate consistent long-term capital appreciation by investing predominantly in equity and equity related securities by following value investing strategy.

To know more about value investing, you can read this note.

The fund makes it abundantly clear that it follows a value style and not a contrarian style. In the latter, the focus is on finding temporarily out of favour stocks which may not be available at below their intrinsic value.

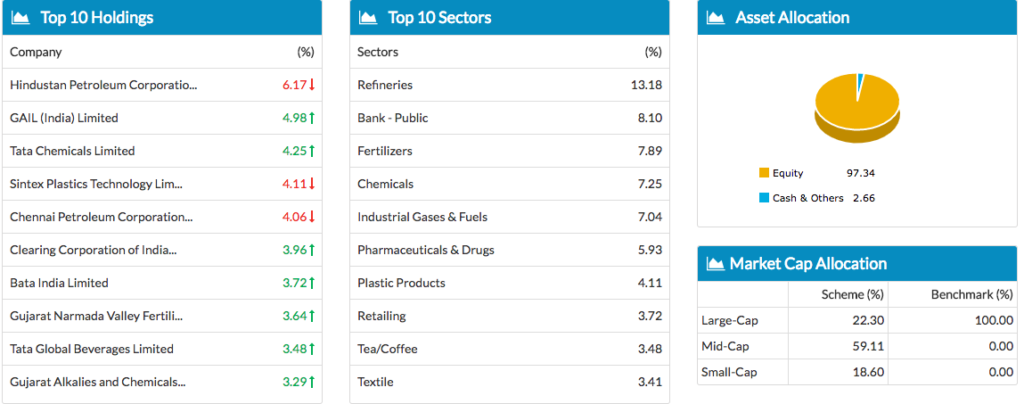

As for investment strategy, the fund manager picks opportunities across market capitalisation including large, mid and small caps.

However, if you see its actual portfolio, there is a definite bias towards mid and small cap stocks.

Holdings analysis of Aditya Birla SunLife Pure Value Fund

Source: Unovest, data as of Oct 2017.

This funds characteristics are eerily similar to another value style fund that was rising and making its presence felt around 2014 – ICICI Pru Value Discovery Fund. It’s another matter that Value Discovery soon changed track as it became a blockbuster.

What about the performance?

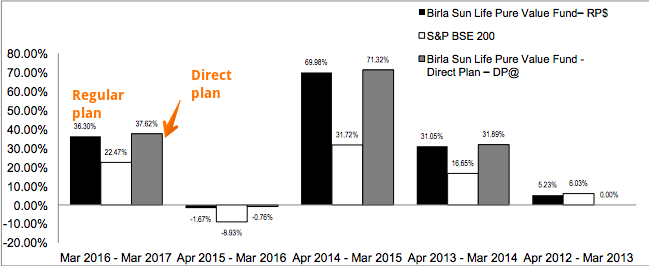

If you look at the financial year wise performance, the fund has done reasonably well. It is bound to be so with predominant holdings in mid and small cap stocks. Refer to the previous chart on holdings.

Source: Scheme Information Document

There are some obvious problems with the above chart and the comparison.

First, the index return is only price based and does not incorporate the total returns including dividends.

Second, the index itself is incorrect for this fund.

The benchmark of this fund is S&P BSE 200. This comes across as inconsistent with the style and focus. Ideally, the benchmark should have been the BSE 500 or the Nifty 500. In fact, for the historical holdings the more appropriate benchmark is the BSE Mid cap or the Nifty Free Float Mid cap 100.

If compared with Nifty Free Float Mid cap, the performance of the fund will pale in comparison to the index. You don’t have to go far. Just look at the Aditya Birla SunLife Mid cap Fund.

Does the fund deliver Pure Value?

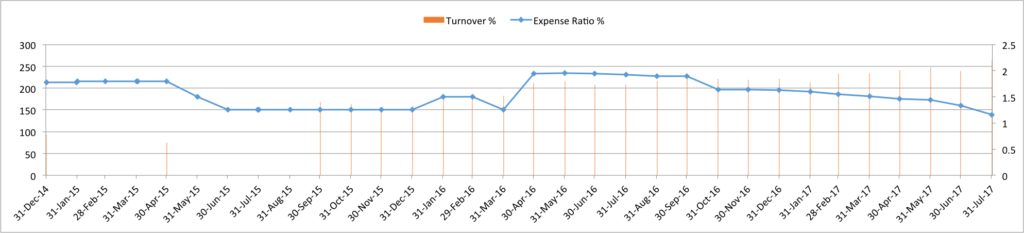

Difficult to assess but let’s look at 2 aspects of this fund – Expenses and Turnover.

Source: Unovest Research. Factsheets, Scheme Information Documents. The above chart maps the expense and turnover numbers from Dec 2014 to Jul 2017.

On the expense front, the fund has progressively reduced it over time. This is a good sign. The current expense ratio, as per Oct 2017 factsheet, is 1.11% for the direct plan.

However, when it comes to turnover, the fund baffles me to no end. It has been consistently running a turnover ratio of over 200%. The last reported turnover ratio of the fund is a whopping 272%. As a layman, what this means to me is that on an average a stock remains in its portfolio for less than 4 months.

One is not really sure if this is a value trading strategy or a fundamental long term investing. Whatever it may be the turnover number is a far cry from value style. A good value style fund including its peers have a turnover ratio of less than 20%. Patience is the biggest idea in value style investing, which this fund completely seems to lack.

Even if you look at the Asset Allocation of the fund, the fund is almost fully invested as of Oct 2017. For a market in which everyone is raising a hue and cry about valuations and expensive PE ratios, being fully invested, that too for a value style fund, looks out of order.

Conclusion

Overall, it appears that the fund operates in a heavily inconsistent manner in contrast to its investment objective.

When the current guidelines on fund consolidation are implemented as is, the Aditya Birla Sunlife Pure Value fund is going to be completely mauled.

To know more about the Aditya Birla SunLife Pure Value Fund, click here.

Note: Recency bias means getting influenced by recent events or outcomes and believing that the same are likely to continue or repeat in the future too.

What’s your take on the Pure Value Fund? Does it deserve your money? Is the recency bias at work for you? Do share your thoughts and feedback.

Honest reviews..keep it going

Thanks for reading Sriram.

This sort of fund analysis is extremely helpful. Love reading these!

– Is the Nifty Next 50 index a suitable benchmark for multi-cap funds? There are relatively few multi-cap funds that have managed to beat the Nifty Next 50 Index over 3,5, or 10 year periods. It seems strange, and almost no fund benchmarks itself against this index.

– Could you do an analysis of TATA Equity P/E fund, a fund that claims to follow a value style investing?

Thanks Sagar.

you are right. Nifty Next 50 is a relatively unexplored and untouched benchmark. IN fact, there is an ICICI Nifty Next 50 fund, if you may want to look at.

I will definitely take a look at a TATA Equity p/e fund, though it is difficult to expect anything from a TATA fund.

May I ask what you mean by difficult to expect anything from TATA funds? I recently started investing in mutual funds, so I don’t really know of the history with TATA.

Sure. Here’s an example: http://unovest.co/2015/12/should-you-own-a-piece-of-india-tata-mutual-fund-nfo/

No one analyses and reviews mutual funds and shares it with the general public like you do, Vipin. And I absolutely love how you dissect and expose some of these funds and their fund houses for their shenanigans. This is why your positive reviews (and the ones in Unovest MF Platform) carry a lot of weight, in my opinion, because you don’t compromise on quality.

I was initially planning on investing in ABSL Multicap (Advantage or Equity) but the number of funds they have is so confusing (not just these guys, the ones like ICICI, HDFC, Franklin). Even between ABSL Advantage and Equity, I couldn’t decide on one. Surprisingly, Axis is better organised.

Keep them reviews coming!

Thank you so much Srikanth. Much needed encouragement! 🙂

Great Review…

Thank You Vipin..

Thank you Jayakrishna.

Loved the ‘beyond-the-ratings’ kind of analysis. A couple of questions / thoughts –

1. While I agree that the fund seems to be tracking the wrong index, a quick comparison against it peers in the mid cap category on value researchonline suggests it is doing well with w.r.t its peers tracking other indices as well. Comments?

2. Do we know if after the recategorization exercise all funds in one category track against the same index? In fact, I am surprised that it wasn’t already the case.

3. Turnover % looks very high in comparison to its mid cap peers. But do we know if that is a recent thing or has the fund’s turnover % been high historically as well?

Thank you Anand.

The performance bit is fine. That’s the reason investors are flocking.

Yes, that’s not the case. Funds choose their own benchmark. Not sure if this will change with the recategorisation.

The turnover has been consistently high. Check out the chart in the article.

Its time to reveal your Value investing guide . I am eagerly waiting to know, what is value investing. So many AMCs are confusing customers by naming one of their products as value investing. Every one refer Warren buffet is following value investing.

Seriously do not know what is the real meaning of value investing. Hope your guide will clear my queries as usual 🙂

I cannot dispute to what you have to say about the fund, however feel most of the fund reviews that I have read on this site are negative and do not remember seeing any fund in positive light. Either all the well known funds in India are corrupt and are not professionally run or I am glossing over the real facts which you are presenting. Hope it is the later.

The aim is not to present funds in bad light or negatively, but to help investors see the other side too. Most investors only look at latest performance as a sole decision making parameter. Hope the reviews increase awareness.

Agree. I am curious to see an article in this site where a fund has been reviewed positively for how it is run and if they are true to their mandate. Is there one?

Here’s one of the earlier reviews. http://unovest.co/2016/03/fund-report-sundaram-select-midcap/

You will see more in times to come.

Thank you.

Thank you sir for your kind review.

Plz help me with the review of Mirae Asset emerging bluechip fund.

Here’s it http://unovest.co/2017/12/mirae-asset-emerging-bluechip-fund-know/